As Q2 nears its end, the XRP price action might be setting up for a surprising breakout. The altcoin has been stuck below the $2.50 mark for over a month now, but new technical indicators show brewing optimism.

While the broader crypto market drifts sideways, XRP quietly builds bullish momentum beneath the surface. This analysis has the details.

Traders Eye XRP Rally

XRP’s liquidation heatmap shows a notable concentration of liquidity around the $2.20 price zone. At press time, the token trades at $2.14, placing it just 2.8% below this liquidity cluster.

Liquidation heatmaps are visual tools traders use to identify price levels where large clusters of leveraged positions are likely to be liquidated. These maps highlight areas of high liquidity, often color-coded to show intensity, with brighter zones representing larger liquidation potential.

These liquidity zones act like magnets for price action, as markets naturally move toward them to trigger stop orders and open new positions.

In XRP’s case, the liquidity cluster around the $2.20 level highlights strong trader interest in buying or closing short positions at that price. If bullish momentum builds, this setup increases the likelihood of a near-term rally.

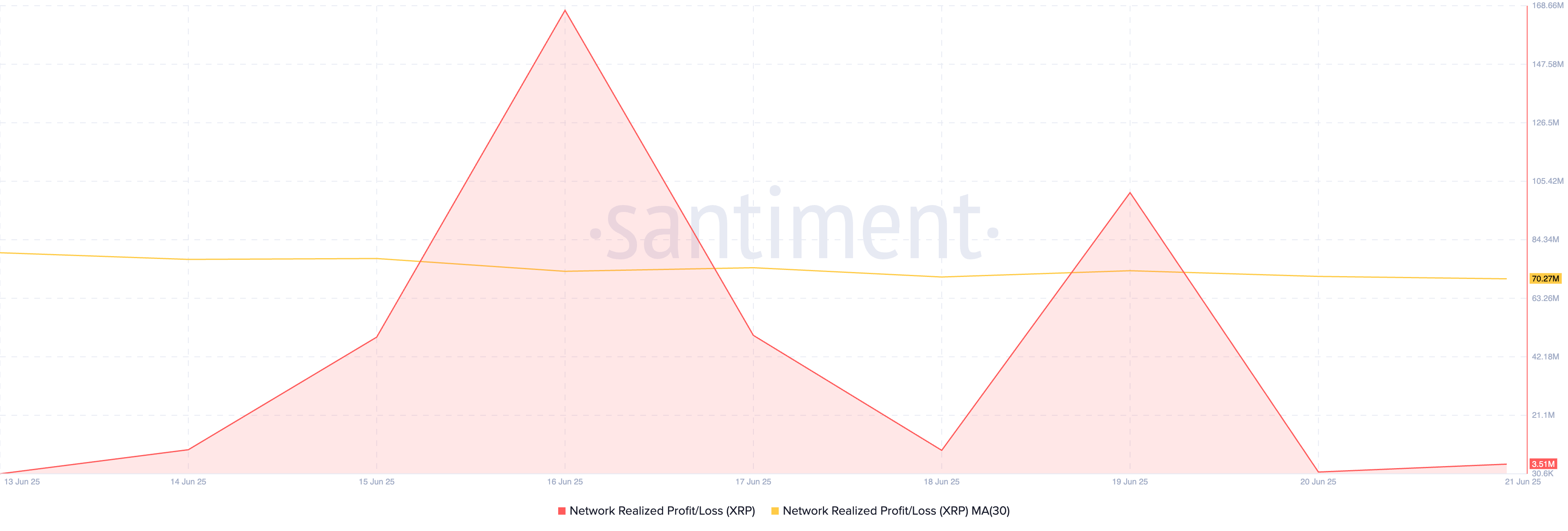

Further, the decline in XRP’s Network Realized Profit/Loss (NPL) supports this bullish outlook. On a 30-day moving average, it sits at 70.27 million, falling by 11% over the past week.

The NPL measures the total profit or loss investors realize when they move their coins. When NPL dips into negative territory, it indicates that more holders are moving their tokens at a loss rather than a gain.

Historically, this trend reduces selling pressure, as investors are generally reluctant to part with their assets while underwater. In XRP’s case, the recent NPL decline suggests that most holders are holding out for a rebound rather than locking in losses.

XRP Eyes Breakout as Bulls Target $2.29

At press time, XRP trades at $2.13. If buying pressure climbs and the altcoin breaks out of its sideways trend, it could rally toward $2.29.

A successful breach of this price mark could set XRP up for a rally toward $2.45.

However, if sell-side pressure surges, the XRP token price could extend its lackluster performance and fall to $2.08. If demand remains low at this point, the altcoin could dip further to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here