Key takeaways:

-

Since 2021, 78% of Bitcoin’s bullish engulfing patterns have led to new local highs, especially within broader uptrends.

-

Bitcoin has absorbed over $544 billion in capital since November 2022, pushing the realized market cap to $944 billion.

Bitcoin (BTC) closed Monday with a strong 4.34% daily gain, forming a bullish engulfing candlestick that fully reversed the previous two days of bearish price action. This pattern, coupled with BTC maintaining support above the $105,000 level for two consecutive days, signals a potential shift in market structure and adds weight to the ongoing recovery.

Despite the bullish technical setup, market sentiment remains divided, prompting a deeper examination. To assess the reliability of this pattern, Cointelegraph did a comparative analysis of all bullish engulfing formations on BTC’s daily chart since 2021.

While the bullish engulfing pattern served as the primary signal, additional criteria were used to validate its strength:

-

The engulfing candle must encompass at least the previous two candles.

-

The pattern should emerge at the tail end of a corrective phase, indicating a potential trend reversal.

-

In the sessions following the engulfing pattern, a clear break of structure should be observed to confirm bullish momentum.

Since January 2021, Bitcoin has recorded 19 instances of the bullish engulfing pattern meeting the defined confirmation criteria. Out of these, 15 led to the formation of new local highs in the following days or weeks, translating to a historical success rate of approximately 78%.

Notably, all 19 instances occurred within a broader bull market context. In 2024 and 2025, there were only two failed signals, in May 2024 and March 2025, where the pattern did not lead to new price highs.

Despite these exceptions, the prevailing bull market structure suggests a statistically favorable environment for continuation, with Bitcoin currently positioned to make new highs before potentially retesting the $100,000 level.

For broader context, the same pattern was also observed during the 2022 bear market, where four occurrences were identified. None of these led to new highs, with three instances clustered within February 2022.

This contrast underscores the importance of trend context, as the pattern’s effectiveness has historically been limited in downtrends, further reinforcing the higher probability of success during the present bull market.

Related: Bitcoin price starts ‘normal and healthy’ support test as $108K halts bulls

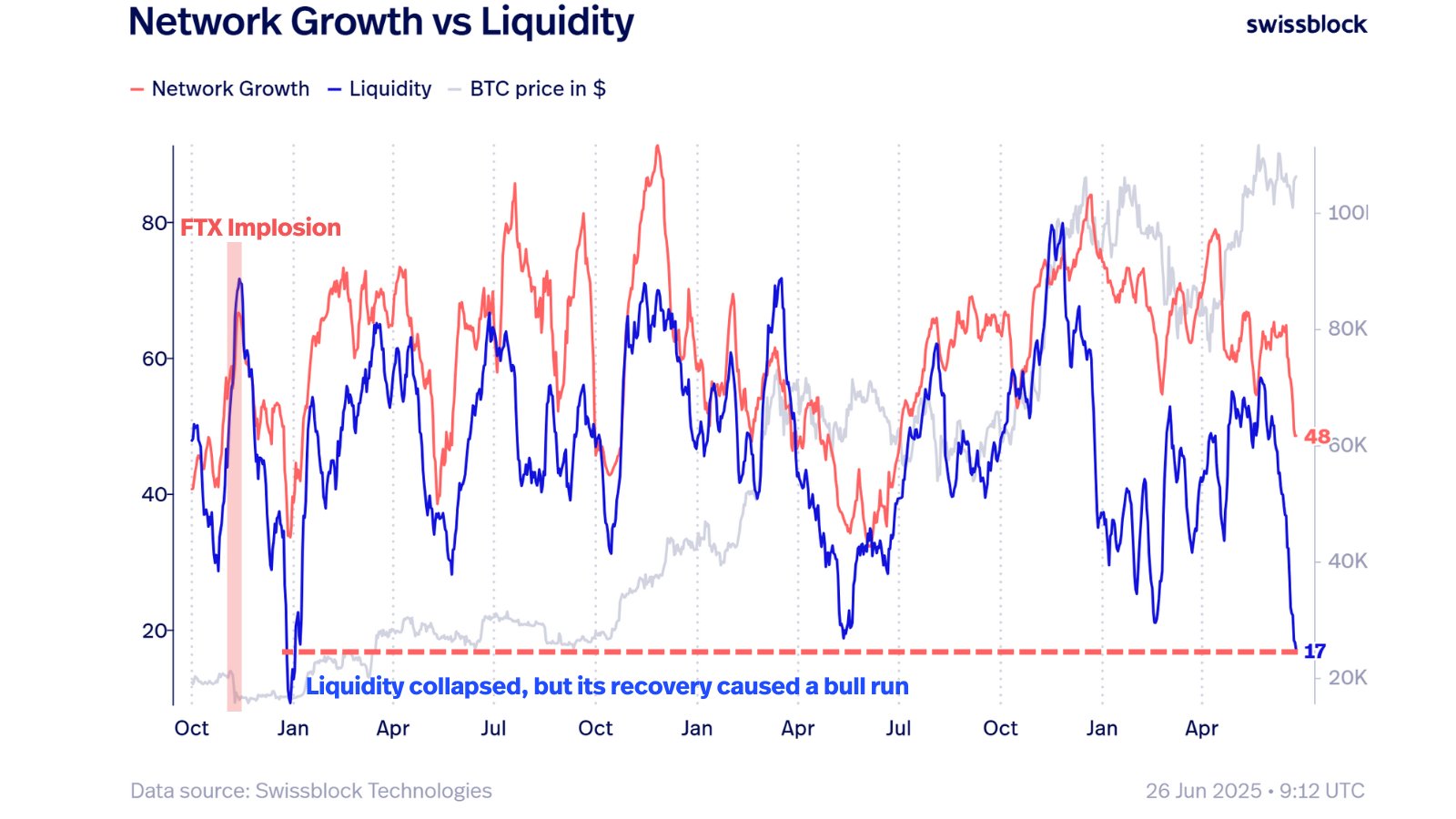

Bitcoin flashes “undeniably bullish” liquidity conditions

Bitcoin market conditions are flashing a setup not witnessed since late 2022. Despite widespread panic, BTC bottomed at $16,800 and doubled in three months. According to recent data from Swissblock, liquidity levels have returned to those seen in December 2022, hinting at a potentially bullish continuation.

While the macro environment, market participants, and catalysts have changed, one fundamental truth remains consistent: when liquidity recovers, BTC price follows. The current structure suggests that Bitcoin could be positioning for a similar breakout, as capital flows back into the system.

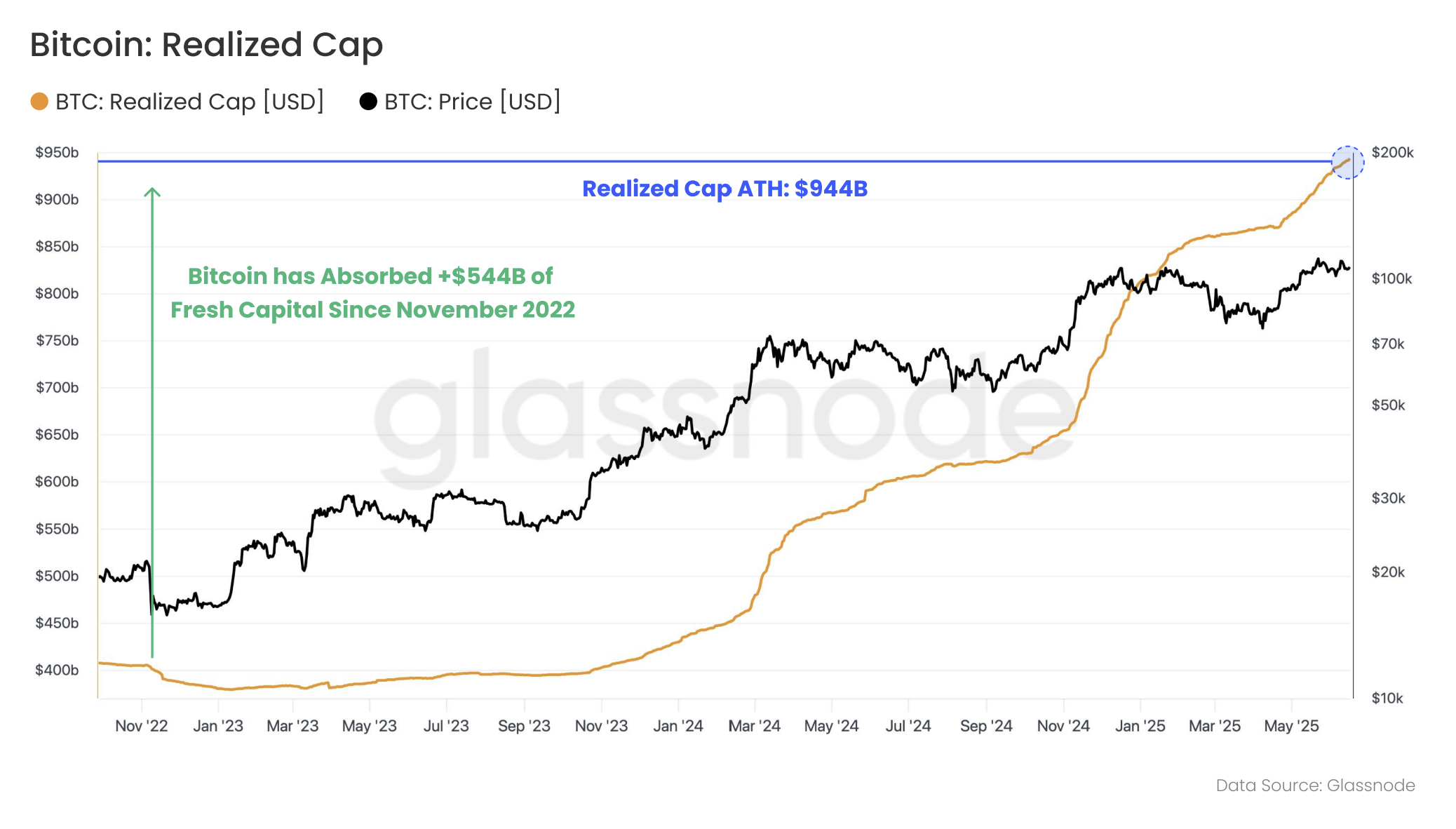

The role of liquidity has evolved significantly this cycle, highlighting Bitcoin’s growing maturity as a macro asset. Since the cycle low in November 2022, Bitcoin has absorbed over $544 billion in fresh capital inflows, driving its internal network liquidity or realized market cap to an all-time high of $944 billion.

Related: Bitcoin analysts say this must happen for BTC price to break $112K

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here