This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

World War II’s outcome was fundamentally determined by access to oil.

So depleted was the resource by the final stages of the war that Nazi Germany resorted to extraordinary measures to maintain basic mobility — pulling trucks by oxen, four at a time.

The oil situation for the armies of Imperial Japan was equally dire. In Daniel Yergin’s Pulitzer Prize-winning book The Prize, he documented how the Japanese kamikaze suicide pilots would fill their tanks to only halfway since they were not meant to return from their missions.

The armies of both Nazi Germany and Imperial Japan were defeated not for lack of manpower or armaments, but because they ran out of oil.

Oil’s enduring legacy in the history of the deadliest conflict in human history continues to influence and reverberate throughout contemporary thinking.

For instance, “data is the new oil” is the rally cry of Big Tech critics when they clamor for stronger regulations of tech companies.

Whether they do it unknowingly or not, the metaphor draws a parallel between oil’s historical importance and the emerging value of data in the digital economy.

That analogy too has permeated crypto, evident in our use of words like “gas” and “burn.”

Channeling that meme to the fullest is last week’s “The Bull Case For ETH” report co-authored by top Ethereum stakeholders.

In the report, ETH is projected at a value of $8k per ETH ($1 trillion market cap) in the short term.

The long-term moon math goes even further: ETH at a $85 trillion asset of $706k per ETH — a steal at today’s prices!

Source: Ethdigitaloil

Part of this valuation model benchmarks ETH against today’s $85 trillion oil market valuation.

But the case for ETH as “digital oil” is more complex than that.

For one, unlike real armies, the heaviest gas guzzlers of ETH have cheaper alternatives.

Ethereum’s largest gas guzzlers have historically been Uniswap and Tether. Both are actively moving their execution onto more gas-optimized environments (Unichain and Plasma).

Though Plasma isn’t live yet, and Unichain is still in its early days, it does considerably weaken the case for ETH as “digital oil.”

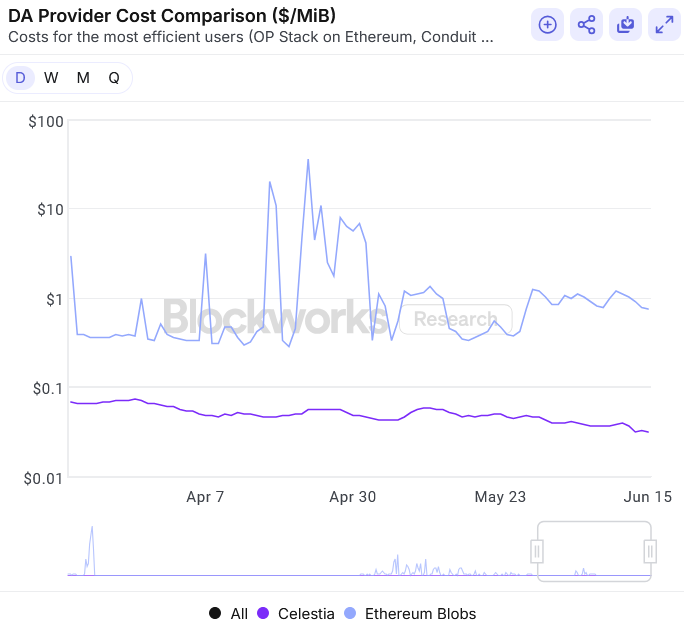

What about data availability?

The biggest ETH-denominated bill for L2s is the cost of using Ethereum DA, namely publishing your raw transaction data to the L1.

Before the introduction of blob space with EIP-4844, 1 kB of call data would cost about 16,000 gas, or about $1.44 (assuming ETH at $3000).

That’s a non-trivial 80-90% of a typical L2 fee.

EIP-4844 brought legacy call data costs down by ~99%, yet it is still cheaper by ~20-30x if rollups use an alternative-DA layer like Celestia or EigenDA.

The ETH as “digital oil” thesis crumbles further when you consider that Ethereum itself faces stiff competition from competing L1s.

If Ethereum can claim its native asset as “digital oil,” so can Solana, Sui and every other ecosystem.

Read the full article here