Ethereum’s price has been on a significant decline lately and has yet to reverse. If things remain the same, much lower prices could be expected.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the price has been making lower highs and lows since getting rejected by the $4,000 resistance level twice in December.

Currently, ETH is trading below the 200-day moving average, located around the $3,000 mark, and is trying to break back above $2,700. If the market is able to do so, a bullish reversal will become probable. In case of failure, a drop toward the $2,350 support zone would be imminent.

The 4-Hour Chart

Looking at the 4-hour chart, the price has been consolidating over the past couple of weeks. While the market is testing the $2,700 level at the moment, the RSI is on the verge of dropping below 50%.

This signal would indicate a bearish shift in momentum and could result in another push lower toward the $2,000 zone in the coming weeks.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

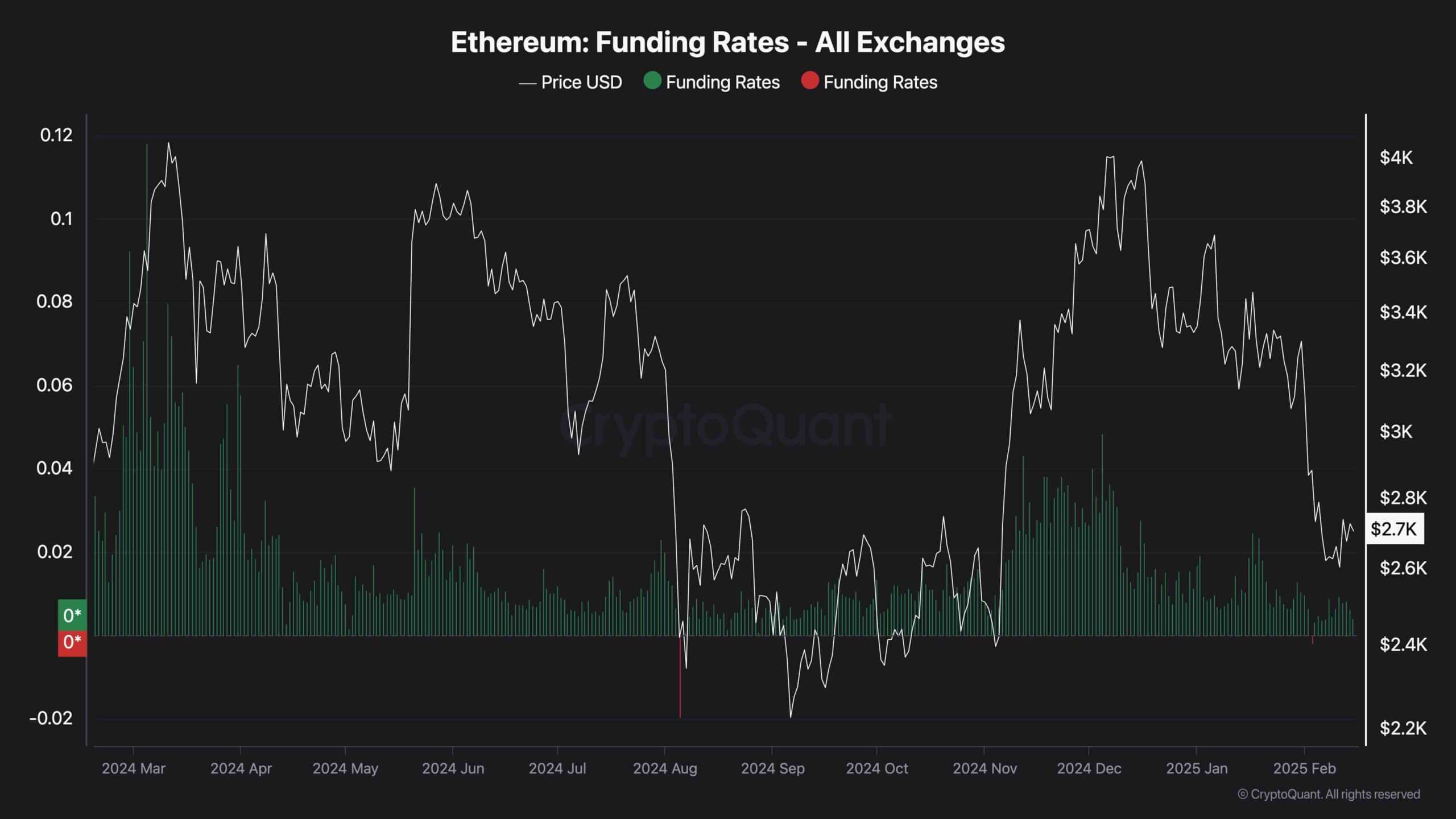

Funding Rates

The futures market has been very influential on the Ethereum price action over the past few years. The funding rates metric is one of the most important indicators of its sentiment, showing whether the buyers or sellers are executing their orders more aggressively.

As the chart suggests, the funding rates have been decreasing consistently amid the recent drop in price. This suggests that the futures market is no longer overheated, and with sufficient spot demand, the market will likely recover.

Read the full article here