Ethereum’s price recently faced resistance in its journey toward the $3,000 mark, struggling to secure $2,700 as a solid support floor. The recent price action saw unexpected selling pressure that prevented further gains, yet this offloading seems to be easing.

With resistance levels now tested, ETH could see renewed buying momentum, suggesting a more favorable outlook in the coming weeks.

Ethereum Is Noting a Slowdown in Selling

Ethereum’s exchange net position change has been trending downwards since the beginning of the month, a positive sign for ETH’s potential rally. As the metric inches closer to the neutral line, this shift indicates that selling pressure is declining. If it flips below neutral, it would imply that buying is beginning to outpace selling, a bullish signal that may help Ethereum reclaim critical support levels.

A decline in exchange positions often reflects reduced selling pressure as traders opt to hold ETH rather than offload it. This sentiment shift would benefit Ethereum’s price trajectory, as reduced sell-side pressure can allow room for a surge.

Read more: How to Invest in Ethereum ETFs?

Ethereum Exchange Net Position Change. Source: Glassnode

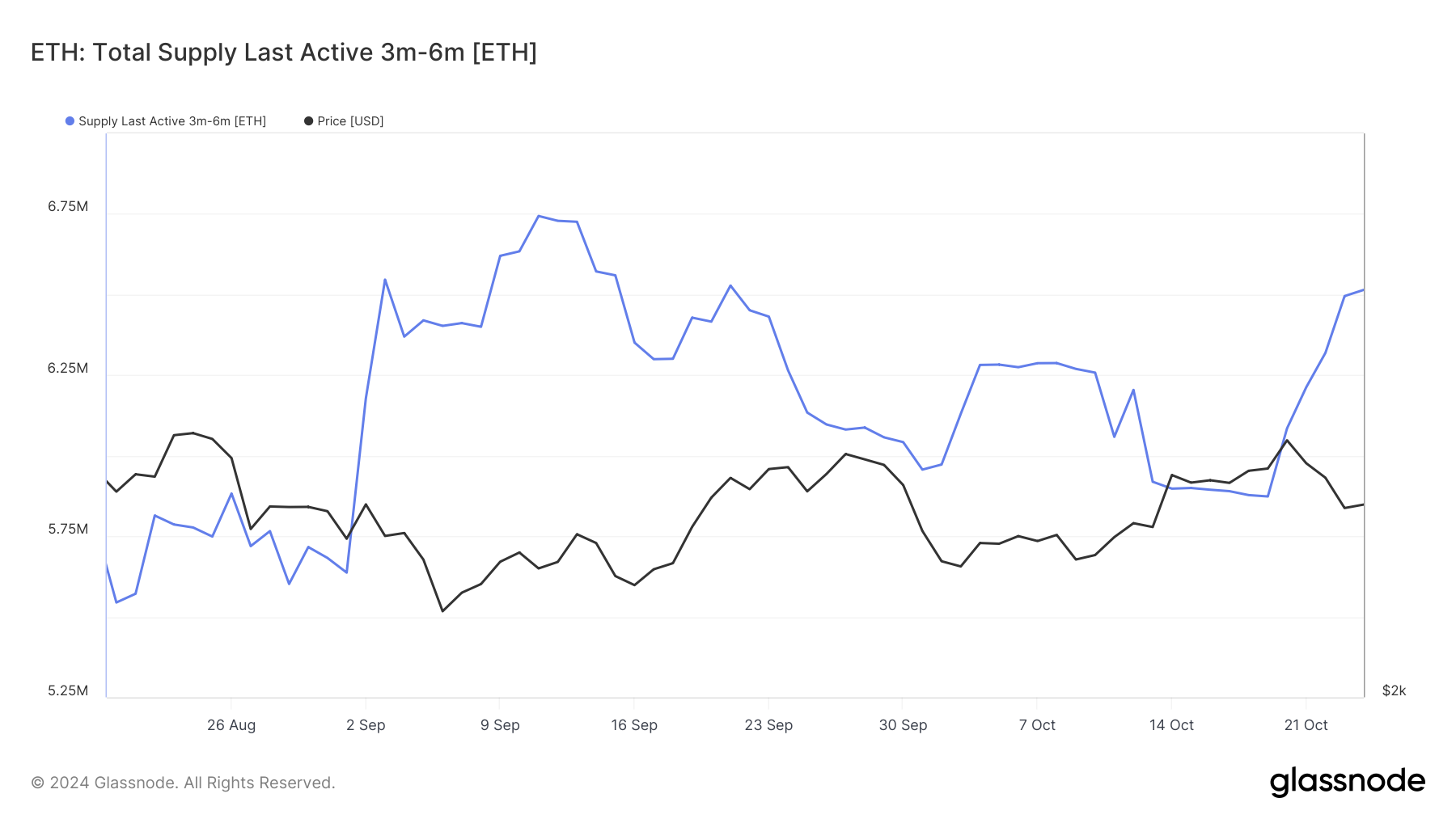

In terms of macro momentum, Ethereum’s mid-term holders (MTHs)—addresses holding ETH for between 1 and 12 months—have been notably active. As ETH’s price dipped this week, these MTHs moved approximately 700,000 ETH, valued at over $1.7 billion.

Such movement by mid-term holders indicates market uncertainty, with this cohort often being more responsive to price shifts. Their recent activity highlights concerns about the potential downside, as large movements can signal hesitation among investors regarding ETH’s short-term stability.

The increased activity from mid-term holders introduces volatility, but it is countered by lower movement from other investor cohorts, which are showing reduced activity.

Ethereum MTH Supply. Source: Glassnode

ETH Price Prediction: No Gains in Sight

Ethereum’s price, currently at $2,538, is striving to reclaim the nearby support at $2,546. Reaching and holding this level is crucial for Ethereum’s run toward the resistance at $2,698, which could pave the way for further gains. As selling pressure subsides, this level is likely within reach.

The overall indicators point to a positive outlook despite the volatility among mid-term holders, as other cohorts remain steady. To push toward $3,000, Ethereum would need to secure $2,698 as a strong support floor.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Price Analysis. Source: TradingView

Ethereum has been holding above a two-month-old uptrend line, reinforcing its overall bullish trajectory. Maintaining this level would keep ETH on a positive track, but a break below this trendline could lead to a drop to $2,344. Such a decline would challenge the bullish outlook, potentially leading to broader market uncertainty around Ethereum’s future price direction.

Read the full article here