Ethereum (ETH) is currently facing downward pressure, with its price facing a potential decline below the $3,000 mark. Apart from the broader market consolidation, ETH’s current price fall is driven by the decrease in activity from its large investors.

This analysis explains why the price decline may occur and highlights the price points ETH holders should pay attention to.

Ethereum Faces Selloff Pressure as Whale Netflow Drops

According to IntoTheBlock, ETH’s large holders’ netflow has plummeted by 73.19% over the past seven days. Large holders are whale addresses that hold more than 0.1% of an asset’s circulating supply.

When an asset witnesses a fall in whales’ netflow, it indicates that its big investors are reducing their positions by selling off or transferring assets. This often signals a lack of confidence in the asset’s short-term prospects, leading to potential downward price pressure as these holders move their funds elsewhere.

Ethereum Large Holders Netflow. Source: IntoTheBlock

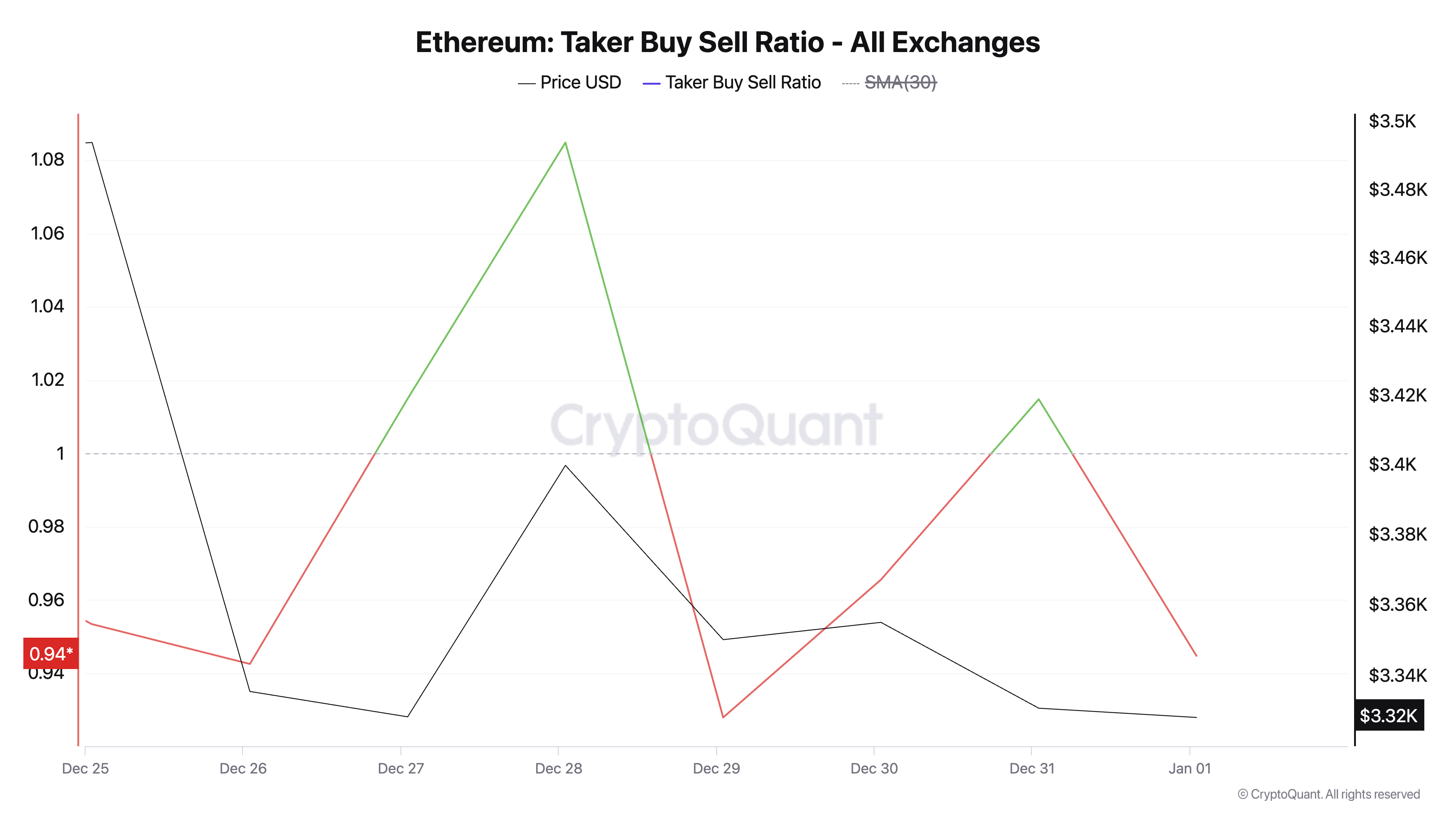

In addition to reduced whale accumulation, ETH’s Taker-Buy-Sell ratio has been predominantly less than one in the past seven days, indicating selloffs among its derivatives traders. According to CryptoQuant, this stands at 0.94 at press time.

An asset’s Taker-Buy-Sell ratio measures the proportion of buy orders to sell orders executed by market takers. A ratio below one indicates that sell orders outweigh buy orders, signaling bearish sentiment. This suggests selling pressure exceeds buying interest, often hinting at potential price declines as more traders exit positions than enter them.

Ethereum Taker Buy Sell Ratio. Source: CryptoQuant

ETH Price Prediction: All Lies With the Whales

On the daily chart, readings from ETH’s Moving Average Convergence Divergence confirm the drop in the demand for the leading altcoin. At press time, the coin’s MACD line (blue) rests below its signal line (orange) and zero line.

This indicator helps traders identify changes in a trend’s strength, direction, and duration. As with ETH, when the MACD line is below the signal line, it indicates a bearish trend. If selling pressure strengthens further, ETH’s price could fall below support at $3,070 to trade at $2,558.

Ethereum Price Analysis. Source: TradingView

On the other hand, if market sentiment improves and ETH whales resume accumulation, they may drive the coin’s price toward $3,415.

Read the full article here