- Ethereum could face a heavy decline if Middle East war tension persists.

- Ethereum ETFs are lagging because ETH investment narrative isn’t easy for traditional investors to digest, says BlackRock.

- Ethereum broke a key support level and could decline to $2,207 if bearish pressure persists.

Ethereum (ETH) is trading below the $2,595 support level on Tuesday as investors are becoming more cautious following heightened war tensions in the Middle East.

Daily digest market movers: Ethereum declines following Middle East war tension

Ethereum and the entire crypto market is in a downtrend on Tuesday following geopolitical tension in the Middle East. Ethereum dropped below the $3,500 psychological level upon news of Iran launching a missile attack on Israel. The top altcoin may see a further decline if the tension escalates, as market participants anticipate a retaliation from Israel.

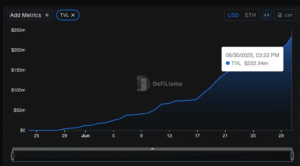

Ethereum exchange reserves also align with the decline as investors have rapidly switched from a risk-on attitude to a more cautious approach. According to CryptoQuant’s data, Ethereum exchange reserves increased by over 144K ETH in the past 24 hours.

Ethereum Exchange Reserve

An increase in the spot exchange reserve of a cryptocurrency indicates higher selling pressure and a potential for more price decline.

Meanwhile, Ethereum ETFs recorded a net outflow of $0.8 million on Monday as BlackRock ETHA’s $11 million inflow failed to outweigh the $11.8 million negative flows in Grayscale’s ETHE, per Farside investors data. On the other hand, Bitcoin ETFs posted a net inflow of $61.3 million.

Since launch, Ethereum ETFs have largely underperformed their Bitcoin counterparts, and a key executive of asset manager BlackRock expects the trend to continue.

According to a report by Fortune, a BlackRock executive believes ETH ETFs haven’t seen high volume because an Ethereum investment narrative isn’t easy for many traditional investors to digest. The executive noted that issuers need to be committed to sensitizing and educating customers on ETH’s potential and use cases.

Ethereum breaks key support level

Ethereum is trading around $2,480 on Tuesday, down nearly 4% on the day. In the past 24 hours, ETH has sustained over $87 million in liquidations — its highest since August — with long and short liquidations accounting for $71.01 million and $16.36 million, respectively.

Despite optimism surrounding a potential bullish October for crypto, Ethereum opened the month on a low, crossing below the support level around $2,595. The move also saw ETH crossing below its 50-day, 100-day and 200-day Simple Moving Averages (SMA), indicating potential for increased bearish pressure.

ETH/USDT 4-hour chart

The next support level to watch is $2,395. A breach of this level could send ETH toward $2,207.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) momentum indicators are below their neutral levels and approaching their oversold regions.

A reclaim of the $2,595 support level will invalidate the bearish thesis.

Share: Cryptos feed

Read the full article here