Ethereum price has entered a phase of consolidation, hovering between $3,300 and $3,400 after dropping from its recent high of $4,085. While this stability might reassure some investors, others remain cautious about the potential for further declines. With crypto prices losing momentum and Bitcoin facing challenges, could Ethereum price dip to new lows?

Ethereum Price Analysis: Current Trends and Market Activity

Ethereum price currently sits at $3,330, showing mixed performance over different time frames:

- 1-Year Performance: +44%

- 1-Month Performance: -8.5%

- 7-Day Performance: -4.5%

The current traded volume for Ethereum has dropped by 31% in the past 24 hours, which is typical for this time of year when market activity slows down due to seasonal trends. This declining volume reflects waning interest among traders, which could pave the way for further corrections.

ETH/USD 4-hours chart – TradingView

Why Is Ethereum Losing Momentum?

The crypto market as a whole has been struggling to maintain its recent highs, with prices across major assets like Bitcoin and Ethereum seeing declines. Analysts attribute this to several factors:

Seasonal Slowdown

Market activity tends to dip at the beginning of the year, leading to reduced trading volumes and price stagnation.

Bitcoin’s Influence

Bitcoin’s inability to sustain a price above $90,000 has had a ripple effect on the broader market, including Ethereum. If Bitcoin price drops further, Ethereum is likely to follow suit.

Profit-Taking

After Ethereum’s impressive gains in 2024, many investors are locking in profits, contributing to the recent price decline.

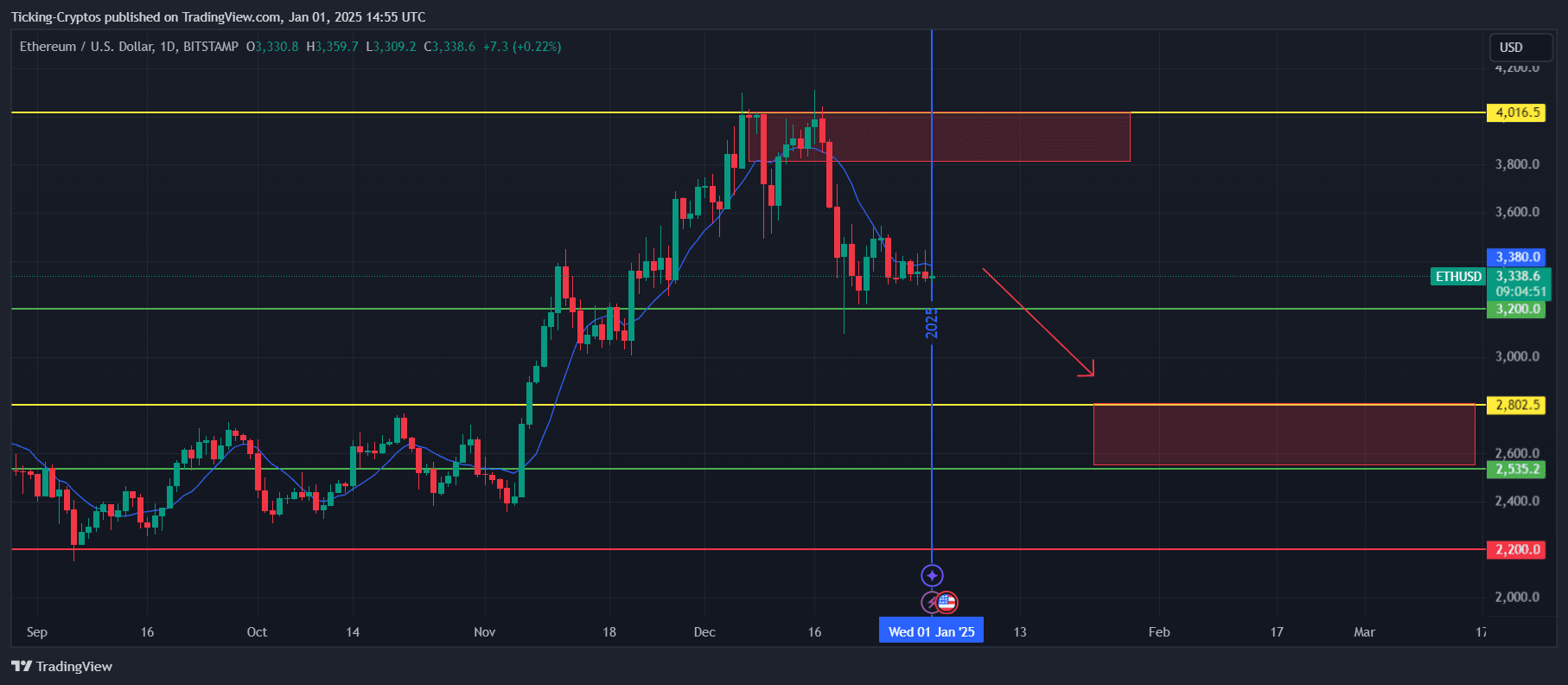

Ethereum Price Prediction 2025: Key Support Zones to Watch

Analysts are closely monitoring Ethereum price as it approaches critical support levels.

Short-Term Outlook

Ethereum price could drop to $3,000 if Bitcoin’s price fails to hold its current levels.

Medium-Term Outlook

Key correction zones for Ethereum are expected to be between $2,500 and $2,800. These levels represent significant support and could provide a buying opportunity for long-term investors.

ETH/USD 1-day chart – TradingView

Despite the current bearish outlook, Ethereum’s long-term potential remains strong, particularly given its ongoing development and widespread adoption.

What’s Next for Ethereum Price?

The Ethereum price is at a crossroads, consolidating around $3,330 while facing potential downward pressure. With the crypto market losing momentum and Bitcoin struggling to maintain its highs, Ethereum could see further corrections in the coming weeks.

For investors, keeping an eye on the $3,000 and $2,500 levels is crucial. While short-term volatility may continue, Ethereum’s strong fundamentals suggest that any dip could present a strategic buying opportunity.

Read the full article here