Ethereum (ETH) has been experiencing ongoing sideways momentum, with the price struggling to make any sharp gains. Currently trading around $2,476, the altcoin king has been unable to break through key resistance levels.

The situation is worsened by growing impatience among investors, particularly from key ETH holders, who are opting to sell rather than hold.

Ethereum Selling Rises

Ethereum’s exchange net position change indicates that ETH is starting to flow back into exchanges, which could be a bearish signal. In the past five days, around 350,000 ETH, worth over $870 million, have been sold by investors. This increase in selling pressure suggests that conviction among ETH holders is waning.

The uptick in selling, particularly by large holders, reflects a decline in optimism about Ethereum’s short-term prospects. As ETH’s price fails to show significant recovery, these key holders may be acting on their belief that the altcoin’s price is unlikely to make substantial gains.

Ethereum Exchange Net Position Change. Source: Glassnode

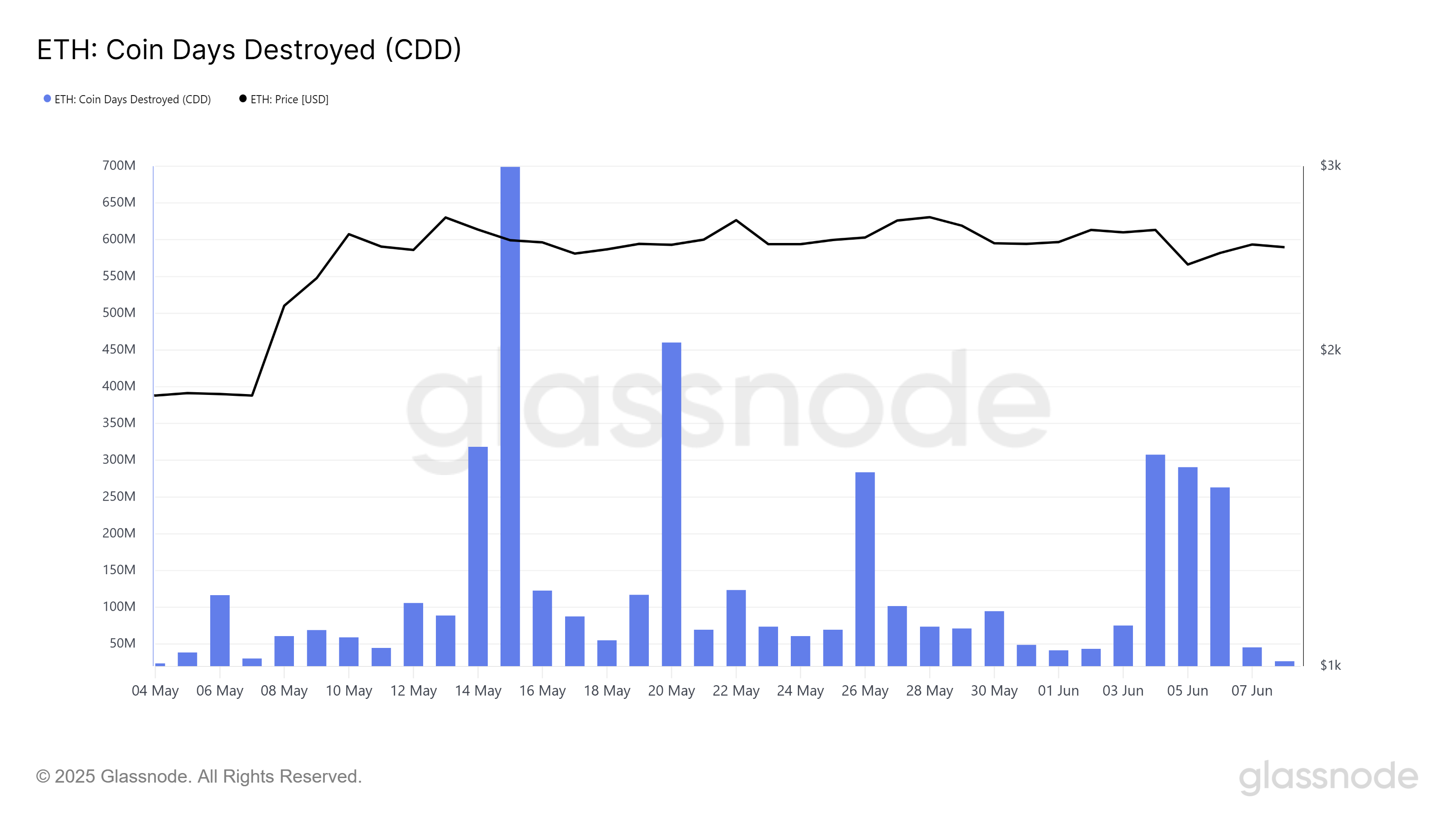

Ethereum’s macro momentum is further impacted by the behavior of long-term holders (LTHs). The Coin Days Destroyed (CDD) metric shows that LTHs have been increasing their selling activity in recent days. The consecutive spikes in CDD suggest that LTHs, who typically act as the backbone of an asset, are moving their holdings as their optimism declines.

The selling pressure from LTHs could exacerbate Ethereum’s price decline, making it harder for the altcoin to maintain upward momentum. As LTHs continue to reduce their positions, Ethereum may struggle to find stability, increasing the likelihood of further price drops. If this trend continues, Ethereum could face a more prolonged period of stagnation or even a sharp decline.

Ethereum Exchange Net Position Change. Source: Glassnode

ETH Price is Holding on

Ethereum is currently trading at $2,485, holding just above the local support level of $2,476. Given the current market uncertainty and the growing selling pressure, ETH’s price is likely to experience a lackluster performance in the short term. The broader market cues remain uncertain, contributing to the lack of clear direction for Ethereum.

The current market conditions and increased selling pressure suggest that Ethereum could slip below the support level of $2,344. If this happens, ETH may decline further to $2,205, extending the losses for investors and indicating a potential continuation of the bearish trend.

Ethereum Price Analysis. Source: TradingView

However, if Ethereum manages to bounce off the support of $2,476 and the selling pressure decreases, ETH could see a rebound. If the price holds steady and market sentiment shifts, Ethereum could rise towards $2,606 or even $2,681. This would invalidate the bearish outlook and could restore confidence in Ethereum’s price, leading to a potential rally.

Read the full article here