Bitcoin exposure is increasing in cryptocurrency portfolios, driven by more innovation-friendly US crypto regulations and growing institutional adoption triggered by the introduction of spot Bitcoin exchange-traded funds (ETFs), according to a new report from Bybit.

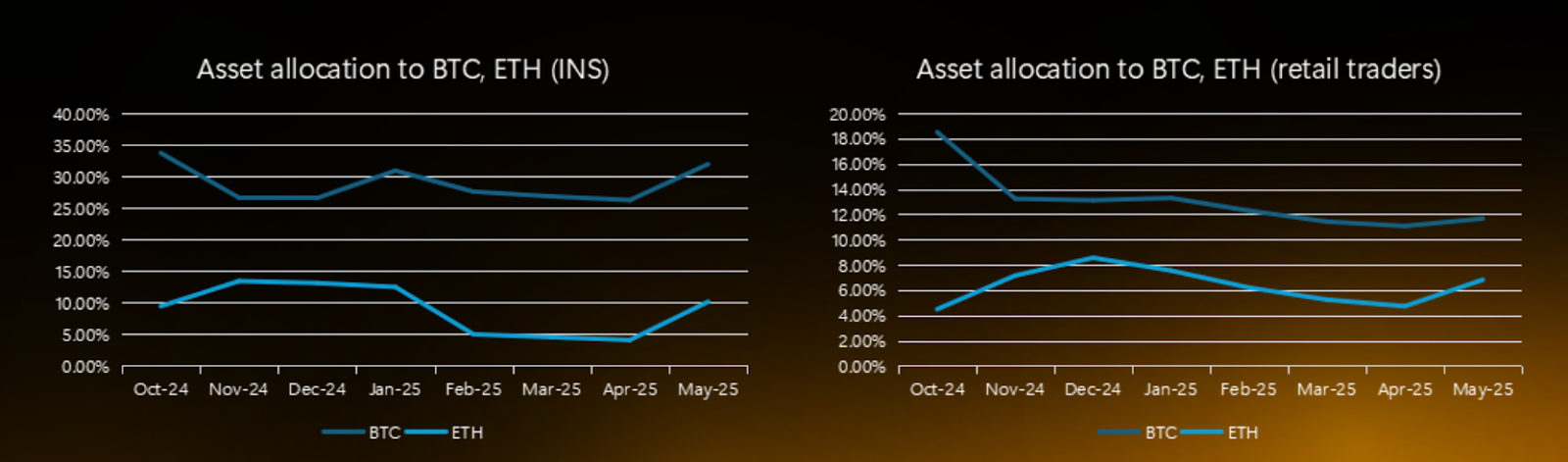

Bitcoin (BTC) accounts for about one-third of investor portfolios, or 30.95% of total assets as of May, up from 25.4% in November 2024.

This makes Bitcoin the largest single asset held by cryptocurrency investors, the report said. Meanwhile, the Ether (ETH)-to-Bitcoin holding ratio plunged to a 2025 low of 0.15 at the end of April, before recovering to the current 0.27.

This means that for every $1 worth of Ether, investors are likely holding about $4 worth of Bitcoin.

Related: Investor makes nearly $30M from Bitcoin bought in 2013

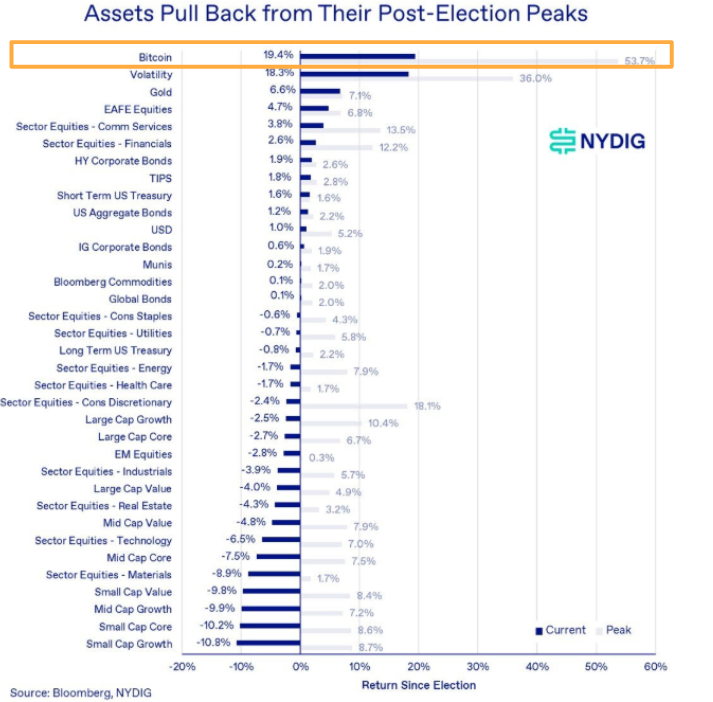

Bitcoin outperformed all major global assets after US President Donald Trump’s inauguration, including the stock market, equities, treasuries and precious metals, garnering significant interest as a portfolio diversifier asset that can generate additional returns, Cointelegraph reported in March 2025.

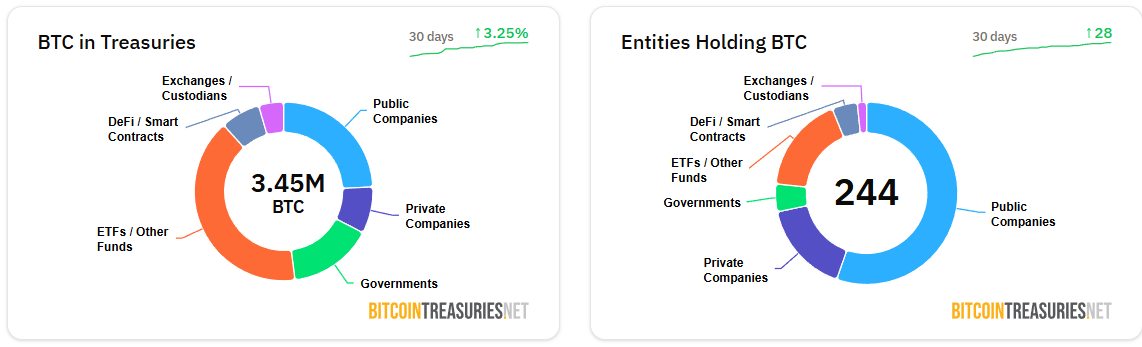

Bitcoin’s robust returns have inspired a new wave of institutional adoption, which has seen corporate Bitcoin holding companies nearly double since June 5. Over 244 companies are now holding Bitcoin on their balance sheets, up from 124 just weeks ago, according to BitcoinTreasuries.NET.

A total of 3.45 million Bitcoin is held in treasuries, with 834,000 or 3.97% of the total supply in public company treasuries and over 1.39 million Bitcoin or 6.6% through the spot Bitcoin ETFs.

The growing institutional adoption may put Bitcoin on track to $1.8 million by 2035, as the world’s first cryptocurrency will start rivaling gold’s $22 trillion market capitalization, according to Joe Burnett, director of market research at Unchained.

“When I think about where Bitcoin will be in 10 years, there are two models I admire,” Burnett said during Cointelegraph’s Chainreaction show. “One is the parallel model, which suggests that Bitcoin will be about $1.8 million in 2035.

Related: Bitcoin treasury trend is new altseason for crypto speculators: Adam Back

SOL holdings down 35% since October 2024

Despite solid momentum, retail traders’ Bitcoin allocations have fallen by 37% since November 2024, to just 11.6%, about half of the percentage held by institutions.

Retail traders have most likely “disposed of the Bitcoin holdings in order to purchase altcoins,” including XRP (XRP) and stablecoins.

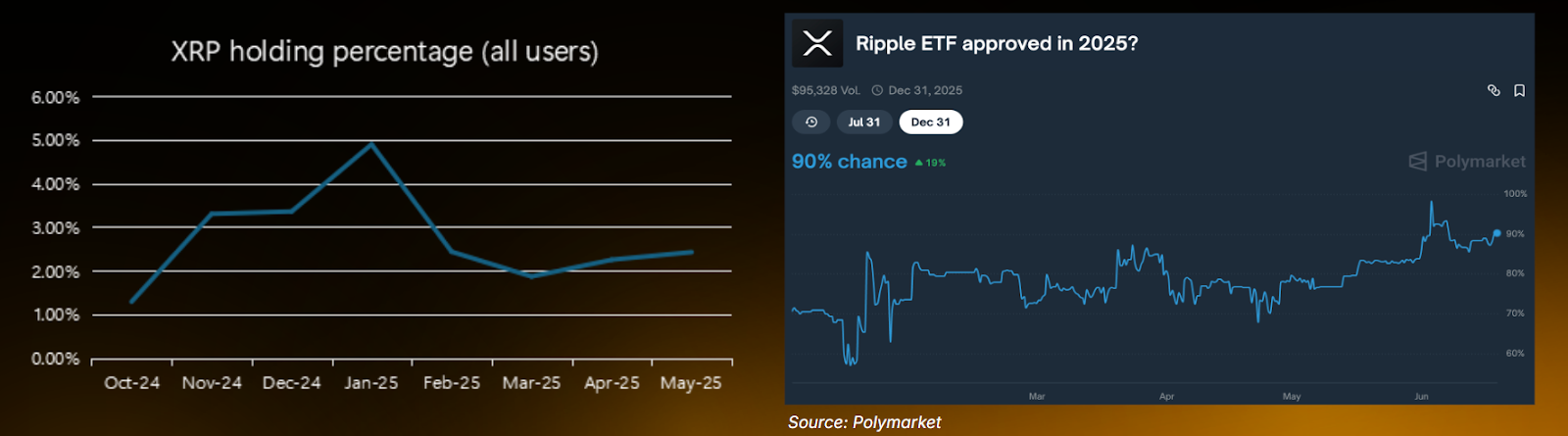

Meanwhile, the percentage of XRP held in portfolios has doubled, from 1.29% in November 2024 to 2.42% as of May, driven by growing ETF expectations, according to the Bybit report:

“The crypto investing industry view is that Ripple spot ETF approval is likely ahead of such approval for Solana spot ETF.”

“As such, we’ve observed partial capital allocation on the part of institutions from SOL to XRP,” the report said.

Meanwhile, Solana portfolio holdings plunged from 2.72% in November to 1.76% as of May.

Magazine: History suggests Bitcoin taps $330K, crypto ETF odds hit 90%: Hodler’s Digest, June 15 – 21

Read the full article here