Even though Ethereum’s (ETH) price has not produced the gains that holders would hope for, recent data shows that investors holding the altcoin have remained resilient and optimistic. This could be surprising, especially as the Ethereum Foundation, which has been at the helm of selling ETH, has liquidated some assets again.

While the sale initially sparked valid concerns, this analysis explains why holders are unfazed by the development.

Another Sale Leaves Ethereum Holders Unfazed

Earlier today, the Ethereum Foundation sold 100 ETH for $262,474. This sell-off is just a little part of the coins the foundation has let go over the last few months. According to Spot On Chain, the total number of ETH sold this year has reached 3,766.

With an average price of $2,777, 1,250 ETH were sold in September, valued at $3.06 million. In total, the foundation sold 3,766 ETH in 2024, with the total value reaching $10.46 million.

This consistent selling trend could indicate strategic profit-taking or cover operational costs, but it may also impact Ethereum’s market supply and price moving forward.

Ethereum Foundation Transactions. Source: Spot On Chain

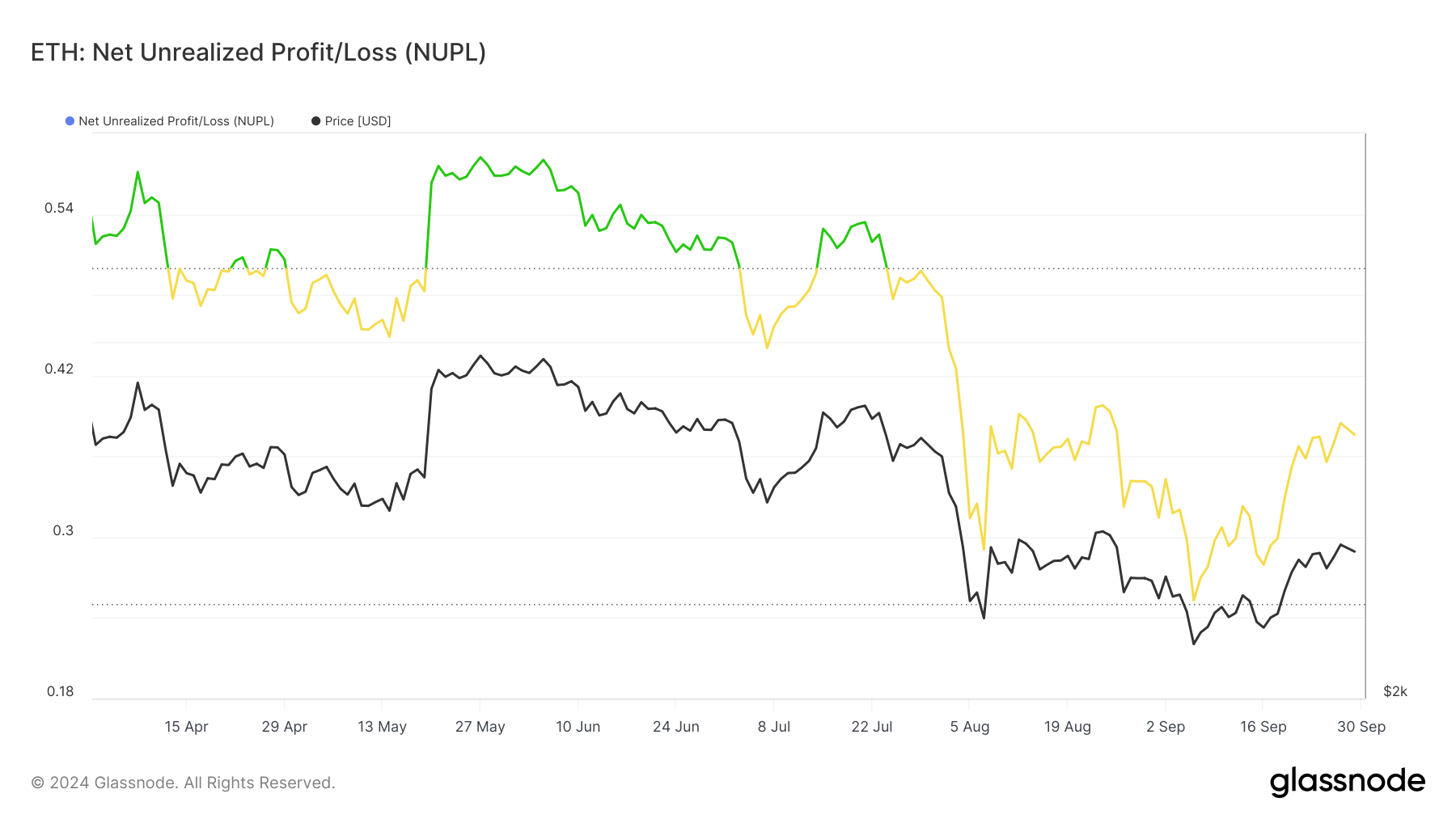

However, according to the Net Unrealized Profit/Loss (NUPL), ETH holders appear optimistic about the coin’s potential. Based on Glassnode’s data, NUPL is the sentiment investors have about a cryptocurrency.

This perception ranges from capitulation (red), hope (orange), optimism (yellow), belief (green), and euphoria (blue). As seen below, ETH holders are in the optimistic region, indicating confidence in a higher price for the cryptocurrency.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Ethereum NUPL. Source: Glassnode

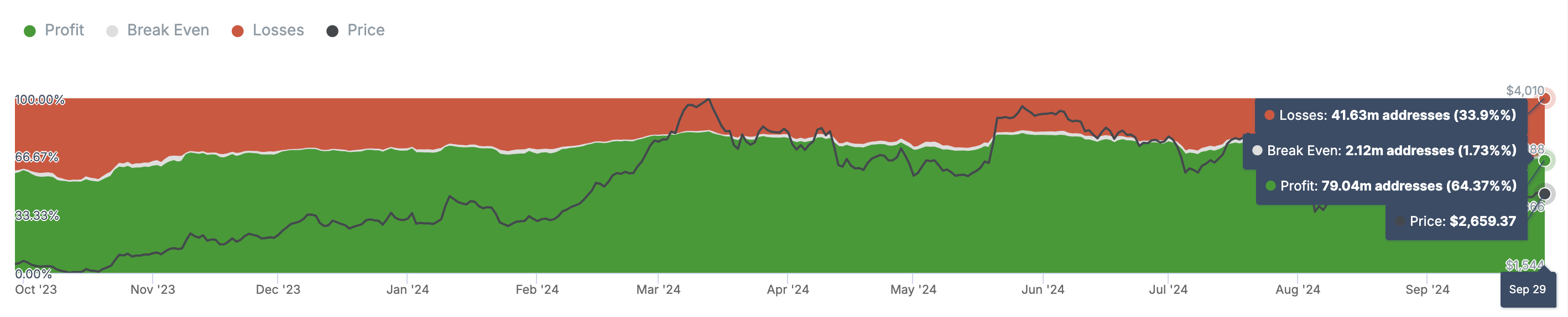

Beyond that, the Historical In/Out of Money shows that the ratio of holders in profit has risen from 60% on September 16 to 64.37% today. The HIOM, as it is commonly called, shows the level of unrealized gains or losses in the market.

If the level of unrealized losses increases, it derails investors’ confidence. However, since unrealized profits have risen recently, more investors might be encouraged to buy ETH, and this could drive the price higher.

Ethereum Historical In/Out of Money. Source: IntoTheBlock

ETH Price Prediction: Ready to Break $3,000

A look at Ethereum’s weekly chart revealed that the Commodity Channel Index (CCI) had increased. The CCI is a technical indicator that measures the difference between the current price and the historical average value.

When it increases, the asset’s price has a good chance of moving upward. A decrease in the CCI, on the other hand, indicates weakness. With the altcoins price at $2,632, a further rise in the CCI could bring about ETH’s run toward $3,255.

Read more: 9 Best Places To Stake Ethereum in 2024

Ethereum Daily Price Analysis. Source: TradingView

However, if the indicator fails to rise above the signal line at the midpoint, Ethereum could drop. In that scenario, the coin’s value might decline to $2,301.

Read the full article here