A new crypto investment platform, Affluent, has launched on Telegram, aiming to simplify DeFi participation while leveraging traditional finance principles. Developed by former TON Foundation director Justin Hyun, Affluent provides automated yield strategies and lending opportunities directly on The Open Network (TON).

The next evolution of DeFi is here, and it’s happening inside Telegram.

Introducing Affluent. Unlocking institutional-grade yield from BTC, Gold, and RWAs with just one tap.

A full breakdown 🧵 pic.twitter.com/bm7HhU6po9

— Affluent (@AffluentOrg) June 16, 2025

The platform effectively transforms the Telegram interface into a decentralized financial hub. Built natively on TON, the application allows users to earn yield without navigating the technical barriers often associated with DeFi.

How Affluent Blends Automation with Human Oversight

The core feature of the platform is the Strategy Vault. This system uses smart contracts to automatically distribute user assets across multiple lending markets. This setup enhances returns and balances risk, giving users a streamlined experience backed by human decision-making.

Deposits are made through a simple Telegram interface, allowing even novice users to grow wealth with minimal steps. Founder Justin Hyun emphasized the app’s mission to deliver trustless asset management in a user-friendly way.

“TradFi Expertise Meets DeFi”: A Look at the Founders’ Vision

Affluent’s co-founder Hyung Lee, known for his background in traditional options trading, contributed to the app’s design by blending risk-management tools from TradFi with blockchain automation. The result is a hybrid system where smart contracts handle execution while institutions guide performance and oversight.

According to Lee, the app introduces a modular approach to asset management. Users can earn interest by depositing funds in a single tap, with the underlying structure combining TradFi safeguards and DeFi scalability. This model positions Affluent as a next-generation financial tool aiming to serve both retail and institutional users.

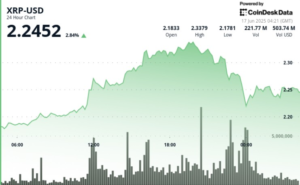

Affluent also addresses key DeFi risks. Hyun confirmed the platform uses isolated lending pools, which localize potential bad debt events to individual pools, protecting the broader protocol. Affluent’s launch arrives during heightened interest in Toncoin (TON), which recently surpassed $1.5 billion in daily trading volume.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here