Ethereum’s (ETH) price peaked at $3,443 on Tuesday and has since witnessed a correction. It currently trades at $3,063 at press time, losing 3% of its value over the past 24 hours.

With waning bullish sentiments, the Ethereum coin price risks a potential dip toward the $2,900 price level. This analysis explains why this scenario may play out in the short term.

Ethereum Traders Reduce Activity

A corresponding drop in trading volume has accompanied Ethereum’s price decline over the past few days. Over the past 24 hours, its trading volume has totaled $35 billion, dropping by 25%.

A price drop indicates that the demand for the asset has weakened as sellers outnumber buyers. The simultaneous drop in ETH’s price and volume suggests weakening momentum, which could signal the end of its bullish trend.

Ethereum Price and Trading Volume. Source: Santiment

Traders often interpret this trend as a lack of conviction among market participants, further discouraging activity and potentially leading to a self-reinforcing cycle of declining price and volume.

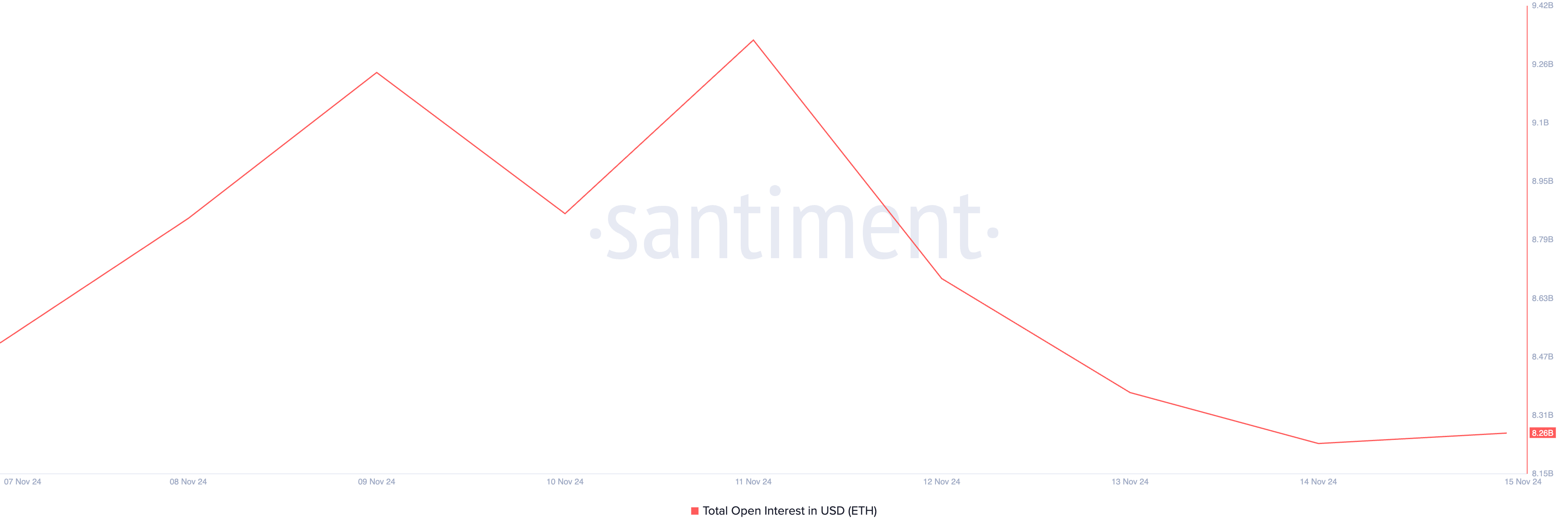

Moreover, Ethereum’s open interest fell to a seven-day low on Thursday, confirming the decline in market activity. Per Santiment’s data, the coin’s open interest, which measures the total number of outstanding contracts in the derivatives market, is now at $8.26 billion. It has plummeted by 12% since Monday.

Ethereum Open Interest. Source: Santiment

When open interest declines, existing contracts are closed rather than new ones being opened. During periods of price rallies, a decrease in open interest means that traders are locking in profits or limiting losses by closing their positions.

As in ETH’s case, this occurs near the peak of a price trend, where traders might want to secure their gains before a potential reversal.

ETH Price Prediction: Coin Eyes Decline Below $3,000

Ethereum is trading at $3,063, hovering just above the critical support level at $2,942. If market activity remains subdued, the altcoin could test this support. A failure by bulls to defend this level may lead to a deeper decline toward $2,787.

Ethereum Price Analysis. Source: TradingView

Conversely, an improvement in market sentiment and renewed demand could see ETH rebound off the $2,942 support and reinitiate its uptrend. This recovery could drive the Ethereum coin price past the $3,162 resistance level and potentially toward its cycle peak of $3,443.

Read the full article here