Key points:

-

Bitcoin sees a snap reaction to news of direct US involvement in the Israel-Iran conflict, dipping below $102,000.

-

Traders note that war-based headlines have acted as a BTC price springboard in the past.

-

Price analysis suggests that a local bottom may coincide with order book liquidity at around $97,000.

Bitcoin (BTC) risked new month-to-date lows into the June 22 weekly close as geopolitical threats soured crypto sentiment.

Bitcoin can still gain from war headlines — Traders

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD falling under $102,000 as US President Donald Trump confirmed strikes on nuclear facilities in Iran.

Iran, Trump said during a televised address uploaded to Truth Social, “must now make peace” or face additional strikes.

Ahead of what promised to be a volatile open to the Wall Street trading week, Bitcoin traders began considering potential BTC price bottom levels.

“A dump towards $93K-$94K before bottom formation and reversal,” popular trader Cas Abbe suggested, adding that the low $90,000 zone only had a “20%-25% chance” of being reached.

Abbe and others referenced events in April, when BTC/USD suffered following the announcement of reciprocal US trade tariffs before beginning a sustained rebound to new all-time highs.

The war is actually bullish…

2024:

Iran → Israel on April 13

Israel → Iran on April 19$BTC: –18% (first 2 weeks), +28% (next 1.5 months)2024 (2):

Iran → Israel on October 1

Israel → Iran on October 26$BTC: –10% (1st week), +62% (next 2 months)2025:

Israel → Iran… pic.twitter.com/Q6IRDlnZ1h— Xremlin (@0x_gremlin) June 13, 2025

“In 2022, $BTC pumped +42% in 35 days after the Ukraine war began. That was deep in a bear market,” fellow trader Merlijn continued with another historical geopolitical comparison.

“Now it’s 2025. War fears rise again. But Bitcoin’s above $100K. And we’re still in a bull market. What happens if history repeats with more fuel?”

$97,000 BTC price support in play

With hours until the weekly close, however, BTC price strength still lacked conviction, leaving a key level out of reach.

Related: $112K BTC was not ‘bull market peak’: 5 things to know in Bitcoin this week

“I remain long over $93,500, but remember i really want to see the $104,500 hold for the bulls to remain in control,” trader Crypto Tony told X followers about the issue on the day.

BTC/USD thus remained on course for its lowest weekly close since the start of May.

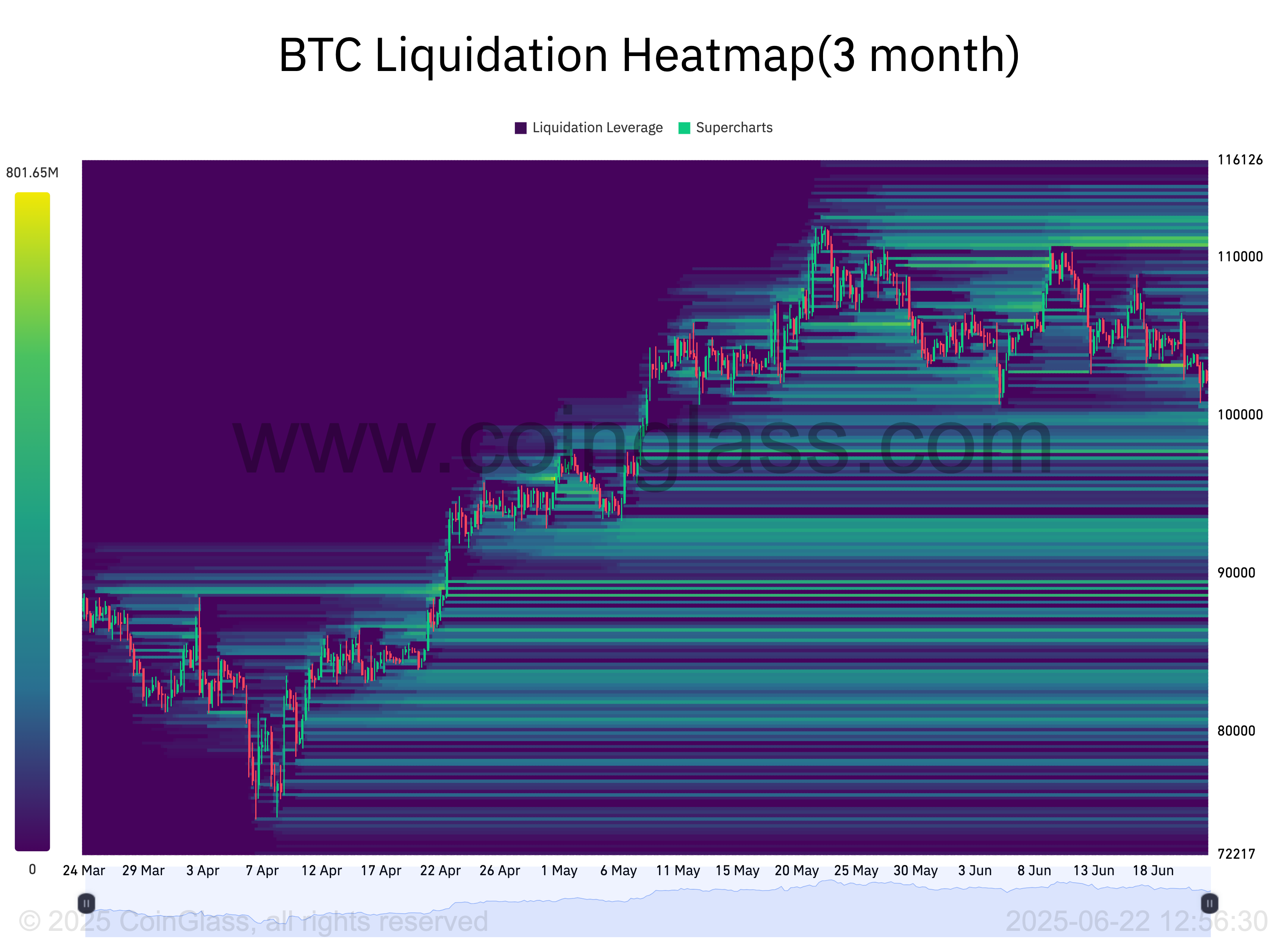

Previously, Cointelegraph reported on exchange order book liquidity, potentially providing the first major support band at around $97,000.

Data from monitoring resource CoinGlass showed that the area remained significant at the time of writing.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here