US crypto stocks remain in the spotlight today following Tuesday’s landmark Senate passage of the GENIUS Act—the first federal legislation to establish a regulatory framework for stablecoins.

In light of this development, key stocks to watch include Coinbase’s COIN and Circle CRCL, with Galaxy Digital’s GLXY trending on the back of recent ecosystem updates.

Coinbase Global (COIN)

COIN’s price rose more than 15% after the Senate’s landmark passage of the GENIUS Act, which creates the first federal regulatory framework for stablecoins.

Adding fuel to the rally, yesterday, the exchange announced the launch of Coinbase Payments, a new stablecoin transaction network enabling USDC payments on major commerce platforms like Shopify and eBay.

These developments have culminated in today’s sharp surge in COIN’s price. The stock is up 16% over the past 24 hours, reflecting climbing investor confidence.

Its soaring Chaikin Money Flow (CMF) on the daily chart confirms the rise in buy orders. As of this writing, the momentum indicator is above the zero line at 0.04.

The CMF indicator measures how money flows into and out of an asset. Readings above zero like this indicate that buying pressure is dominant among traders. If this continues, it could push COIN’s price above $305.42.

COIN Price Analysis. Source: TradingView

However, if demand falls, the stock’s price could drop to $270.61.

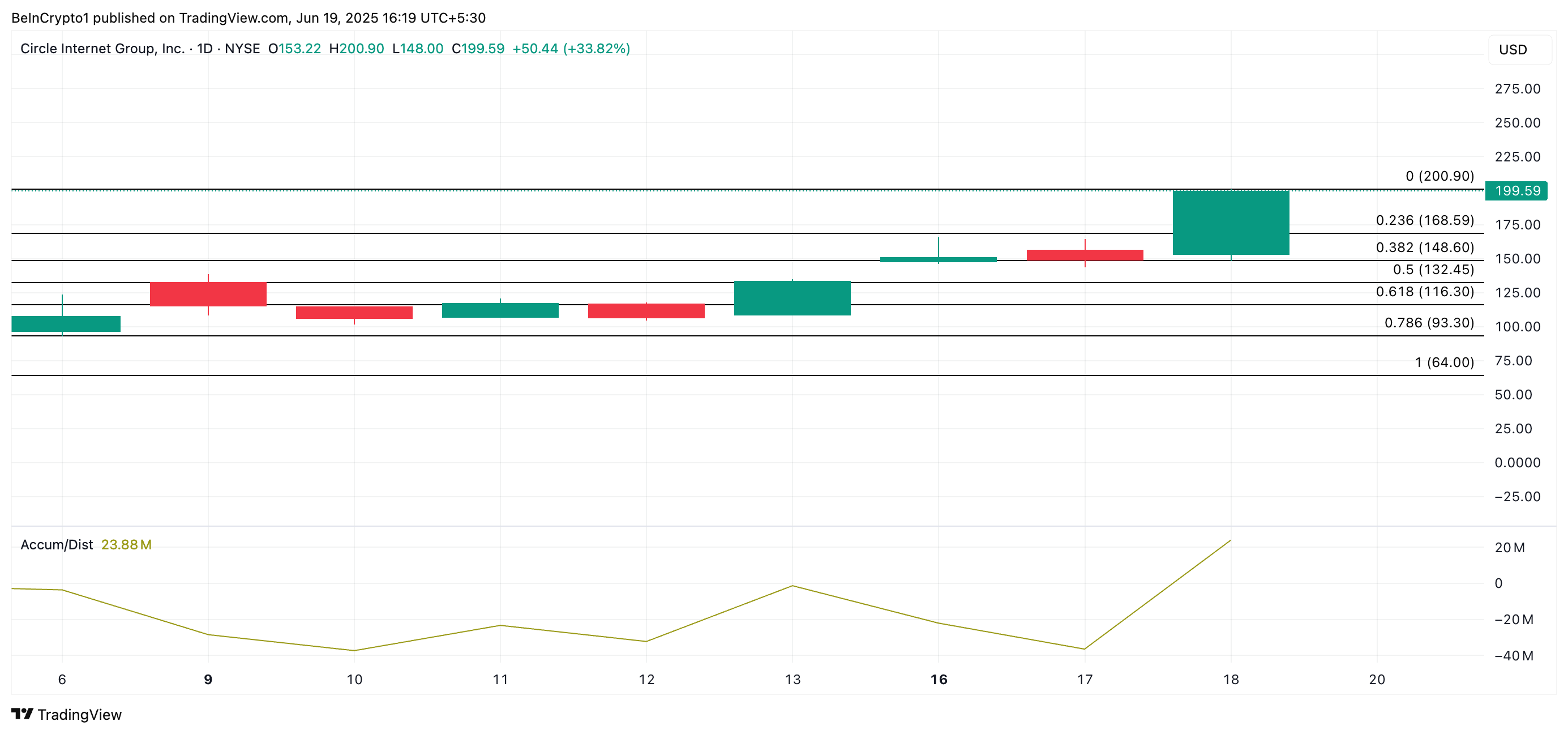

Circle Internet Group (CRCL)

Circle’s stock has soared since its IPO on June 5. On Tuesday, CRCLE rocketed 33% in response to the Senate passage of the GENIUS Act. It currently trades at $199.59, a more than fivefold gain from its $31 IPO price.

On the daily-hour chart, the stock’s Accumulation/ Distribution (A/D) Line is at 24 million, climbing over 250% over the past day.

The A/D Line measures money flow into or out of an asset by combining price and volume data. When the A/D Line climbs, it indicates that buying pressure outweighs selling pressure, suggesting a potential for a price increase.

If this trend holds, CRCL could break above its all-time high of $200.90, extending its gains.

CRCL Price Analysis. Source: TradingView

On the other hand, if buying pressure leans, the stock’s value could dip to $168.59

Galaxy Digital (GLXY)

GK8 by Galaxy has partnered with Polymesh to offer institutional-grade custody and secure staking for POLYX, enabling compliant, high-security staking via its Impenetrable Vault.

The move strengthens institutional access to regulated digital assets, especially in South Korea, where POLYX is seeing rapid growth and adoption.

This has bolstered GLXY’s performance, which notes a 4% price uptick over the past day. As of this writing, the stock’s Relative Strength Index (RSI) is rising, poised to break above the neutral line. This highlights the demand for GLXY.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 48.53 and increasing, GLXY’s RSI signals that buying momentum is building. This suggests potential for further upside if bullish sentiment continues to strengthen. In this case, the stock’s price could breach resistance at $19.57 and rally toward $21.30.

GLXY Price Analysis. Source: TradingView

On the other hand, if demand falls, the stock’s value could dip to $17.40.

Read the full article here