On Sunday, the US entered the Iran-Israel conflict by targeting three Iranian nuclear sites via ‘Operation Midnight Hammer.’ This escalation stirred significant volatility in the crypto market, leading to a widespread downturn.

High-stakes crypto whales also felt the effects, experiencing both gains and losses. This highlighted the risks and potential rewards of leveraged trading in these uncertain times.

How Crypto Whales Are Navigating the Market Amid the Iran-Israel Conflict

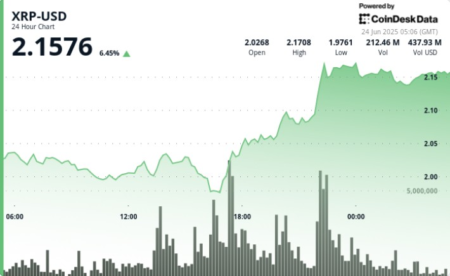

According to BeInCrypto data, the overall crypto market capitalization dropped by 3.2% in the past 24 hours, with the majority of coins in the red. Yesterday, Bitcoin fell below the $100,000 mark for the first time since May 8. This dip was triggered by fears that Iran might close the Strait of Hormuz following the US strike.

While Bitcoin reclaimed $100,000 to trade at $101,516 at press time, it remained down by 1.2% over the past 24 hours. In addition, BTC has lost 4.4% of its value in the past week, with the decline being even more pronounced for other altcoins.

Crypto Market Performance Amid Iran-Israel Conflict. Source: BeInCrypto

The current market instability has led to a surge in crypto liquidations, with several whales bearing the brunt of the impact of the Iran-Israel tensions. Lookonchain data highlighted that a whale identified by the wallet address 0x7e8b went long on Bitcoin and Ethereum.

However, the whale was liquidated as the market dipped, resulting in a loss exceeding $3.5 million.

“Due to the market crash, whale 0x7e8b was liquidated for 965 BTC($97.5 million) and 12,024 ETH($26.22 million), losing over $3.5 million,” the post read.

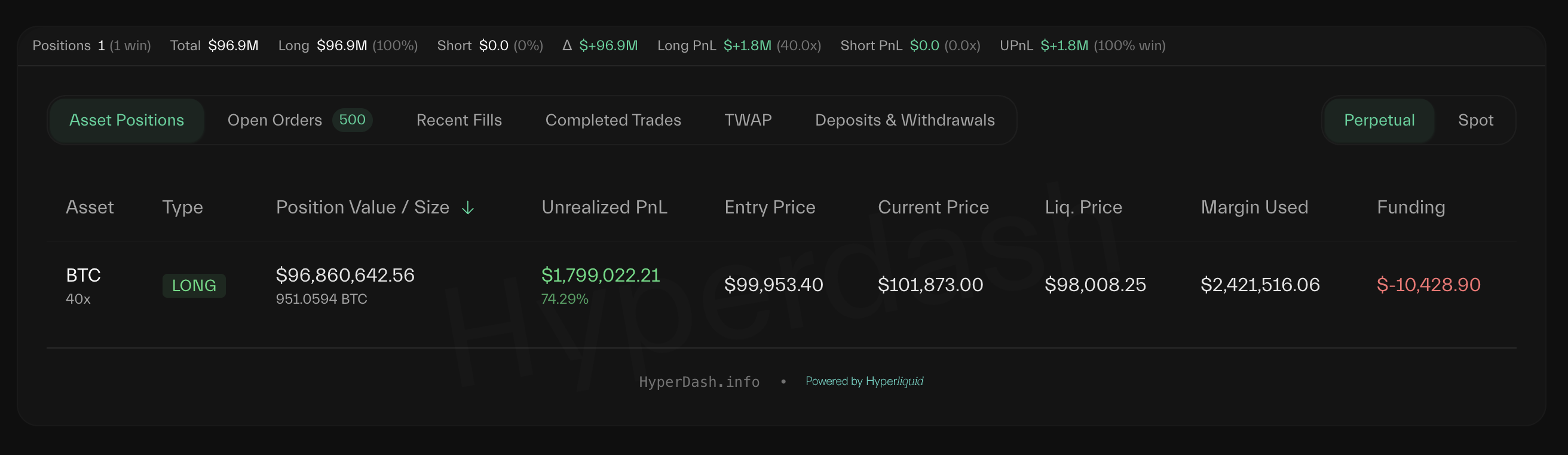

Despite the loss, the whale re-entered the market and opened a 40x-long position on BTC. HyperDash data showed that this position has yielded an unrealized profit of $1.79 million.

Whale (0x7e8b) Long Bitcoin Position. Source: HyperDash

The blockchain analytics firm also highlighted the activity of swing trader AguilaTrades. Over the past two weeks, three of AguilaTrades’ long positions have resulted in losses totaling $32.7 million.

The most recent loss occurred on June 22, when the trader closed a Bitcoin long position, incurring a $17 million setback. However, the trader flipped to a short position on Bitcoin and managed to close it for a profit.

Nonetheless, not all traders have seen losses. Some whales have capitalized on the downturn. A trader (Gambler 0x51d9) secured over $9 million in profit from a 40x short Bitcoin position, betting correctly on the price decline.

“He had lost a total of $4.96 million across his last 6 trades, but this one trade made it all back,” Lookonchain wrote.

Similarly, Abraxas Capital has also emerged as a significant winner. It has been utilizing two wallets on the Hyperliquid platform to short BTC, ETH, HYPE, SUI, and SOL with 10x leverage. This strategy has generated over $74 million in floating profits.

Read the full article here