Key points:

-

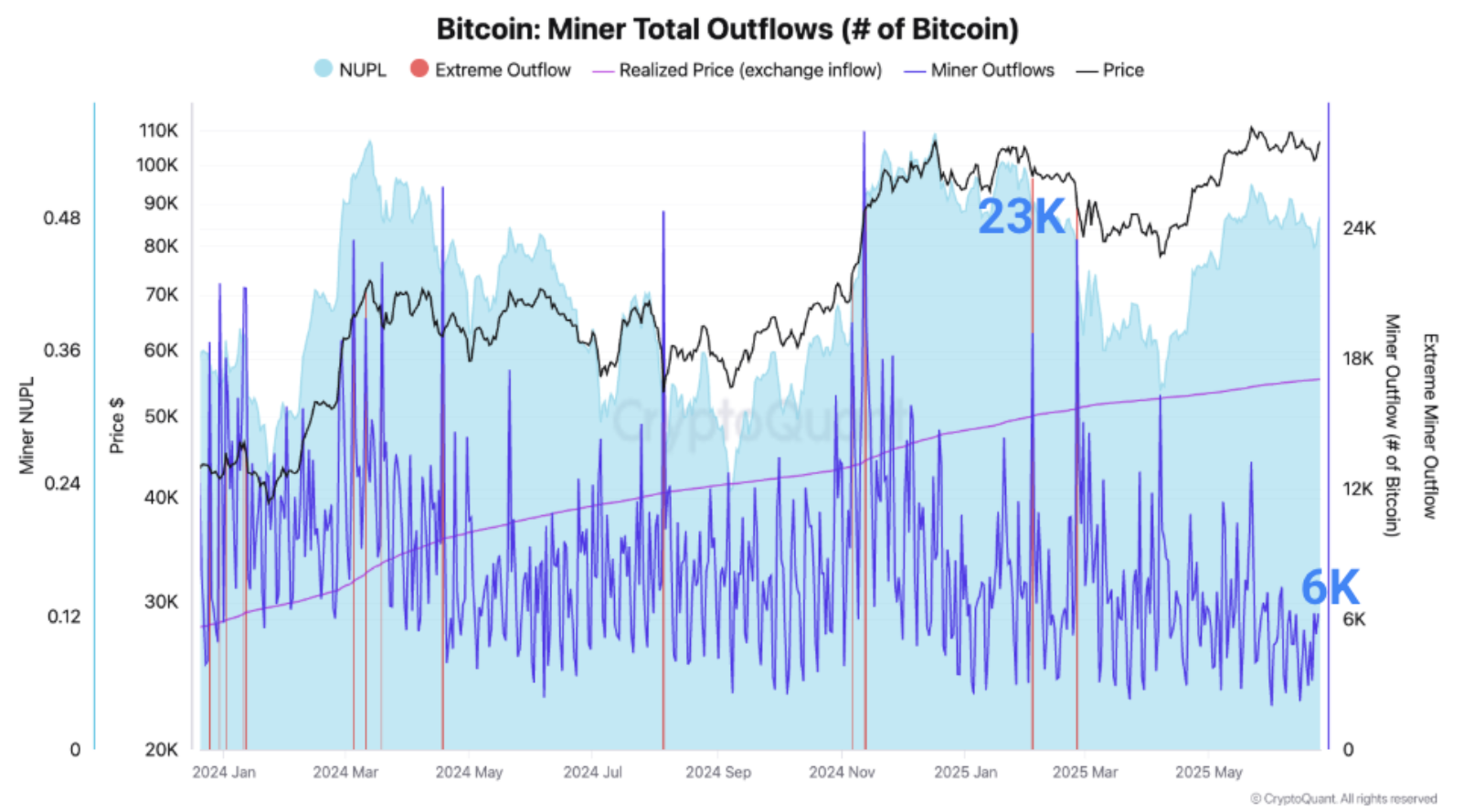

Bitcoin miners are showing rare behavior as BTC price action hits repeat all-time highs in 2025.

-

Large miners are adding to their reserves, while the oldest participants have slashed sales compared to 2024.

-

Miners are nonetheless “extremely underpaid” at current prices, research says.

Bitcoin (BTC) miners have added 4,000 BTC to their reserves since April, despite new BTC price all-time highs.

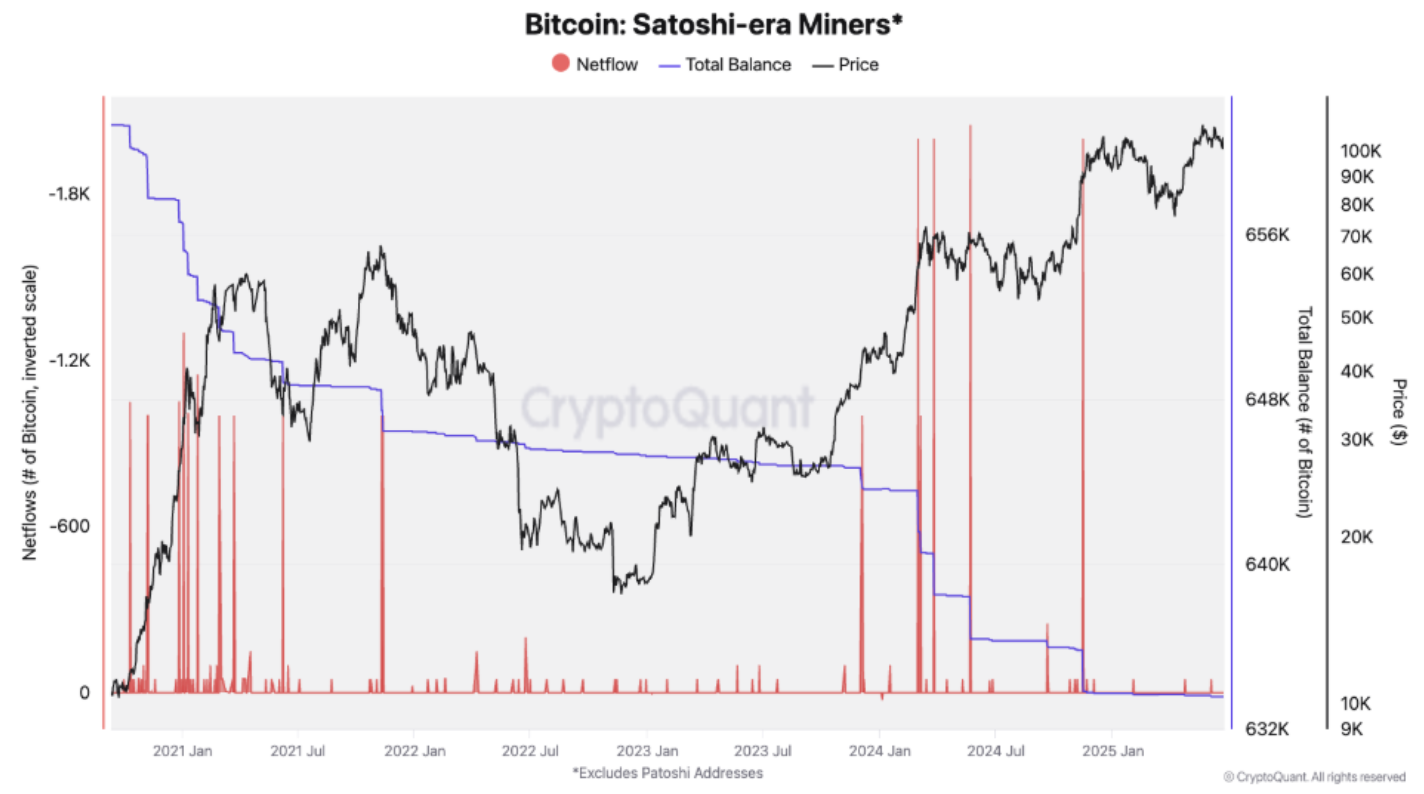

New research from onchain analytics platform CryptoQuant on Thursday also points to a dramatic slowdown in “Satoshi-era” miner sales.

”Extremely underpaid” Bitcoin miners refuse to sell

Bitcoin miners are holding onto their BTC reserves despite being “extremely underpaid” at current prices.

According to CryptoQuant’s findings, conditions for miners remain difficult despite BTC/USD trading within a few percent of all-time highs.

“Bitcoin miners are the most underpaid they have been in the last year as daily revenues decline to two-month lows,” it wrote in its latest Weekly Report.

“The Daily revenue fell to $34 million on June 22, the lowest since April 20 2025, due to lower transaction fees and the recent decline in the price of Bitcoin.”

Bitcoin network hashrate has declined 3.5% over the past 10 days. This represents the largest drawdown since July 2024, following the most recent block subsidy halving event, which cut miner revenue per block by 50%.

“However, miner selling is still muted in spite of lower revenues,” the report continued.

“Miner outflows have dropped from a daily peak of 23K BTC in February 2025 to roughly 6K BTC as of today. Moreover, there have not been any days with extremely high outflows since February, and Bitcoin transferred directly from miners to exchanges has also remained low.”

CryptoQuant suggests that miners’ overall 48% operating margin is responsible for the “hodl” trend.

Miners holding between 100 and 1,000 BTC have, on aggregate, upped their reserves by 4,000 BTC to 65,000 BTC since April’s local BTC price lows. This is the highest since November last year, when selling increased as Bitcoin broke through old all-time highs of $73,800.

”Satoshi-era” miners flip to hodl mode

Despite high prices, the oldest miners are breaking tradition this year. Instead of selling into bull market rallies, “Satoshi-era” miners are keeping distribution to a minimum, even compared to 2024.

Related: Bitcoin bulls ‘in control’ as BTC price spikes to $108K

“Selling from Satoshi-era miners remains at low levels. These miners have sold only 150 Bitcoin so far in 2025, compared to almost 10K Bitcoin in 2024,” CryptoQuant reports.

“Historically, old miners from the Satoshi-era usually move their coins after a strong price rally, indicating a potential market top.”

Earlier in June, Cointelegraph reported on a classic “buy” signal from the Hash Ribbons metric, which tracks periods of miner capitulation to define local BTC price bottoms.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here