Dogecoin (DOGE) transaction volume has plunged to its lowest level since November, indicating a significant drop in market participation on both spot and derivative exchanges.

This decline coincides with DOGE failure to break above $0.48 since December 8. If this trend persists, the meme coin’s 300% year-to-date (YTD) gains could face further downside pressure.

Interest in Trading Dogecoin Plunges

In October, Dogecoin’s price was $0.10. By the first week of December, it had surged to $0.48, with several analysts suggesting that the cryptocurrency’s value could be higher. The spike in price could be linked to Donald Trump’s election as US president and the return of retail investors.

A few weeks after Trump’s election, Dogecoin’s transaction volume climbed to $5.69 billion, reflecting the notable interest in trading the cryptocurrency. However, as of this writing, Santiment data showed that the volume has dropped to $415.31 million.

This value is the lowest it has reached since November 4. Rising volume is typically a bullish sign. Therefore, the recent decline, if sustained, suggests that DOGE could face another price decrease in the short term.

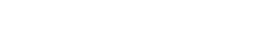

Another metric suggesting a further decline in DOGE is the Weighted Sentiment. The Weighted Sentiment gauges the broader market’s perception of a cryptocurrency using comments made on social media platforms.

A positive reading on the metric reflects predominantly bullish market sentiment, while a negative reading signals widespread pessimism, which is typically bearish. Currently, the metric sits at -0.57, indicating an increase in bearish comments.

If this sentiment persists, Dogecoin may struggle to attract heightened demand. Consequently, the price could face downward pressure, potentially dropping below the $0.48 mark.

DOGE Price Prediction: Lower Lows Next

On the 4-hour chart, DOGE continues to trade below a descending triangle. A descending triangle is a bearish chart pattern marked by a downward-sloping upper trendline and a flatter, horizontal lower trendline. T

This pattern typically signifies a continuation of downward price movement, as sellers consistently push the price lower while buyers struggle to maintain support at the horizontal trendline.

With DOGE’s price below the lower support line, it suggests that bulls might not be able to push the meme coin higher in the short term. Instead, the cryptocurrency’s value might slide under $0.36.

However, if sentiment around the coin turns bullish and volume rises, this might not be the case. In that scenario, DOGE could rise to $0.45.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here