Ethereum’s ecosystem is undergoing notable changes, according to an update by Leon Waidmann from Onchain Insights. In his latest post, Waidmann highlighted Ethereum staking reaching an all-time high while exchange reserves hit record lows. At the time of writing, Ethereum was valued at $2,680.40 showing a 9.26% growth over the past 24 hours.

#Ethereum Staking at ATH levels, while ETH on exchanges is hitting record lows. 📈📉

A supply squeeze incoming!

Bullish #ETH 🟢🚀 pic.twitter.com/Vwd1RT2lwP

— Leon Waidmann | Onchain Insights🔍 (@LeonWaidmann) November 6, 2024

These developments suggest a potential supply squeeze, which could boost ETH’s price. Also, on-chain data points to increased confidence in Ethereum’s long-term viability, as more investors move their holdings into staking and self-custody.

Staking Growth and Declining Exchange Reserves

Ethereum 2.0 staking participation has surged, with a growing portion of ETH locked in staking contracts. This trend reduces the amount of ETH available for trading on centralized exchanges. As exchange reserves decline, selling pressure could ease, potentially fueling a price rally.

Source: X/LeonWaidmann

Furthermore, investors are displaying increased confidence in Ethereum’s ecosystem by opting for self-custody solutions. Data shows a significant outflow of ETH from exchanges, suggesting a shift towards long-term holding and staking. This tightening supply scenario strengthens the case for a bullish outlook on Ethereum.

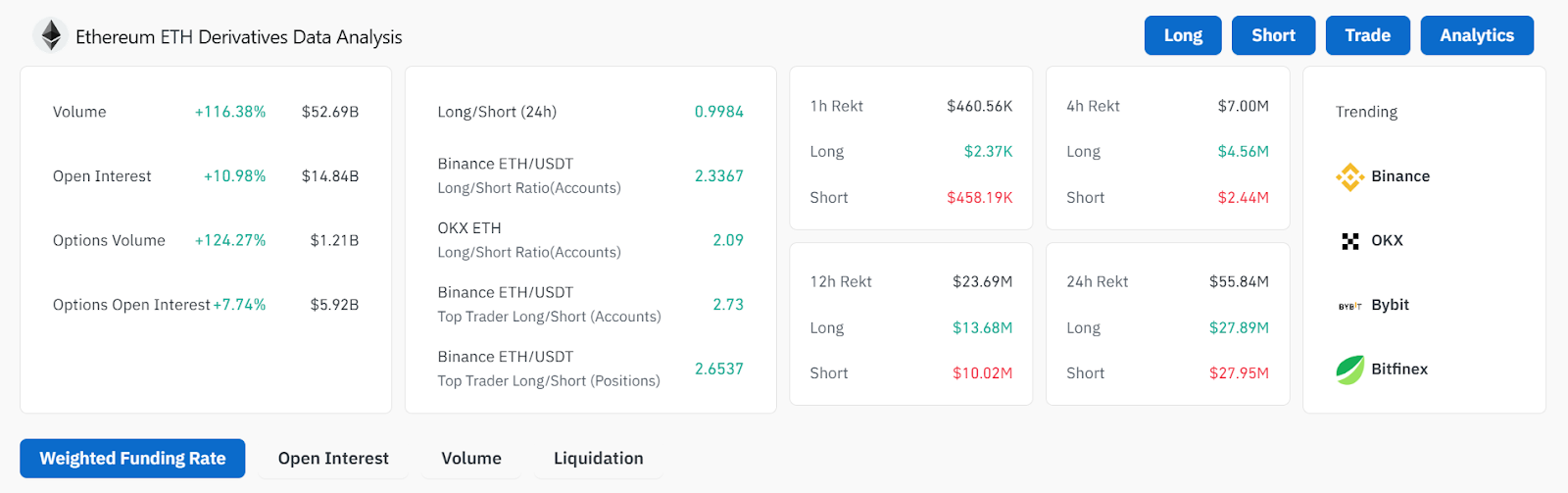

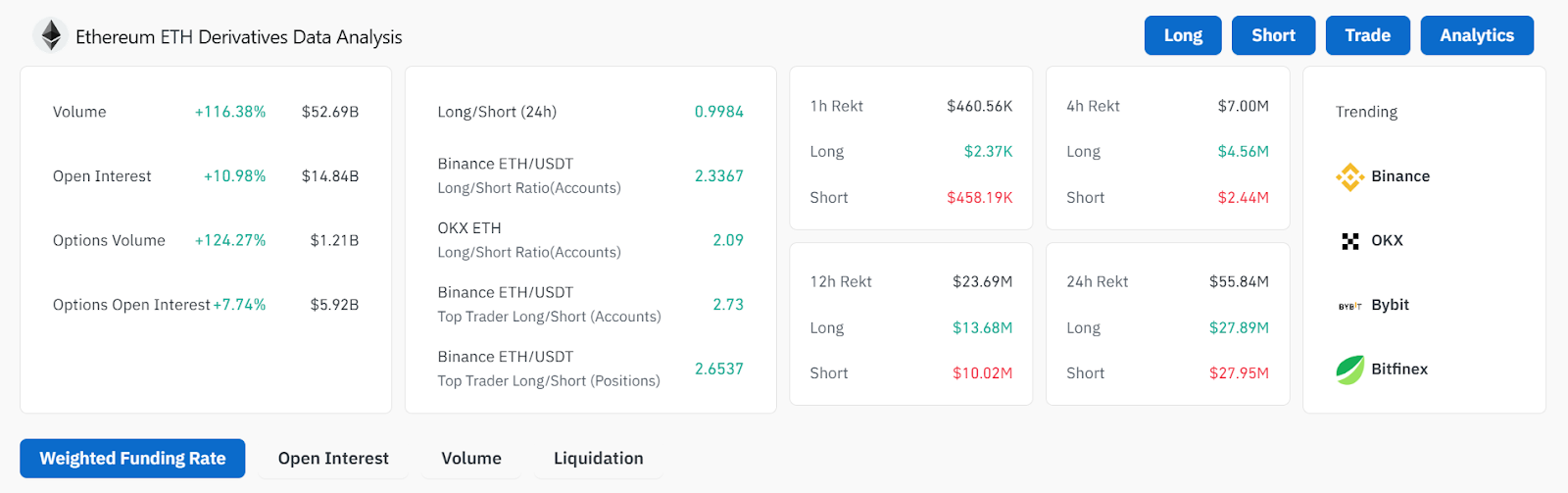

Derivatives Market Activity Jumps

Ethereum’s derivatives market has also seen a sharp increase in activity. Trading volumes have surged by 116%, reaching $52.69 billion, while open interest has climbed by 11%. These figures point to heightened market engagement, driven by both speculative and hedging strategies.

Source: Coinglass

In addition, bullish sentiment is strong in the derivatives space. On platforms like Binance and OKX, long positions substantially outnumber short positions. But market volatility persists, with data showing substantial liquidations for both long and short positions. Regardless, the growing activity in the derivatives market signals potential price movements in the near term.

On-Chain Metrics: A Mixed Picture

Ethereum’s on-chain data presents a complex market situation. Only 29% of ETH holders are currently in profit, while 64% face losses. This underscores the impact of recent price declines. However, large holders, who control 92% of the supply, remain active. High-value transactions totaling $6.83 billion were recorded over the past week, suggesting whale activity.

Source: IntoTheBlock

The trend of ETH flowing out of exchanges continues. Approximately $34.61K in ETH has been moved off centralized platforms. This shift demonstrates growing confidence in self-custody and staking options. Despite short-term price pressures, Ethereum’s fundamentals remain solid.

ETH Price Predictions

Changellyblog analysts project Ethereum’s price to stabilize by December 2024. Forecasts suggest that ETH will not fall below $2,528.39, with a peak value of $2,564.25 expected. The estimated average trading price for the month is $2,546.32.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here