The new EU crypto regulations, set to take effect at the end of the year, are already reshaping the market for digital tokens, especially stablecoins like Tether’s USDT. Many crypto exchanges in the EU have delisted the dominant stablecoin USDT to comply with the MiCA. While the regulations aim to improve oversight and prevent crimes like money laundering, crypto experts warn that they might reduce market activity without fully achieving these goals.

Could MiCA Hamper Market Liquidity?

Crypto executives warn that the MiCA regulations may reduce market liquidity without meeting their intended goals, potentially making the EU less attractive to digital-asset traders at a crucial time.

Usman Ahmad, CEO of Zodia Markets, explained that the removal of USDT, the most liquid stablecoin, limits options for EU clients. While Stablecoins like USDT are essential for crypto traders to transfer funds, move money across borders, and settle traditional assets, concerns have grown about their use in illegal activities, as witnessed in recent reports of Russian networks using USDT for illicit transactions.

However, Tether has condemned these illegal uses and emphasized its commitment to preventing such activities.

MiCA Requires Stablecoins On CEXs To Have E-Money License

In an effort to tighten the oversight of the asset class, MiCA requires all stablecoins listed on centralized exchanges must be issued by a company with an e-money license. The issuers must keep up to two-thirds of reserves backing their tokens with an independent bank and monitor all transactions made for payment purposes

While Circle has received this license, but Tether hasn’t yet obtained it, which could lead to its delisting by December 30. Even with MiCA in place, authorities need better tools to track illegal transactions, something that is not ready yet. USDT has been widely used in illegal activities, but Tether is working to address this with a new partnership aimed at combating financial crimes.

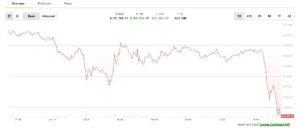

Meanwhile, with President-elect Trump’s victory, there are rising expectations that the U.S. will adopt a more crypto-friendly regulatory approach, sparking a market rally. In contrast, Europe is witnessing declining crypto investments and venture capital in crypto startups is set to hit a four-year low, raising concerns that it may fall behind in the crypto market.

Encouraging Signs

However, there are some encouraging signs. Crypto ownership in the euro area has more than doubled to 9% since 2022, though the European Central Bank cautioned that the increase may be influenced by a change in survey methodology.

Despite this growth, the removal of Tether (USDT) from platforms in the EU is expected to significantly reduce liquidity, as USDT has the most trading pairs globally. Traders are likely to face disruptions as they move away from USDT to other stablecoins or fiat pairs. Some exchanges, like OKX, have already seen traders shift to fiat pairs instead of using other stablecoins.

Read the full article here