Crypto exchange Gemini has launched a tokenized version of Michael Saylor’s Strategy (MSTR) stock for users in the European Union, allowing them to invest in the Bitcoin-buying firm onchain.

“Traditional financial rails are hard to access and in need of modernization,” Gemini said in a statement on Friday.

More tokenized stocks and ETFs are coming to the platform soon

“Tokenized stocks solve this problem by giving investors greater access with fewer restrictions,” it added.

Traditional stock markets come with several restrictions, including limited trading hours tied to market time zones, higher fees for international investors, and limited access for investors in certain regions.

Gemini said, “onchain stock trading solves these problems by offering a frictionless experience in one place.”

Gemini said investors could hold crypto and stocks onchain without having to sell on one platform to use another for trading stocks.

Gemini said it had partnered with US public securities provider Dinari to provide the service. “By leveraging Dinari’s tokenization-on-demand model, we can offer customers greater liquidity, transparency, and the same economic rights as the backing security, where permitted,” it said.

While MSTR is the only tokenized stock currently available on Gemini, the exchange said that more tokenized stocks and ETFs are expected to launch “in the coming days.”

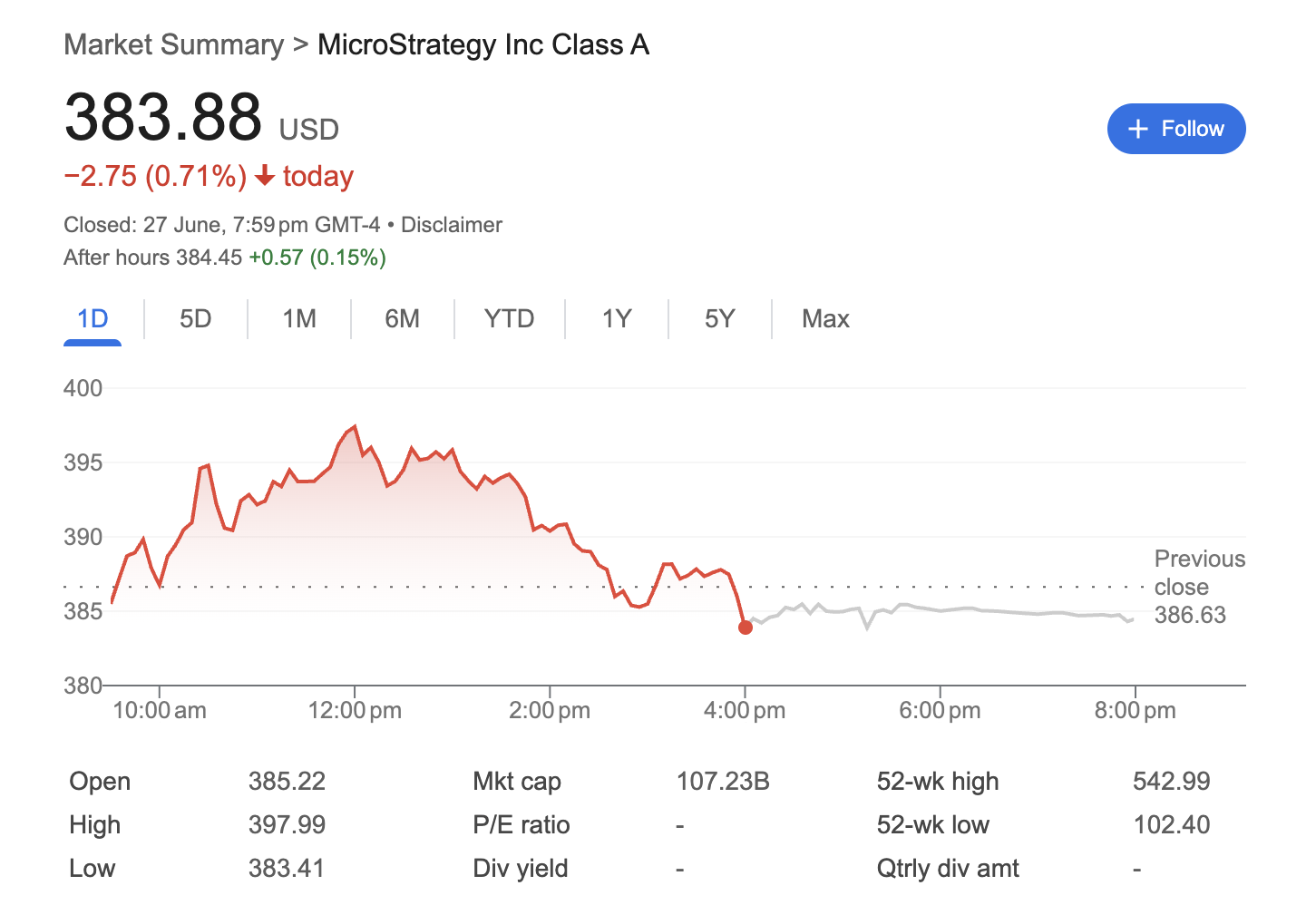

Strategy (MSTR) stock is up 3.84% over the past 30 days, trading at $383.88, according to Google Finance data.

On Wednesday, financial analyst Jeff Walton said that Strategy has a high chance of qualifying for the S&P 500 as long as Bitcoin (BTC) doesn’t drop below $95,240 before the end of the second quarter.

Interest growing for tokenized equities in Europe

This comes amid growing interest from other crypto platforms in bringing US-tokenized equities to the European market. Tokenized equities are not currently available to be traded in the US.

On May 8, reports emerged that brokerage fintech Robinhood is reportedly developing a blockchain network enabling European retail investors to trade US securities.

Related: Coinbase seeks SEC approval for ‘tokenized equities’ — Report

Just weeks later, on May 23, crypto exchange Kraken said it plans to offer non-US customers the option of trading tokenized US stocks, as part of the company’s push to offer more traditional assets via tokenization.

Meanwhile, crypto exchange Coinbase is trying to get the green light in the US. On Tuesday, Coinbase’s chief legal officer, Paul Grewal, reportedly said the company was seeking the approval of the Securities and Exchange Commission (SEC) to offer tokenized equities.

Crypto executives are hopeful that tokenized equities will grow big. Arnab Naskar, STOKR’s CEO, recently said it is difficult to project but is “definitely a bigger trillion-dollar market.”

Magazine: New York’s PubKey Bitcoin bar will orange-pill Washington DC next

Read the full article here