- Bitcoin (BTC) climbed towards $107K over the weekend, trading around $106,332 despite U.S. domestic unrest.

- President Trump deployed 2,000 National Guard troops to Los Angeles amid an immigration-related standoff.

- BTC showed strong support at $105,400 and broke resistance around $106,100 with strong volume.

Bitcoin (BTC) continued its steady ascent over the weekend, trading above $105,623.12 and pushing towards the $107,000 mark, even as domestic tensions escalated in the United States, notably in Los Angeles.

The cryptocurrency market appeared largely unfazed by the unsettling headlines, showcasing a degree of resilience that underscores its growing perception as a hedge against uncertainty.

The backdrop to Bitcoin’s steady performance was a significant immigration-related standoff in Los Angeles.

According to a report by CNBC, the situation saw over 100 arrests as clashes persisted between protesters and federal agents.

This prompted President Trump to authorize the deployment of 2,000 National Guard troops to the area.

By Sunday morning, elements of the 79th Infantry Brigade had arrived on-site, as confirmed by Northern Command.

The potential for further escalation was highlighted by Defense Secretary Pete Hegseth, who warned that US Marines stationed at Camp Pendleton could also be mobilized if the violence continued.

Despite these significant domestic developments, Bitcoin’s price action remained remarkably stable, hovering around $106,332 by Sunday.

This suggests that crypto investors are, for now, treating the unrest as a localized regional event rather than a systemic crisis capable of derailing the digital asset market.

Technical picture: consolidation with bullish undertones

Bitcoin traded within a relatively narrow range over the weekend, fluctuating approximately $1,057 between a low of $105,043 and a high of $106,101, before pushing to its current level around $106,332.

The price demonstrated a strong rebound after a brief dip below $105,100, with buying interest re-emerging robustly around the $105,400 support level, according to CoinDesk Research’s technical analysis model.

An early attempt to break out above the $106,100 mark encountered selling pressure, which created a high-volume resistance zone.

While this upward move was initially short-lived due to some profit-taking, Bitcoin managed to hold onto its gains.

The overall consolidation structure remains bullish, with a consistent pattern of higher lows hinting at the potential for a sustained push towards the $107,000 level, should the immediate resistance break cleanly.

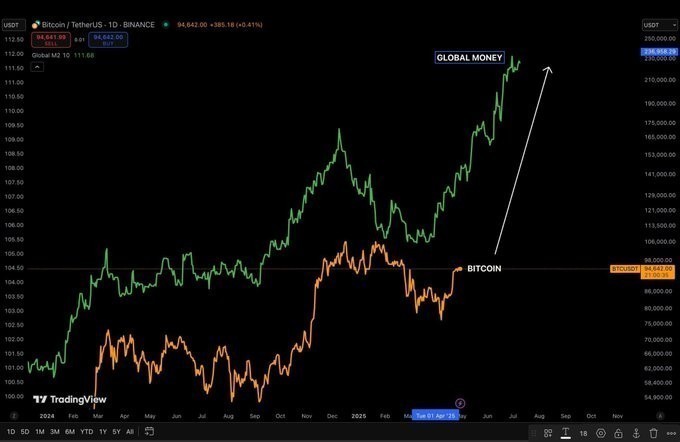

This tendency for Bitcoin to attract buyers during dips, despite broader macroeconomic headwinds, further underscores its perceived role as a hedge in times of rising uncertainty.

Key technical levels and market dynamics

A closer look at the technical indicators provides further insight into Bitcoin’s recent price action and potential near-term movements:

-

Trading range: BTC traded within a $1,288 range (representing 1.22% of its value) between a low of $105,043.65 and a 24-hour high of $106,332.

-

Resistance break: Initial resistance observed around the 105,900–106,100 zone was decisively broken as prices surged beyond this area with strong trading volume during the early afternoon.

-

Support holds: The support level at $105,400 held firm despite several retests, reinforcing the prevailing bullish sentiment in the market.

-

Breakout and stabilization: A clear breakout to $106,332 occurred around 13:48, which was followed by minor profit-taking activity before the price stabilized above the $106,000 mark.

-

Ascending trend: The hourly chart reveals an ascending trend characterized by consistent higher lows, a pattern that invalidates earlier interpretations of a “pump and dump” scenario.

-

Next target: With current momentum intact, market analysts suggest that BTC may test the $107,000 resistance level, provided that the current support near $105,800 continues to hold.

This technical picture, combined with Bitcoin’s apparent decoupling from localized domestic strife, paints a cautiously optimistic outlook for the leading cryptocurrency as it navigates a complex global landscape.

Read the full article here