The crypto market recently saw a stunning change in liquidation flows, as short positions were caught completely off guard. According to CoinGlass, there was a huge $503.7 million in total liquidations, but the real story is the 4,720% difference in Bitcoin’s breakdown: just $45,970 in long positions were liquidated, compared to $2.17 million in shorts.

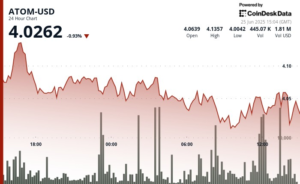

Bitcoin itself was around $105,000 on Tuesday afternoon, showing only a little price movement on the surface. But the mechanics underneath told a different story. The hourly chart from Binance shows a failed breakdown attempt, followed by a quick push back above $105,000, probably triggering a bunch of short liquidations.

The price only went up by 0.16%, but the liquidation activity suggests that the real drama happened behind the scenes, driven by people short-selling aggressively.

Ethereum also had a big impact on the flush, with liquidations of $16.03 million, making it the biggest among all assets. According to the info we have, the biggest single liquidation order was for ETH/USDT, at $12.14 million, and it was done on Binance.

Next up was Bitcoin, with total liquidations at $2.21 million. Other assets like SOL, MGO and 1000PEPE also saw over half a million dollars each, showing the wider impact of the market’s movements.

Shorts suffered the worst of it. Of the $503.7 million that were liquidated overall, $371.35 million were short positions. Only $132.34 million of that was from longs.

That breakdown stayed the same even on shorter time frames — $18.64 million in shorts vs. $7.84 million in longs in four hours — which shows that today’s moves were more about panic covering than fresh bullish conviction.

Read the full article here