As of Feb. 9, 2025, XRP hovered at $2.41, commanding a market valuation of $138 billion—trailing behind USDT’s $141 billion valuation in fourth spot—while posting a 24-hour turnover of $3.2 billion and an intraday dance between $2.39 and $2.50.

XRP

XRP’s 1-hour chart reveals a phase of lateral equilibrium, with prices oscillating between $2.35 and $2.45. A defensive line has emerged near $2.30, where purchasing activity has materialized, while the $2.5 threshold acts as a ceiling for bullish advances. Trading activity has tapered off, hinting at muted participation; a definitive breakout signal is essential before directional commitments. A constructive pattern near $2.35-$2.40—such as higher lows or a reversal candlestick—may present a strategic entry, with profit-taking horizons at $2.50 and $2.60.

XRP/USDC via Binance 1H chart on Feb. 9, 2025.

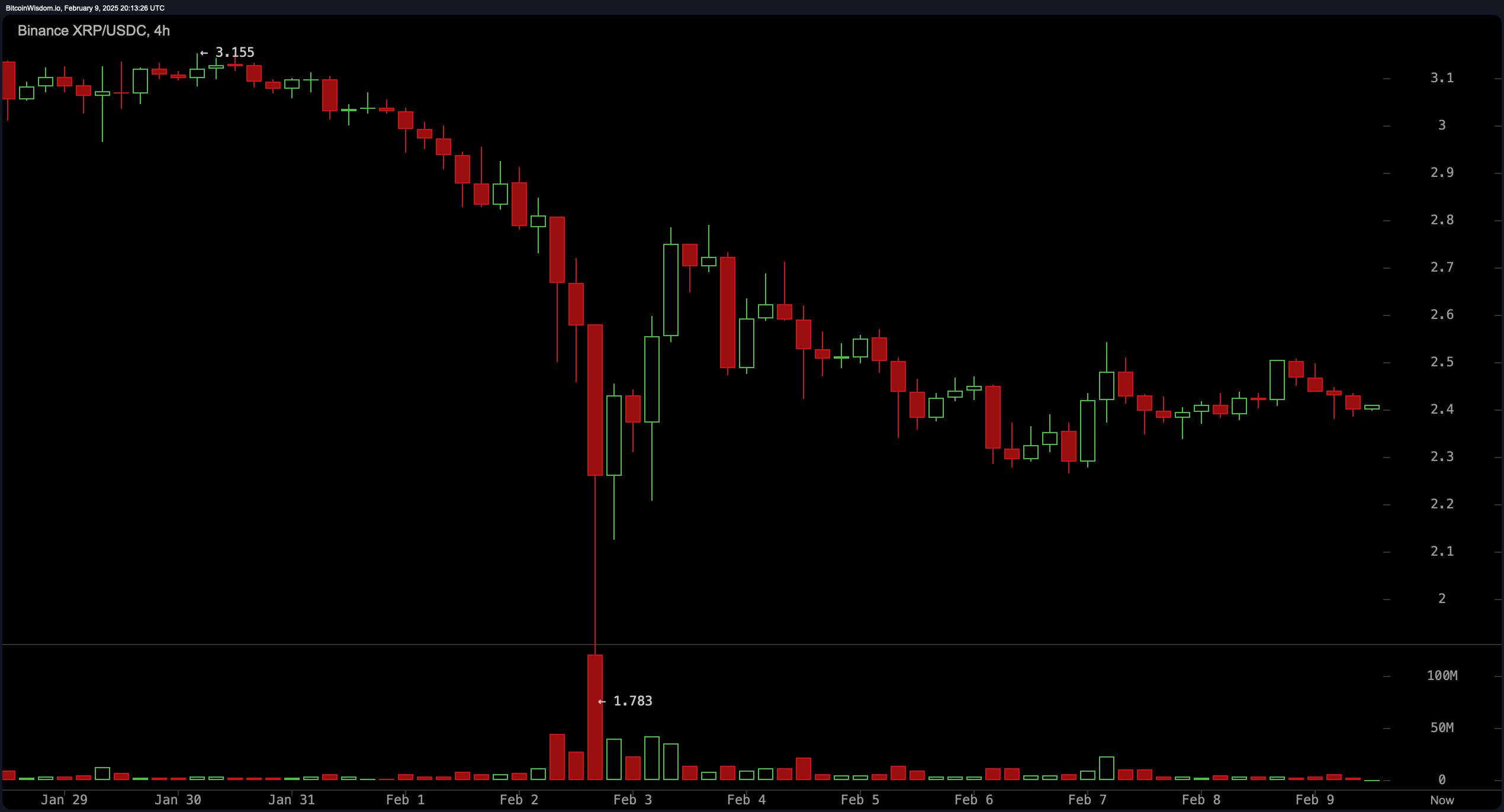

The 4-hour timeframe illustrates an extended descent from $3.10 to $2.30, where prices have found tentative footing. This hints at a provisional base, though distribution dynamics linger. Overhead supply looms at $2.50-$2.60, positioning a basing pattern near $2.30-$2.40 as a tactical entry. Stealth accumulation at XRP’s support zones serves as a harbinger of reversal, advising partial exposure reduction at $2.60 and complete exits around $2.80 should vigor return.

XRP/USDC via Binance 4H chart on Feb. 9, 2025.

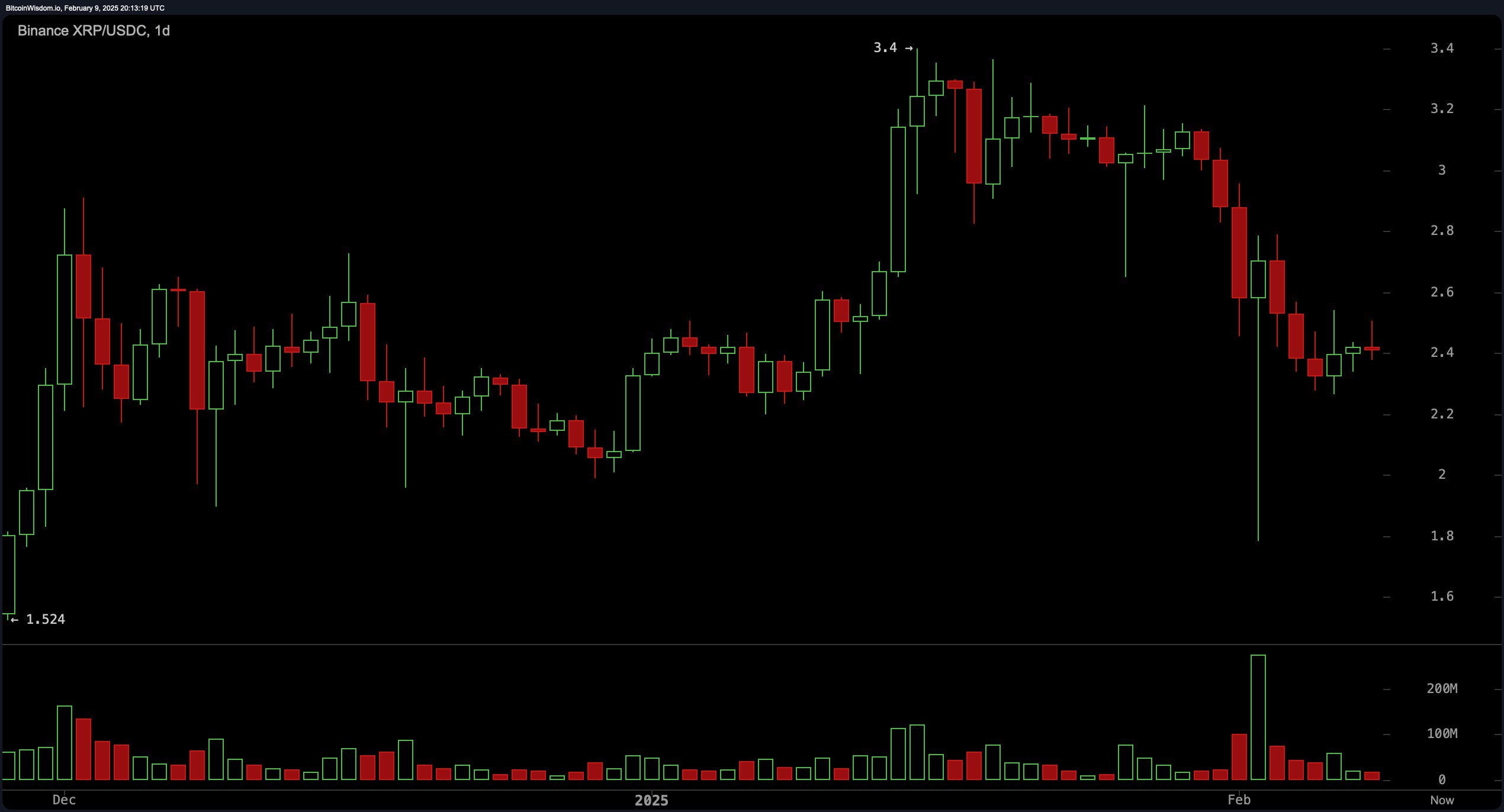

The daily perspective chronicles a precipitous retreat from the $3.40 zenith, with prices probing the $2.20 bastion. Elevated turnover during the plunge reflects a distribution crescendo, yet conditions flirt with exhaustion. Should this foundation hold between $2.2-$2.30, a renaissance targeting $2.80-$3.00 may unfold. A failure here, however, invites further descent, necessitating disciplined risk protocols.

XRP/USDC via Binance 1D chart on Feb. 9, 2025.

Momentum gauges paint a mixed tableau: The relative strength index (RSI) sits at 37.86, Stochastic at 44.27, commodity channel index (CCI) at -90.12, and average directional index (ADX) at 33.85. Yet the awesome oscillator, momentum indicator, and moving average convergence divergence (MACD) tilt toward a negative bias, suggesting prudence for those eyeing rapid gains.

Trend-following tools echo the bearish chorus, with exponential and simple moving averages (EMA/SMA) across 10-, 20-, and 30-day spans issuing sell directives. The 50-period EMA and SMA maintain their downward stance, while 100- and 200-period averages extend an olive branch to optimists. Ichimoku’s baseline remains noncommittal, demanding corroboration before a conclusive trend declaration.

Bull Verdict:

Despite short-term bearish pressure, XRP’s ability to hold support at $2.20 to $2.30 could trigger a rebound, with a potential push toward $2.80 to $3.00 if buyers step in. Long-term moving averages remain bullish, suggesting that a broader uptrend is still intact. A confirmed breakout above $2.6 would strengthen bullish momentum and invalidate the current downtrend.

Bear Verdict:

XRP remains under strong selling pressure, with multiple moving averages signaling a continued decline. The failure to reclaim key resistance at $2.50 to $2.60 could lead to further downside, especially if the $2.20 support line fails. Bearish momentum indicators, including the moving average convergence divergence (MACD) and momentum, reinforce the risk of an extended correction toward lower levels.

Read the full article here