Ether has significantly underperformed Bitcoin and other digital assets this market cycle, but growing institutional interest in Ethereum staking is driving demand for custody solutions to support a wider range of investors, according to Kean Gilbert, head of institutional relations at the Lido Ecosystem Foundation.

On May 27, Komainu, a regulated digital asset custody provider, began offering custody support for Lido Staked ETH (stETH), which is Ethereum’s largest staking token, accounting for 27% of all staked Ether (ETH).

The custody solutions are available for institutional investors in Dubai, United Arab Emirates, and Jersey, the autonomous self-governing territory of the British Islands.

The product provided a compliant path to accessing Ethereum staking yields at a time when more institutional investors were diversifying into digital assets.

“Many asset managers, custodians, family offices and crypto-native investment firms are actively exploring staking strategies,” Gilbert told Cointelegraph in an interview.

At the same time, US exchange-traded fund issuers await regulatory clarity on launching Ethereum staking ETFs.

Despite Ether’s underperformance, “Institutions find liquid staking tokens like stETH useful because they directly address challenges related to capital lock-ups and complex custody arrangements,” Gilbert said.

Tokens like stETH provide immediate liquidity and are compatible with qualified custodians like Komainu, Fireblocks and Copper, he said.

Related: SharpLink buys $463M in ETH, becomes largest public ETH holder

Custody solutions may boost institutional adoption of ETH, crypto assets

Lido’s push toward institutional adoption has accelerated in recent months, marked by the launch of Lido v3, which features modular smart contracts designed to help institutions meet regulatory compliance requirements.

Gilbert told Cointelegraph that custody solutions are essential for certain institutions, such as asset managers and family offices, under strict compliance and risk management frameworks.

“Historically, the limited availability of regulated custodians or MPC wallet providers supporting stETH was a significant barrier for these institutions,” he said.

This contrasts with crypto-native firms, which are generally more comfortable managing crypto assets directly and are often willing to forgo third-party custody solutions.

Related: Bitcoin may struggle in Q3 as eyes turn to Ethereum’s ‘catch-up’ — Analysts

Gilbert said staked Ether tokens like stETH are increasingly being used by both traditional and crypto-native institutions to gain exposure to Ethereum staking rewards without locking up capital for long periods.

These tokens also provide the benefit of liquidity through decentralized finance (DeFi), centralized finance (CeFi), and over-the-counter (OTC) markets.

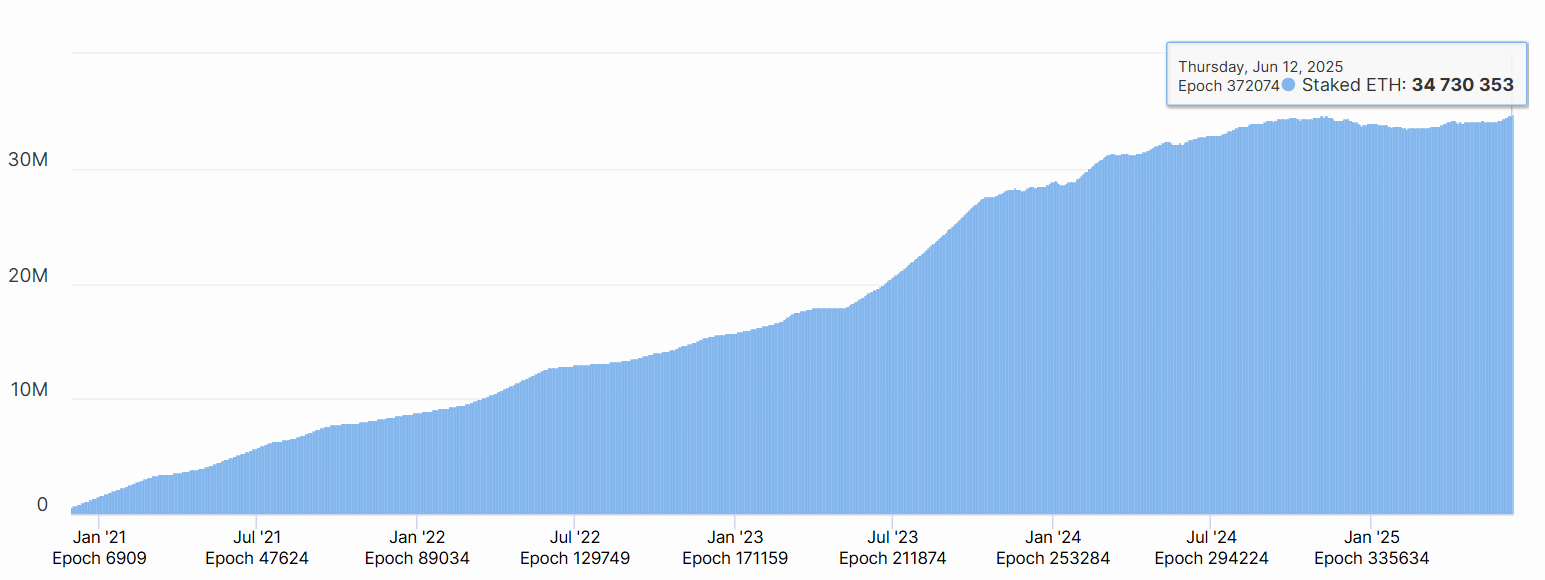

For these reasons, demand for staked Ethereum has grown considerably. Last week, Cointelegraph reported that the amount of Ether staked in the Beacon Chain reached a new all-time high.

Magazine: 3 reasons Ethereum could turn a corner: Kain Warwick, X Hall of Flame

Read the full article here