The decentralized applications (DApps) built on Solana are already beating all others in terms of weekly revenue on the blockchain. The data indicate that Solana is among the top DApps in terms of millions of dollars per week. This increase in revenue underlines the fact that Solana is gradually gaining a leadership position in the decentralized finance (DeFi) industry.

As the most popular DApp on Solana, Pump.fun generates more than 10.45 million in weekly revenue. Next comes Axiom with over 8.64 million, and then there is Phantom Wallet with 3.58 million. These figures indicate that the Solana ecosystem is thriving. The number of users and developers is significant throughout the network.

Source: X

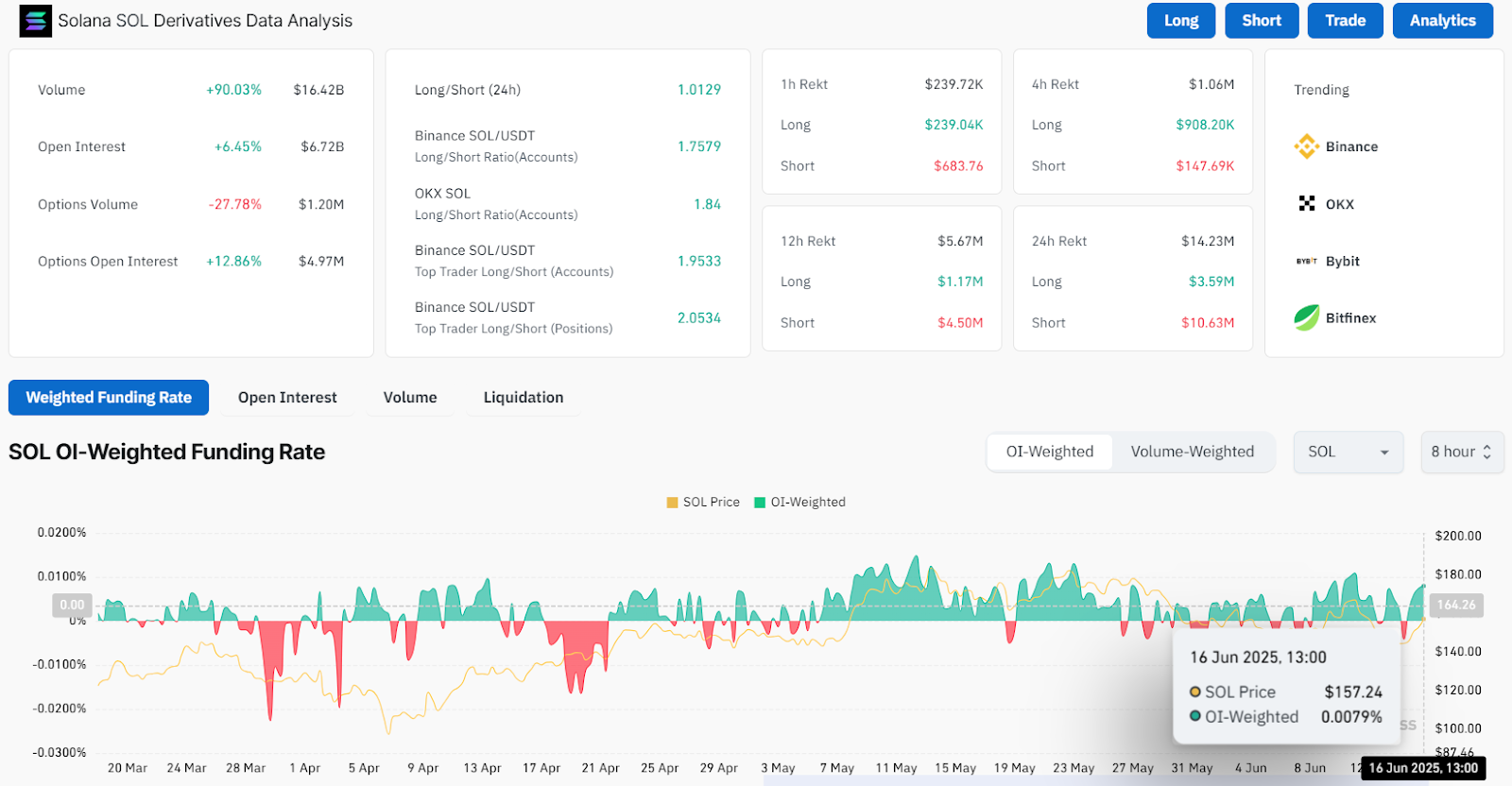

Solana Derivatives Hit $16B as Analysts Predict Breakout

The analytical platform Coinglass has shown a sharp increase in the Solana derivatives market. The volume in derivatives trading increased by 90.03% to a figure of $16.42 billion. Open interest also rose by 6.45%, amounting to $6.72 billion. There is a 0.0079% SOL OI-weighted funding rate. This data is indicative of an increase in trader interest.

Source: Coinglass

The market analysts are monitoring the price movement of Solana. Analyst World of Charts, highlighted that Solana is trading in a bullish pennant region. The analyst anticipates that the pennant will break out, moving toward the resistance level at 185. Closing the price above the mark of $185 each day may boost the price of Solana up to the level of $250 in the near future.

Source: X

Solana Builds Strength for a Major Move

According to technical indicators, Solana might be due for a new rally. The existing round of consolidation may trigger a significant price shift. If Solana can rally above its resistance marks, it could gain more ground.

Solana is showing strong revenue growth with DApps and increasing derivatives activity, which is enhancing its image. There is an increasing number of users and developers who are adopting the network. This development is helping Solana establish new benchmarks in the blockchain sector.

High DApp income, combined with growth in trading, is a positive indicator. The Solana ecosystem is expanding, and it has a growing market presence.

As far as revenue on blockchain and derivative trading is concerned, Solana is in the lead in the DApp industry. It has solid fundamentals and a bullish technical picture, which makes the network a key player in the cryptocurrency field. Everyone is staring at Solana, which is right at critical price points.

Related: SEC’s Latest Action on Solana ETFs Now Mirrors the “Final Phase” of Approval

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here