Ethereum’s price has struggled to close above the $4,000 mark for the second time in the last six months. Despite rallying close to this key psychological level, ETH was unable to maintain its position, signaling the need for a stronger bullish conviction to push the price past this barrier.

The failure to sustain above $4,000 suggests that investors are hesitant, with profit-taking likely playing a key role in halting the momentum.

Ethereum Whales Accumulate

Whale addresses holding between 10,000 and 100,000 ETH, which have demonstrated strong accumulation over the past five days, purchasing a combined total of 400,000 ETH worth over $1.5 billion. This significant accumulation highlights that large wallet holders continue to have confidence in Ethereum’s long-term growth.

The whales’ buying activity highlights Ethereum’s attractiveness as an investment. Despite recent challenges in surpassing the $4,000 barrier, this large-scale accumulation demonstrates that institutional and high-net-worth investors are not deterred by short-term volatility.

Ethereum Whale Holding. Source: Santiment

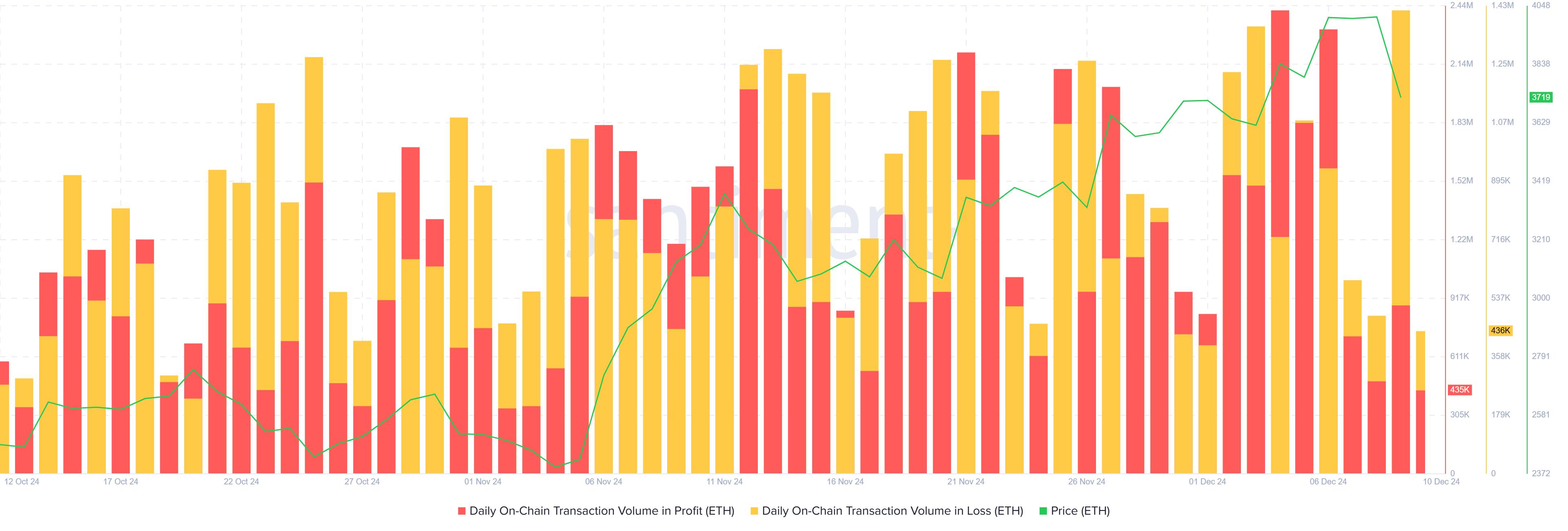

The transaction volume distribution reveals that a significant portion of Ethereum transactions are in profit, far outpacing those in the red. This suggests that a majority of Ethereum holders are sitting on gains, increasing the likelihood of profit-taking. If investors decide to capitalize on their profits, this could trigger short-term sell-offs, placing downward pressure on Ethereum’s price.

The dominance of profitable transactions also indicates that Ethereum has a large number of investors with a vested interest in securing returns. While this reflects healthy market activity, it also means that the risk of price corrections remains elevated. Profit-taking, especially after a strong rally, could hinder Ethereum’s ability to break through the $4,000 barrier and sustain its growth trajectory.

Ethereum Transaction Volume Distribution. Source: Santiment

ETH Price Prediction: Decline or Recovery

Ethereum’s price dropped by 7% yesterday, now trading at $3,761. The altcoin king is attempting to secure $3,721 as support to avoid further declines. This level is crucial in determining whether ETH can maintain its bullish momentum or face a deeper pullback in the coming days.

Securing the $3,721 support is essential for Ethereum to break above $4,000. If this happens, ETH could reach a new year-to-date high above $4,093. This potential rally would also pave the way for ETH to set new all-time highs, reinforcing the positive outlook for the altcoin.

Ethereum Price Analysis. Source: TradingView

However, if Ethereum fails to maintain $3,721 support, it may drop toward $3,524. A further decline could send ETH down to $3,327. If this happens, the bullish thesis will be invalidated, and a more significant market correction may follow.

Read the full article here