- Ethereum’s new addresses surged to 200,000 in January 2025, doubling 2024’s daily average, reflecting growing adoption amid market volatility.

- Ethereum’s price faces bearish pressure near $3,154, with critical support at $3,100 and resistance at $3,343, signaling potential volatility ahead.

Ethereum has achieved notable adoption milestones in January 2025, reflecting a growing user base and network resilience. According to data from Glassnode, new Ethereum addresses surged to approximately 200,000 on January 24–25, a level last observed in October 2022 — a significant increase from the 2024 daily average of 100,000–120,000 addresses.

The sharp rise in addresses emerges during a period of market volatility, highlighting growing interest in Ethereum despite a broader price correction. Historically, such growth in new addresses often correlates with price discovery phases, indicating an influx of new participants even as the ETH/USD pair faces short-term challenges.

The total number of addresses holding a non-zero ETH balance has climbed steadily, now reaching 136 million. This upward trend highlights Ethereum’s ability to attract users beyond speculative activity. The divergence between price fluctuations and address growth underscores the network’s solid base of committed holders, revealing a robust foundation for continued expansion.

Next Support at $3,100? Bulls Under Pressure

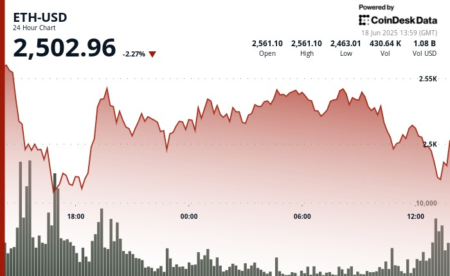

Ethereum (ETH) has broken down from a symmetrical wedge, with the price slipping to $3,154, marking a 5% decline in the last week. The 200-EMA at $3,343 remains a key resistance, while the 50-EMA at $3,290 could act as a short-term cap. RSI at 42.60 signals bearish momentum.

A deeper dive into RSI trends shows a weak recovery attempt, struggling below the neutral 50-mark, hovering around 41.43. The previous bullish divergence failed to sustain, leading to the breakdown. Price may seek the support of nearly $3,100, but if bulls fail, Ethereum could extend losses toward $3,000 in coming sessions.

Ethereum’s selling pressure heightened after rejecting the $3,350 zone, aligning with broader market trends. The $3,207 EMA suggests a critical pivot for bulls. A push above $3,250 could spark recovery, but continued weakness risks a fall to $3,000-$2,950. Volume trends indicate sellers still hold the upper hand.

Ethereum Open Interest Hits $31B

Ethereum’s future open interest has risen to $31.28 billion, signaling increased involvement from retail and institutional investors. While the rise in open interest is a bullish indicator, leverage-driven rallies have historically triggered sharp corrections.

Institutional interest appears to be growing steadily. A consistent rise in Ethereum network activity during recent price corrections signals a more mature market. Historical patterns indicate that increased adoption during price declines often points to potential accumulation and possible future recovery.

Ethereum’s long-short ratio, currently at 0.96, shows a slight advantage for shorts over longs. Traders exhibit reluctance to adopt a strong directional stance, suggesting potential volatility ahead. If buyers fail to reclaim dominance, sustained selling momentum could intensify downward pressure.

Read the full article here