Following a failed attempt at a rebound in early May, PI has been on a steady downtrend, moving within a descending parallel channel.

With buying momentum drying up, the token appears poised to retest its all-time low for the second time this month.

PI Network Eyes Deeper Decline

Readings from the PI/USD one-day chart show that the altcoin has trended within a descending parallel channel since May 22, plunging by 40%.

A descending parallel channel is a bearish signal that forms when an asset’s price moves between two downward-sloping, parallel trendlines. It indicates lower highs and lower lows over time and signals a sustained decline in buy-side pressure.

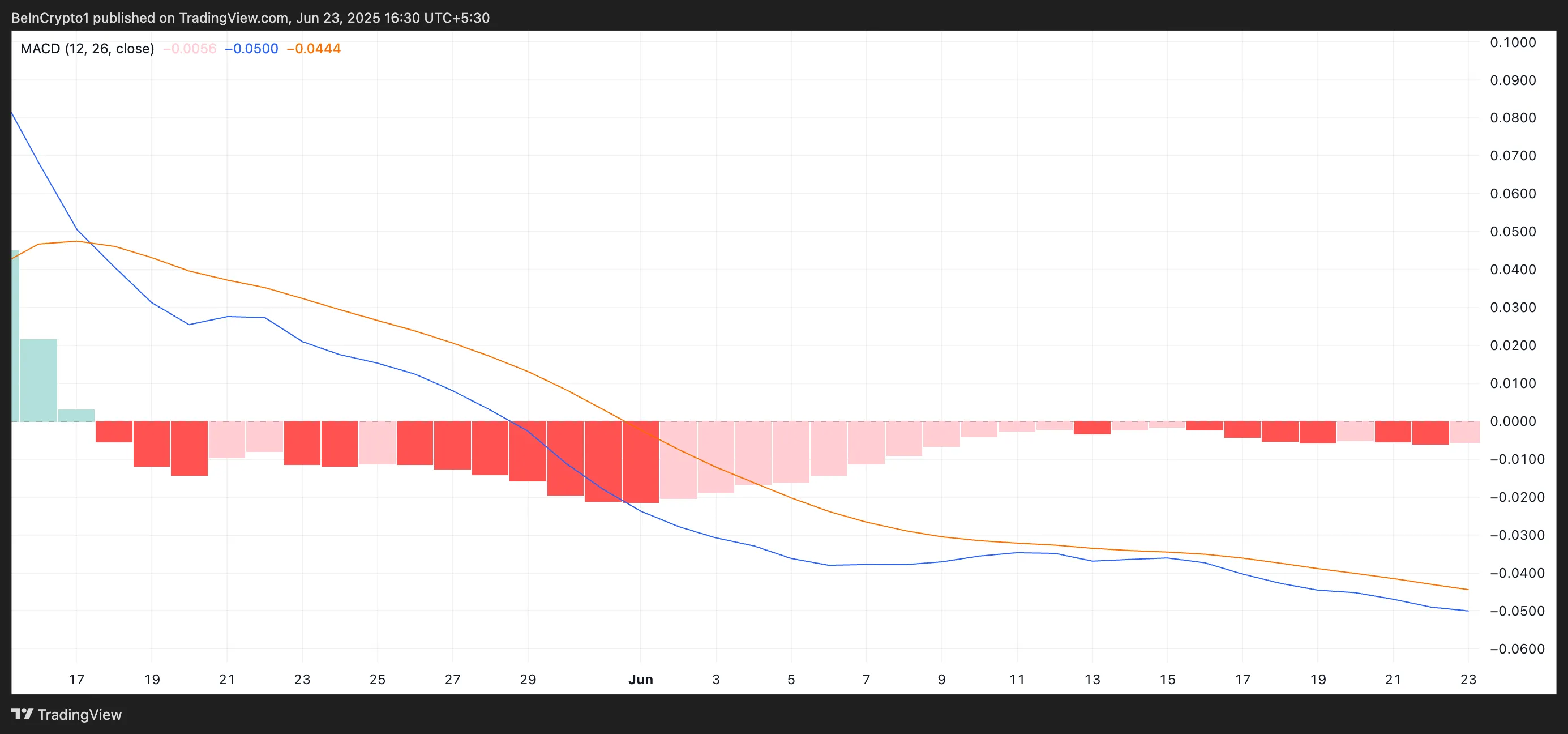

Moreover, technical indicators confirm the waning sentiment around the token. For example, PI’s Moving Average Convergence Divergence (MACD) indicator continues to print bearish signals, with its MACD line (blue) still stuck below its signal line (orange).

The MACD indicator measures the relationship between two moving averages of an asset’s price to identify momentum shifts and potential trend reversals. When the MACD line is below the signal line, it indicates a bearish trend.

PI’s prolonged bearish setup on the MACD indicator suggests that selling pressure continues to outweigh buying interest. This momentum imbalance hints at the possibility of further price declines unless a new demand enters the market to reverse the trend.

Furthermore, PI’s Super Trend indicator still forms dynamic resistance above the token’s price, adding to this bearish outlook. At press time, it is at $0.64.

This indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

When an asset’s price trades below the Super Trend line, it signals a bearish trend, indicating that the market is downtrend and selling pressure dominates.

Pi Slips Toward Danger Zone

At press time, PI trades at $0.49. With climbing selling pressure, the altcoin risks breaking below the lower line of the descending parallel channel. Should this happen, the decline is exacerbated, and PI’s price could revisit its all-time low of $0.40

However, with Pi2Day scheduled for June 28, token holders anticipate major announcements and ecosystem updates, which could generate renewed interest and demand.

It may provide the buying pressure needed to break the PI token out of its descending channel and propel its price toward the $0.79 resistance level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here