Ethereum has shed 18% of its value over the past month. As its price continues to slide, the percentage of ETH’s supply held in profit has fallen to its lowest level since October, signaling mounting challenges for the altcoin.

With the strengthening of selling pressure, ETH holders may record more short-term losses on their investments.

Ethereum Holders Count Their Losses

ETH’s double-digit decline has pushed its price below the crucial support formed at $3,000. The altcoin currently trades at $2,640 and remains under significant bearish pressure.

The recent price drop has pushed many Ethereum holders into the red. According to Glassnode, the percentage of ETH’s circulating supply in profit has plummeted to its lowest point since October. As of now, just 64.19% of Ethereum’s total circulating supply is in profit. Put differently, 48 million ETH out of 121 million ETH remains in profit.

ETH Percentage Supply in Profit. Source: Glassnode

For context, as of January 1, 83% of ETH’s total circulating supply was in profit. When the percentage of an asset’s circulating supply in profit drops, a larger portion of holders are now facing losses, as the asset’s market price has fallen below their purchase price.

This decline often signals reduced investor confidence and can indicate potential downside risks for the asset’s price.

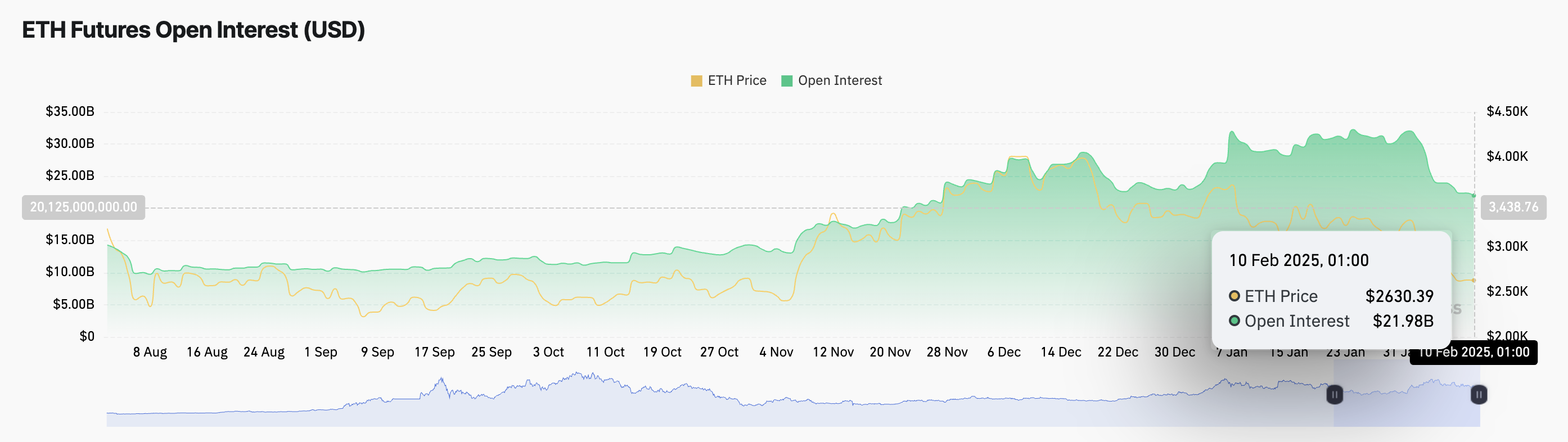

Notably, ETH’s open interest has also declined, confirming the decrease in investor confidence. As of this writing, this stands at $22 billion, falling by 31% since the beginning of February.

ETH Open Interest. Source: Coinglass

Open interest measures the total number of outstanding contracts (long or short), such as futures or options that have not been settled. When open interest drops like this, it indicates a decrease in market activity or investor participation, which can suggest reduced confidence or a shift in market sentiment.

ETH Price Prediction: Drop to $2,224 or Reversal to $2,811?

On the daily chart, ETH trades at the lower line of its descending channel, which forms support at $2,553. If selloffs gain more momentum, the bulls may be unable to defend this level, causing ETH’s price to extend its losses.

In that scenario, the coin’s price could drop to $2,500 or lower to $2,224.

ETH Price Analysis. Source: TradingView

However, a reversal in the current market trend will invalidate this bearish projection. In that case, ETH’s price could resume its uptrend and climb to $2,811.

Read the full article here