Key takeaways:

-

Ripple’s “multiple acquisitions” and XRPL upgrades back the bullish case for XRP.

-

CME XRP futures hit $542.8 million in volume during the first month.

-

Elliott Wave analysis and bull pennant suggest an XRP price breakout to $5-$14

XRP (XRP) price has been stuck within the $2.00 and $2.60 range since early March, with no clear directional bias. However, several factors suggest that this stagnation may soon give way to a significant breakout into double-digits.

Ripple acquisitions and XRP Ledger upgrades

Ripple’s strategic moves to expand its ecosystem are a major catalyst for XRP’s potential breakout. The acquisition of prime brokerage Hidden Road for $1.25 billion reinforces the company’s ambition to cater to institutional investors. Ripple said it would use its stablecoin, RLUSD, as collateral across Hidden Road’s suite of brokerage services.

Ripple chief technology officer David Schwartz said that more acquisitions are in the pipeline.

“Our M&A people are very busy,” Schwartz told DL News in New York, adding:

“We have multiple potential acquisitions in various stages, from early stages to late stages.”

Ripple has been aggressively courting traditional finance companies, with Metaco and Standard Custody being among notable acquisitions.

Ripple is also planning to upgrade its XRPL blockchain to include increased “programmability” and a new lending protocol, according to Schwartz.

The latest partnership with Wormhole is aimed at expanding multichain interoperability on the XRP Ledger (XRPL) and its upcoming XRPL EVM Sidechain.

Today, we are partnering with @Wormhole to bring multichain interoperability to the XRPL and the upcoming XRPL EVM Sidechain: https://t.co/soylouwu47

This integration brings new optionality for developers and institutions looking to build cross-chain applications whether for… pic.twitter.com/dpDDEKEQY6

— RippleX (@RippleXDev) June 26, 2025

These upgrades, reminiscent of Ethereum’s evolution, promise improved scalability and interoperability, which could boost XRP demand for cross-border payments and DeFi applications.

As Ripple strengthens its infrastructure and partnerships, increased adoption could drive demand, pushing XRP’s price beyond its current range.

Growing exposure to CME XRP futures

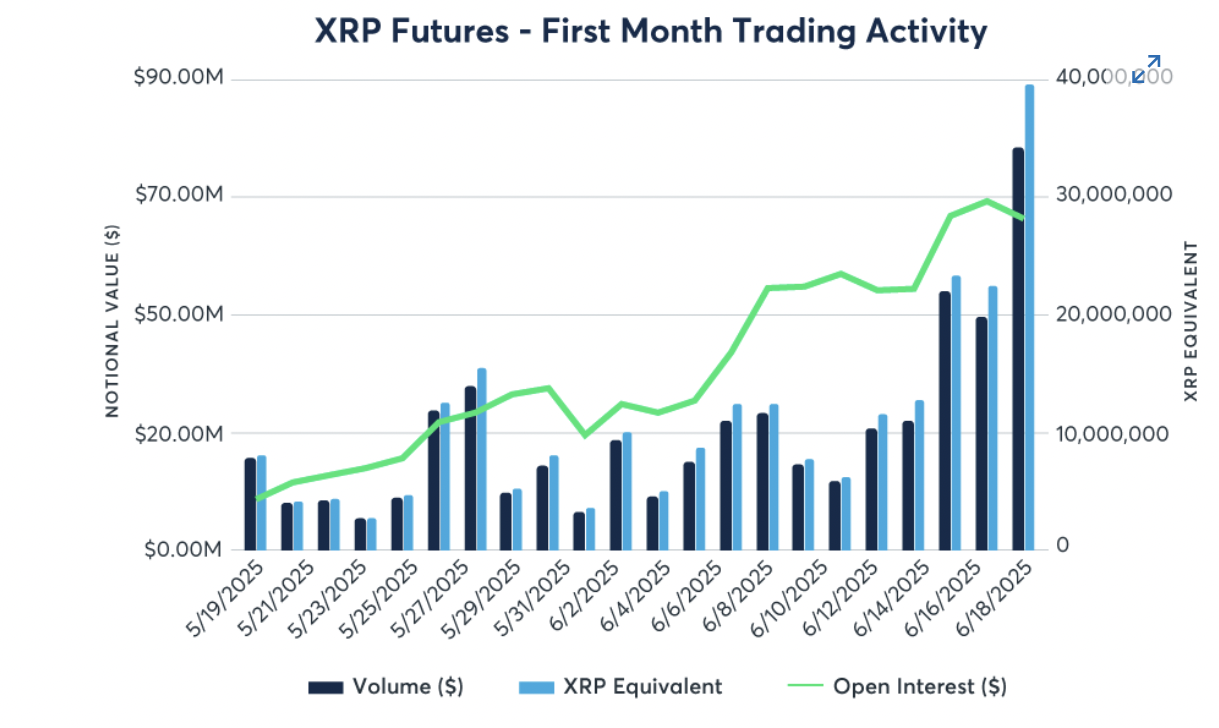

Growing exposure to CME XRP futures could catalyze a significant breakout in XRP’s price, driven by increased institutional participation and market liquidity.

Since launching on May 19, both the standard and micro XRP futures contracts have amassed more than $542.8 million in notional trading volume, indicating robust institutional and retail appetite, according to the CME Group’s latest report.

“The introduction of XRP futures has rapidly demonstrated significant market interest and widespread participation,” with trading volume reaching $19.3 million across 15 firms and four retail trading platforms on the first day, CME explained, adding:

“This diverse engagement, from ETF issuers to individual retail traders, highlights the robust demand for XRP futures.”

CME group also highlighted that over 24,600 contracts were exchanged during the first month of trading, with nearly 50% of the participants coming from outside the United States.

Related: Who is Arthur Britto, the Ripple ‘ghost’ who just broke 14 years of silence?

Moreover, the likely approval of a spot XRP ETF would see more capital inflows into XRP investment products, solidifying its position as a mainstream asset and sending its price higher.

The betting odds for an XRP ETF approval by Dec. 31 currently stand at 76% on Polymarket.

XRP price technicals hint at a breakout ahead

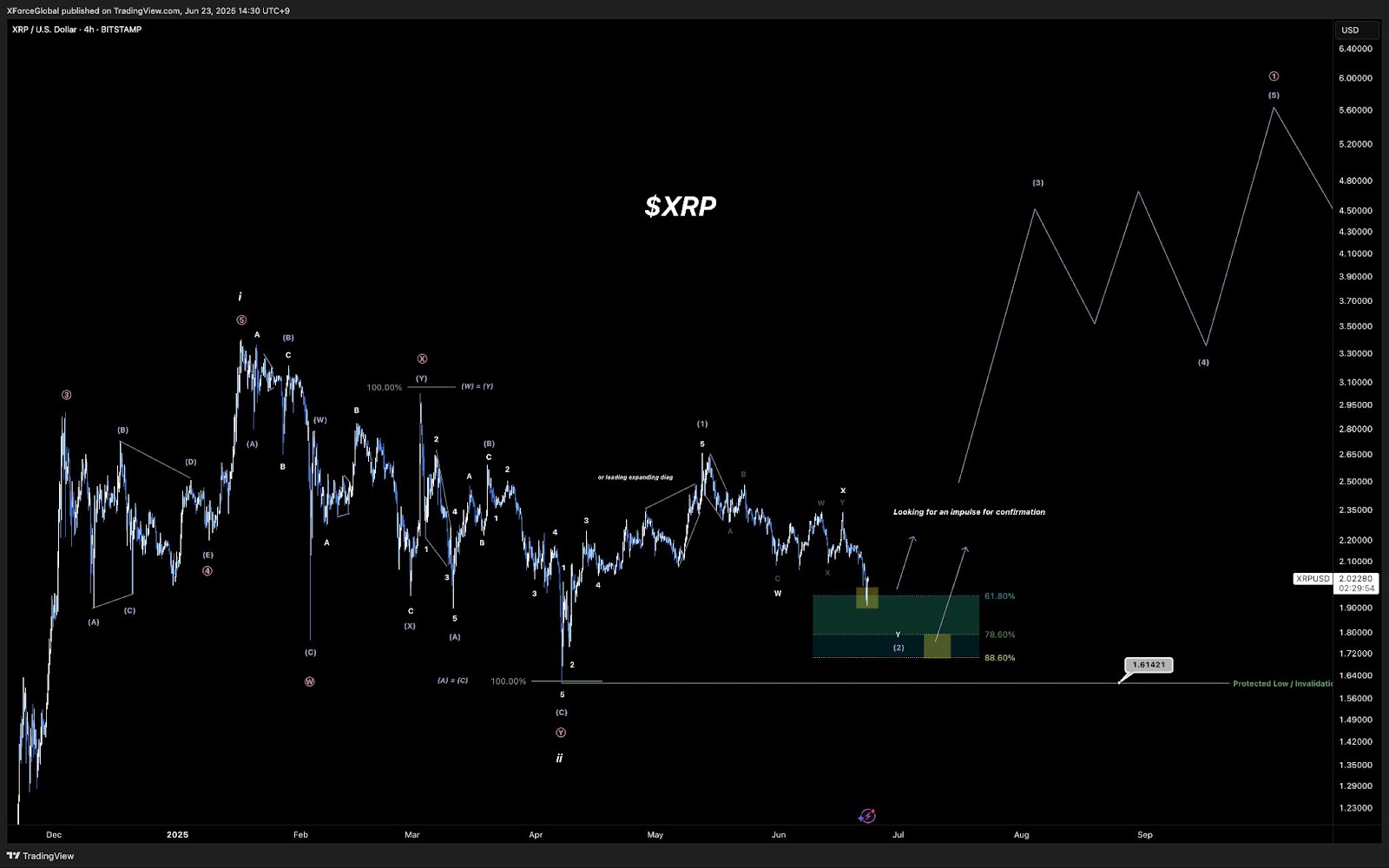

XRP price could be preparing for a major breakout, according to crypto analyst XForceGlobal.

The recent pullback to $1.90 “set the stage for a faster bullish route to the upside,” the analyst said on X, adding the price had retested the key 0.618 Fibonacci level around $2.00.

An accompanying chart showed an Elliott Wave analysis projecting a possible breakout to $5.

In an earlier post, XForceGlobal said his target for this cycle was between $20 and $30. This aligns with Egrag Crypto’s analysis that Fibonacci extension levels centered around a symmetrical triangle projected a $8-$27 XRP price target.

A positive breakout from the pennant could potentially lead to the next leg up for XRP, measured at $14, or 564% from its current price level.

As Cointelegraph reported, XRP’s next big up-move will likely begin after buyers drive the price above $2.65 (the upper limit of the current consolidation range), clearing the path for a rally to $3 and beyond.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here