Key points:

-

Bitcoin long-term holder supply has increased by a record 800,000 coins over the past 30 days.

-

Data shows that even a 750,000 BTC increase has only occurred six times in Bitcoin’s history.

-

BTC price support hinges on supply with a cost basis above $93,000.

Bitcoin (BTC) long-term holders are making history as they increase their BTC exposure by 800,000 BTC per month.

New research from onchain analytics platform CryptoQuant shows Bitcoin “hodl” mentality reaching levels rarely seen before.

Bitcoin long-term holders offer “key signal”

Bitcoin long-term holders (LTHs) — entities holding coins for at least six months without selling — have doubled down on their commitment despite BTC price hitting new all-time highs in 2025.

Analyzing the LTH supply change, CryptoQuant reveals that on a rolling 30-day basis, the supply has increased by a net 800,000 BTC — a new record.

“This week brings a key signal from LTH that shouldn’t be overlooked,” contributor Darkfost argued in one of its “Quicktake” blog posts on June 26.

Over Bitcoin’s history, 30-day LTH supply increases have only passed the 750,000 BTC mark six times. The two most recent occasions, in July 2021 and September 2024, both preceded a BTC price spike.

“This makes it a powerful signal that should absolutely be factored into any strategy,” Darkfost concluded.

The post added that coins now entering the LTH category have a purchase price between $95,000 and $107,000, reinforcing that range as a potential support zone.

Recent buyers need $93,000 to hold

As Cointelegraph continues to report, the opposite end of the Bitcoin investor spectrum, short-term holders (STHs), also play an important role in bull markets.

Related: Bitcoin ‘Satoshi-era’ miners sold just 150 BTC in 2025 amid all-time highs

Currently, STHs — corresponding to speculators hodling coins for six months or less — have their aggregate cost basis at just below $100,000.

That level often acts as support during bull market corrections, with this week’s retracement to $98,000 being no different.

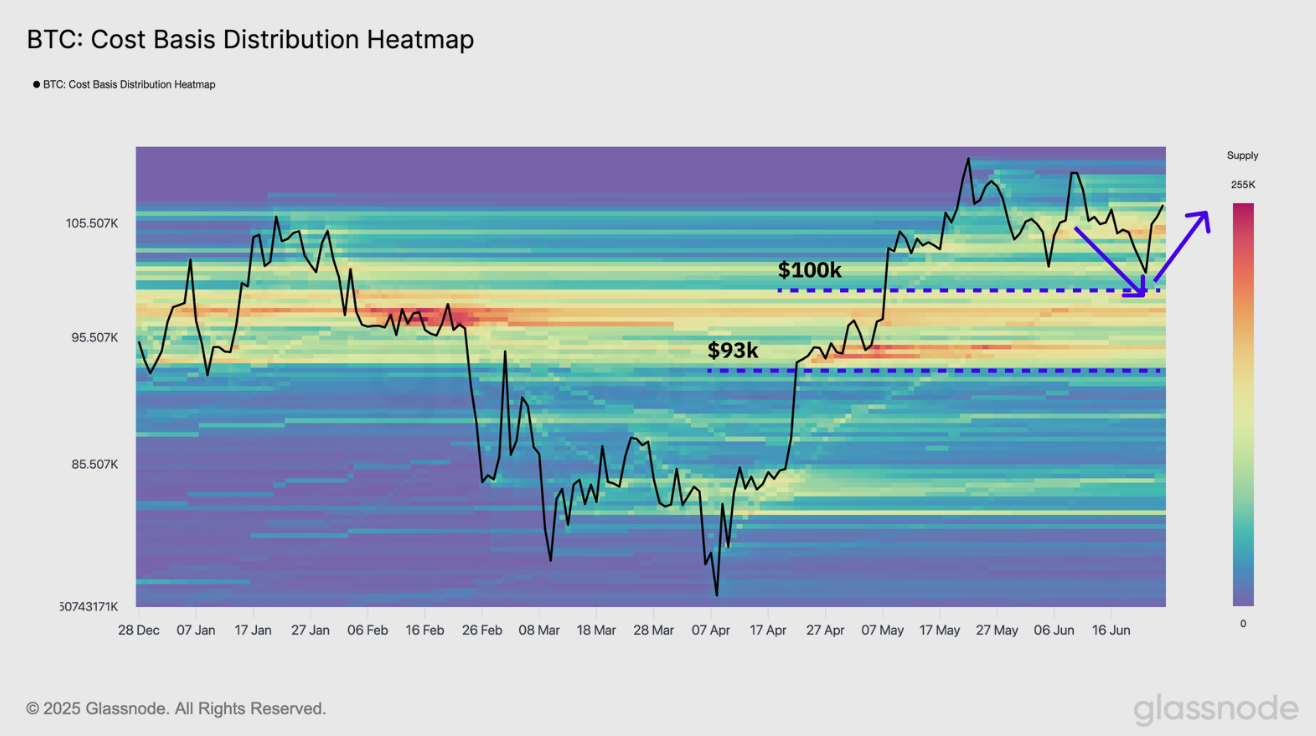

Analyzing support composition this week, onchain analytics firm Glassnode warned that the area between $98,000 and $93,000 was crucial.

“As long as the price holds above this range, the bull market structure remains intact,” it summarized in the latest edition of its regular newsletter, “The Week Onchain.”

“However, a breakdown below could trigger a deeper correction, especially if holders with a cost basis in this zone begin to capitulate and add to the sell pressure.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here