The crypto market will witness over $17.27 billion in Bitcoin and Ethereum options contracts expire today. This massive expiration could impact short-term price action, especially as both assets have recently declined.

With Bitcoin options valued at $14.98 billion and Ethereum at $2.29 billion, traders are bracing for potential volatility.

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

Today’s expiring options mark a significant increase from last week. According to Deribit data, Bitcoin options expiration involves 139,390 contracts, compared to 33,972 contracts last week.

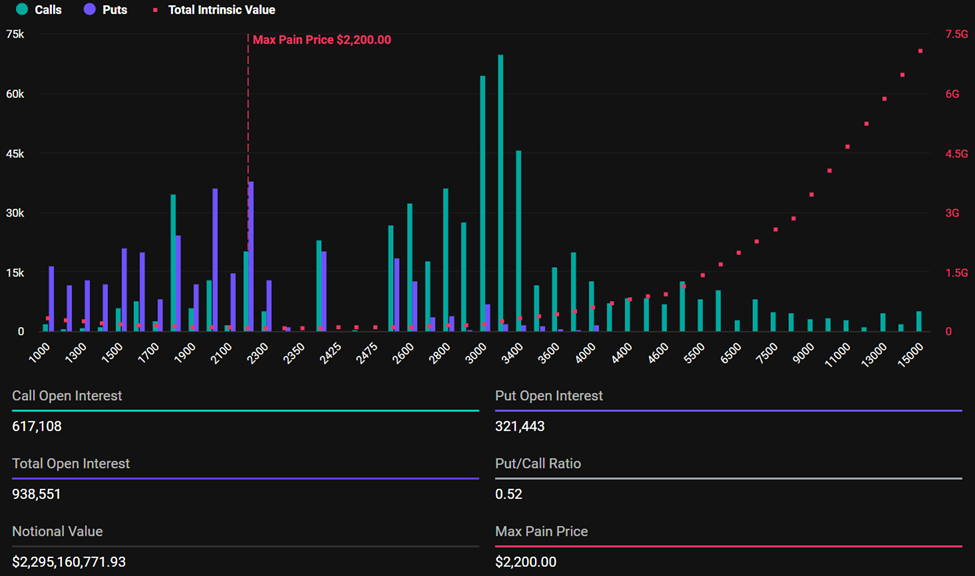

Similarly, Ethereum’s expiring options total 938,551 contracts, up from 224,509 contracts the previous week.

Notably, the huge difference between today’s expiring options and last week comes as the June 27 contracts are for the month.

For the expiring Bitcoin options, the maximum pain price is $102,000, and the put-to-call ratio is 0.75. This suggests traders are buying more call (purchase) options than put (sale) options.

It points to a generally bullish sentiment even as the pioneer crypto reaches for new highs.

The bullish outlook extends to Ethereum, which has a maximum pain price of $2,200 and a put-to-call ratio of 0.52, suggesting optimism in the market.

The maximum pain point is a crucial metric in crypto options trading that often guides market behavior.

It represents the price level at which most options expire worthless. Additionally, the put-to-call ratios below 1 for Bitcoin and Ethereum suggest optimism in the market, with more traders betting on price increases.

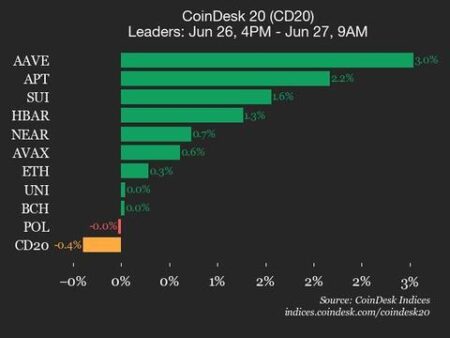

Analysts at Greeks.live note a mixed market sentiment, with traders experiencing flat or break-even results despite market momentum.

The latest data shows that Bitcoin’s trading value has dropped by 0.25% to $107,562. Similarly, Ethereum has fallen by 1.02%, trading at $2,449.

The drop is unsurprising. Based on the Max Pain Theory, asset prices tend to gravitate toward their respective max pain or strike prices as the options near expiration.

As of this writing, Bitcoin and Ethereum are trading well above their maximum pain levels. Traders and investors should brace for volatility, as options expirations often cause short-term price fluctuations, which create market uncertainty.

“…with key resistance at 110k noted as a significant level that may be difficult to breach. There’s a shift in focus toward ETH options trading as Bitcoin volatility remains low, with traders expecting potential downside movement in July,” wrote analysts at Greeks.live.

However, markets usually stabilize soon after traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing future crypto market trends.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here