Bitcoin (BTC) heads into another heavy macro week with bulls hoping that the $100,000 support retest is done.

-

BTC price action offered some hope at the weekly close, with predictions of a return to all-time highs intact.

-

Liquidity grabs remain a focus, and could compound a deeper correction if $100,000 fails.

-

CPI and PPI are due this week, and attention is on the Fed in the week before the June FOMC meeting.

-

Bitcoin short-term holders have a key level at $106,200, potentially cementing short-term resistance at that level.

-

The public feud between Donald Trump and Elon Musk may already be a blessing in disguise for crypto hodlers.

Bitcoin weekly close inspires hope

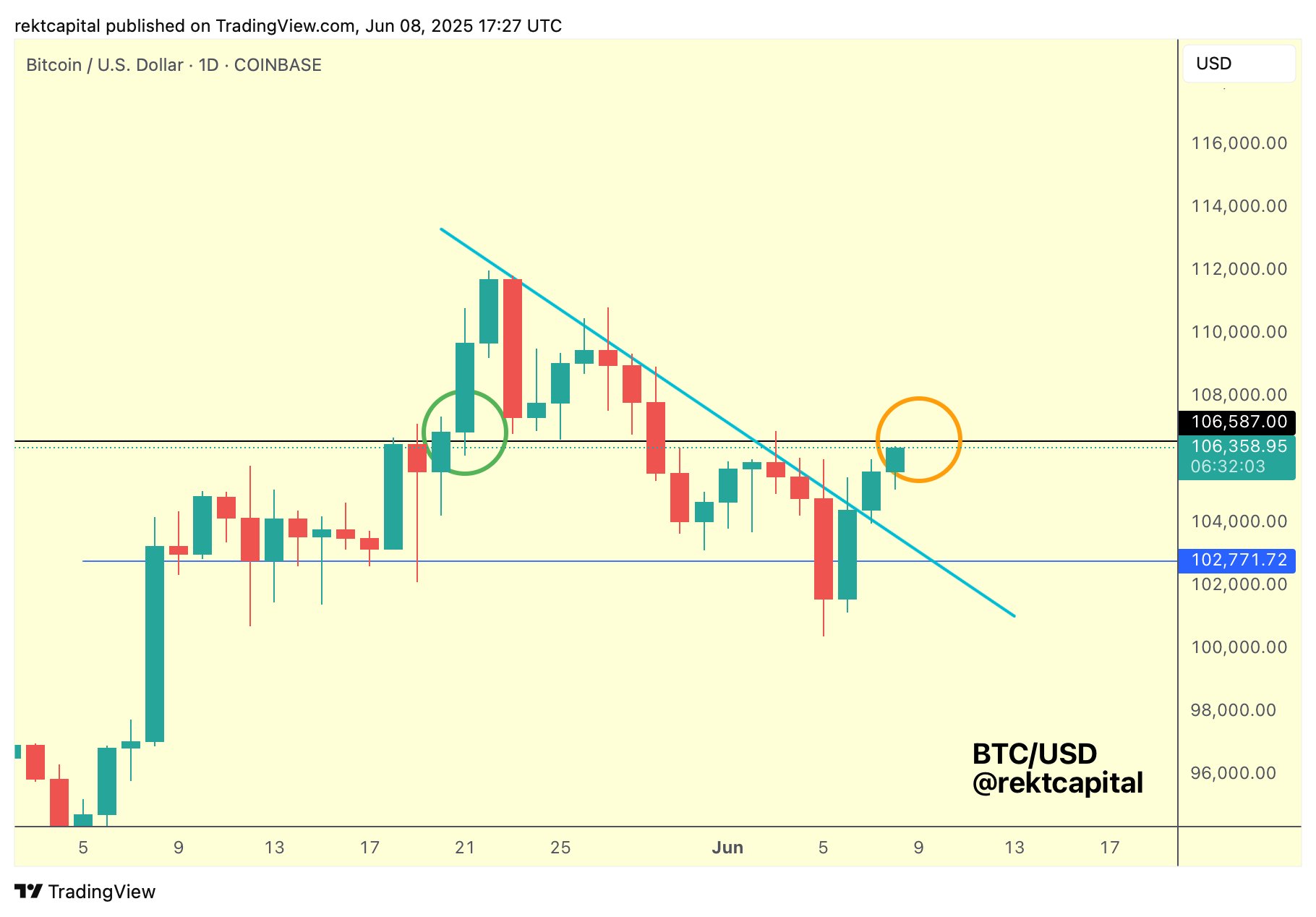

Bitcoin managed to pass $106,000 before sellers appeared into the June 8 weekly close.

Despite volatility through the week, data from Cointelegraph Markets Pro and TradingView shows that BTC/USD came practically full circle to preserve its weekly open position.

This has implications for market observers keen to see evidence of price strength after a retest of $100,000 support.

For trader and analyst Rekt Capital, the result appears mixed, as $104,400 stayed in play, giving BTC/USD its fourth consecutive weekly close higher, but a full bull market comeback remained lacking.

“Bitcoin has broken its two-week Downtrend (light blue). Now, Bitcoin is trying to challenge the $106600 resistance (black),” they told X followers in part of their ongoing analysis on June 8.

“Some light rejection here would be normal. But the goal is for Bitcoin to Daily Close above black for continued bullish bias.”

Others already see encouraging signs when it comes to Bitcoin leaving its trip to $100,000 in the past.

Fellow trader Matthew Hyland noted that price has now had several daily candle closes above the 10-period simple moving average (SMA).

#BTC closes another candle above 10 SMA further confirming recent low: https://t.co/oXI3f8CxOZ pic.twitter.com/GQJCbCEDWn

— Matthew Hyland (@MatthewHyland_) June 9, 2025

Long-term perspectives are likewise far from panicked, with seasoned hodlers waiting for what they see as inevitable bullish continuation.

“$BTC showing Calm Before the Storm. $BTC is compressing just below resistance at $107,800 and it is a classic volatility squeeze only,” trader CryptoKing argued this weekend, referencing multiple price tools.

“If you look at Price holding higher lows. Volumes drying up and the breakout is loading. RSI is also cooling off. If we flip resistance this time the next stop is $120K.”

All eyes on BTC liquidity

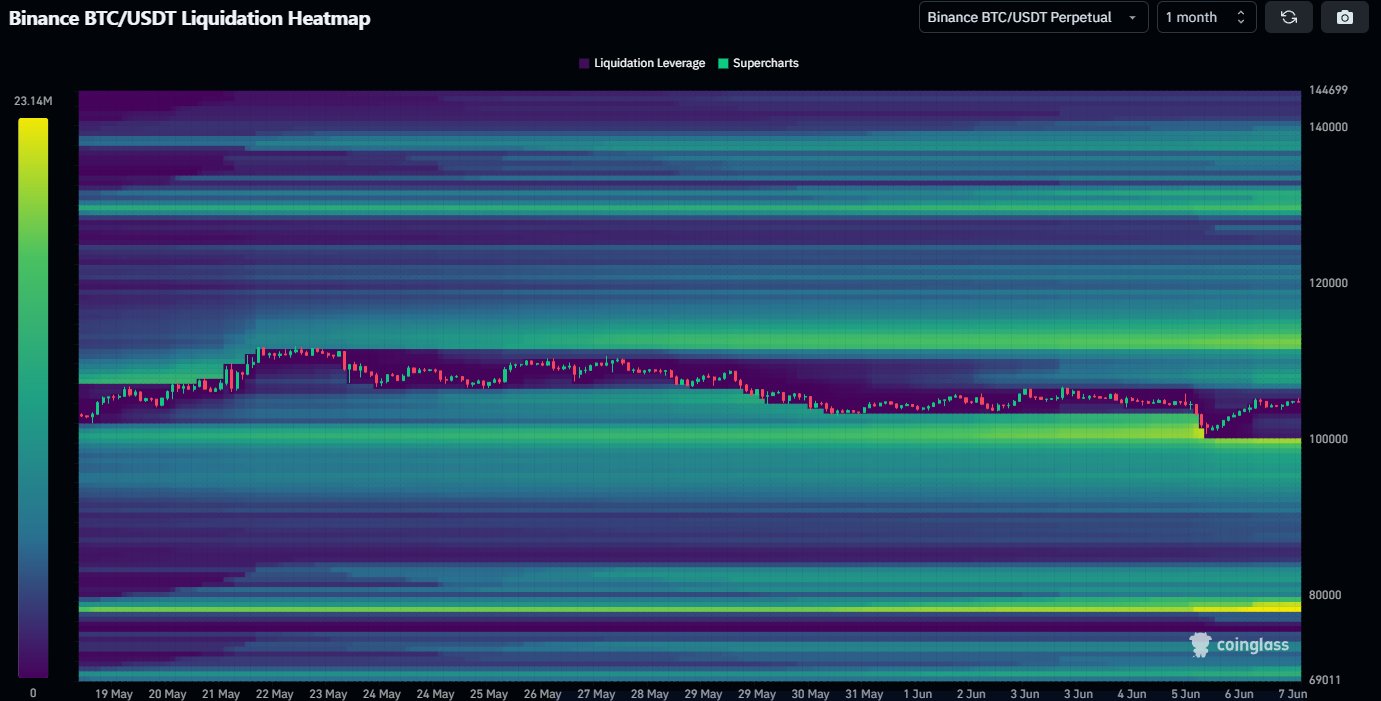

Exchange order book liquidity has featured heavily in recent BTC price analysis.

Throughout May and June, price action has seen snap moves higher and lower in order to “grab” patches of thickening liquidity.

As Cointelegraph reported, these patches are often not organic but rather speculative moves on the part of large-volume traders, attempts to guide price in one direction or the other.

Now, all eyes are on the $100,000 mark as a test of whether the market can stand up to long liquidation risk.

“The $BTC Liquidation chart is telling the same story as the charts where the big liquidity clusters are lining up nicely with important key levels,” trader Daan Crypto Trades wrote in an X post.

“Below $100K and Thursday’s low is where things can really accelerate and see continuation of this current correction.”

Daan Crypto Trades nonetheless noted that upside liquidity was important, making Bitcoin’s current all-time highs at $112,000 another area of interest.

“It’s also likely that there’s a lot of stops placed above that point,” he added.

Over the weekend, fellow trader Cas Abbe noted that a 10% upside move would result in $15 billion of short liquidations.

CPI, PPI in focus in run-up to FOMC

The final week before the Federal Reserve’s June meeting on interest rates contains some classic inflation markers.

The May print of the Consumer Price Index (CPI) and Producer Price Index (PPI) are due for release on June 11-12, with the latter accompanied by unemployment data.

While inflation has been slowing through 2025, attention will be on the Fed itself, as officials have held out against dropping rates — something which would be a key tailwind for crypto and risk assets.

Officials, including Chair Jerome Powell, have also drawn the ire of US President Donald Trump for maintaining their comparatively hawkish stance.

Despite this, markets have either fully or partially priced out any odds of a cut coming at the June or July meetings of the Federal Open Market Committee (FOMC).

Only in September are expectations of a 0.25% decrease in the Fed funds rate on the table, per the latest data from CME Group’s FedWatch Tool.

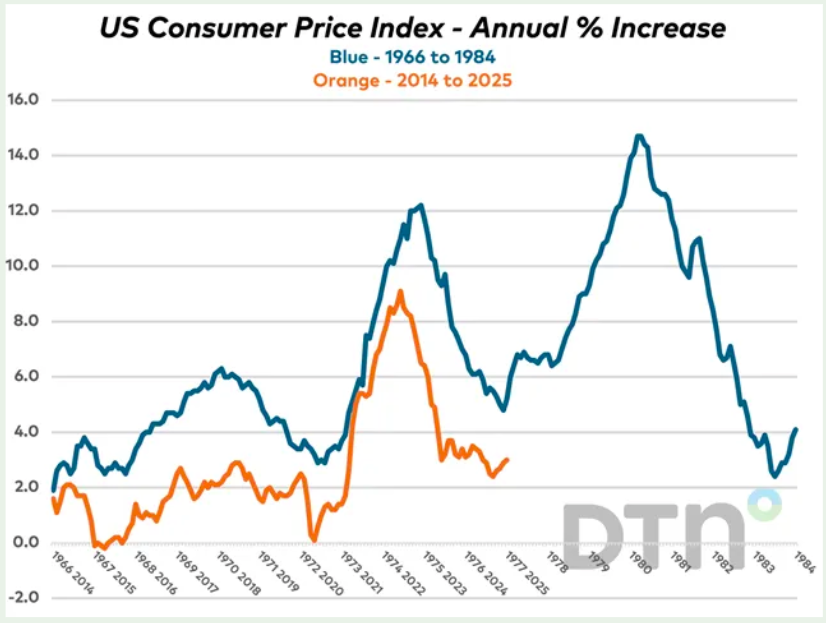

In the latest edition of its regular newsletter, “The Market Mosaic,” trading firm Mosaic Asset warned that inflation may still rebound in the second half of 2025, further strengthening the Fed’s position.

“There are signs of easing inflation across several measures. The most recent Consumer Price Index (CPI) came in at 2.3% compared to last year, which was the smallest gain since February 2021. The Fed’s preferred PCE inflation measure rose by 2.1%, which is close to the Fed’s target,” it noted on June 8.

“But if history is any guide, then the trend of disinflation since mid-2022 could be coming to an end.”

An accompanying chart compared the current inflation cycle to that of the 1970s. A resurgence, Mosaic added, could come thanks to US trade tariffs starting to be reflected in the economy.

Bitcoin short-term holders offer resistance

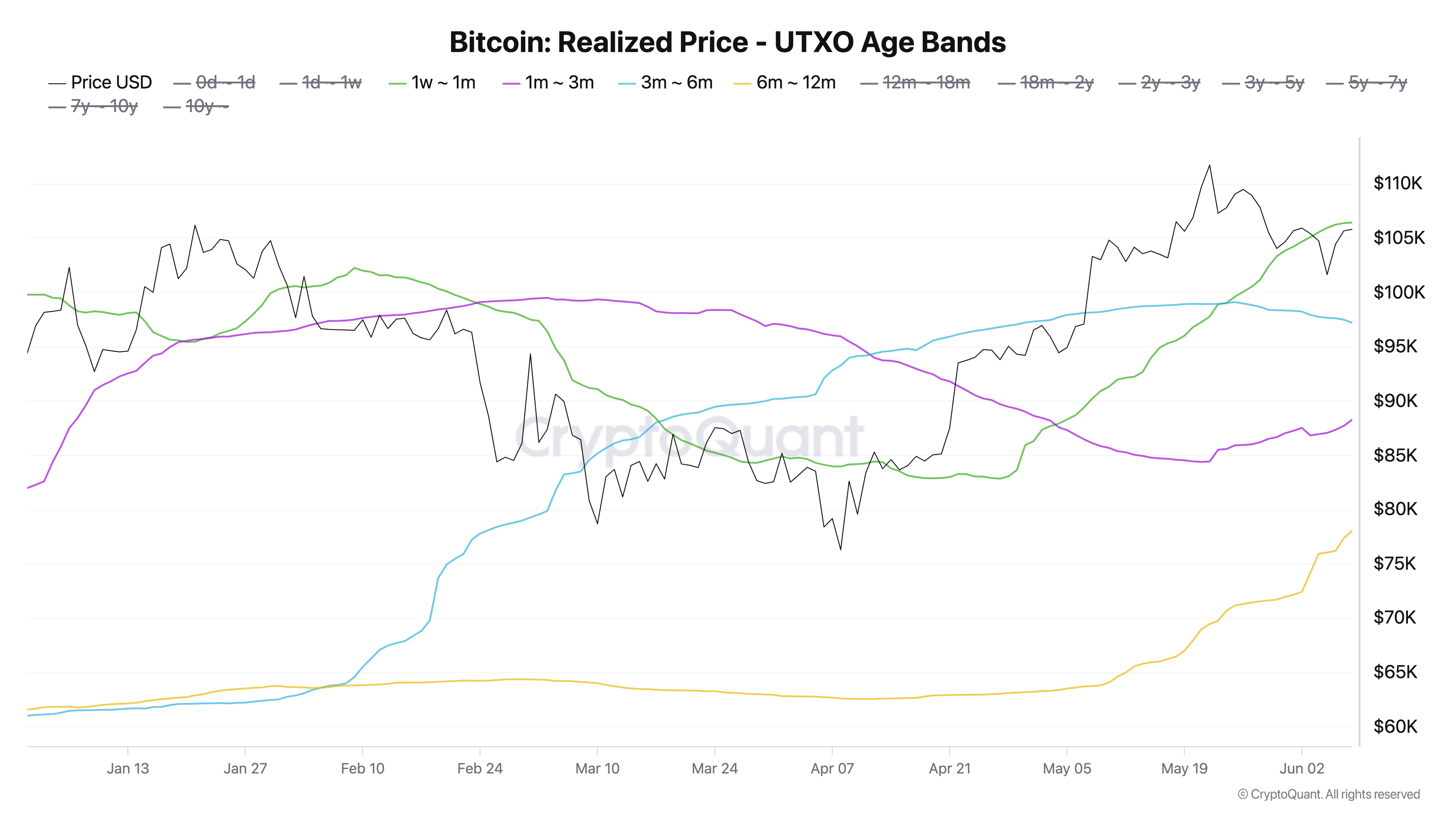

Bitcoin’s speculative investor base continues to be on the radar as a potential source of short-term price volatility.

At certain levels, the profitability of short-term hodlers (STHs) reaches proportions that tempt them to sell or decrease their BTC exposure.

In one of its “Quicktake” blog posts on June 8, onchain analytics platform CryptoQuant flagged one such level as being exactly around Bitcoin’s local high into the weekly close.

“A short-term holder sitting on a loss tends to panic,” contributor Burak Kesmeci explained.

“So, when the price gets back to their break-even level, they might say ‘this much risk is enough for me’ and hit the sell button — turning that zone into potential resistance (like $106.2K).”

CryptoQuant data shows that $106,200 is of particular importance to those investors buying between one and four weeks ago.

Conversely, buyers from between three and six months ago have their cost basis at $97,500, making it desirable for the market to protect that level as support.

“Knowing where short-term holders stand gives us key levels for both fear and opportunity,” Kesmeci added.

“Sell the rumor, buy the news?”

In a potential silver lining for Bitcoin bulls, research firm Santiment said that the worst of the BTC price may be over.

Related: Is a Bitcoin price rally to $150K possible by year’s end?

The reason, it said, lies in the behavior of the crowd and that of US President Donald Trump and Elon Musk.

BTC price downside accelerated as the pair took to social media to trade barbs in what has been billed as the end of their political relationship.

“The public downfall of Donald Trump’s and Elon Musk’s relationship has generated many polarizing reactions from the crypto community,” Santiment told X followers this weekend.

“While others may see it as nothing more than petty drama, others are showing legitimate fear that the two powerful pro-crypto individuals being at odds will create a long-term bearish outcome.”

Santiment suggested that the debacle may have already become a “sell the rumor, buy the news” event.

“Generally, when major crypto personalities see spikes in discussion rate, the chances of market reversals increase,” it said.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here