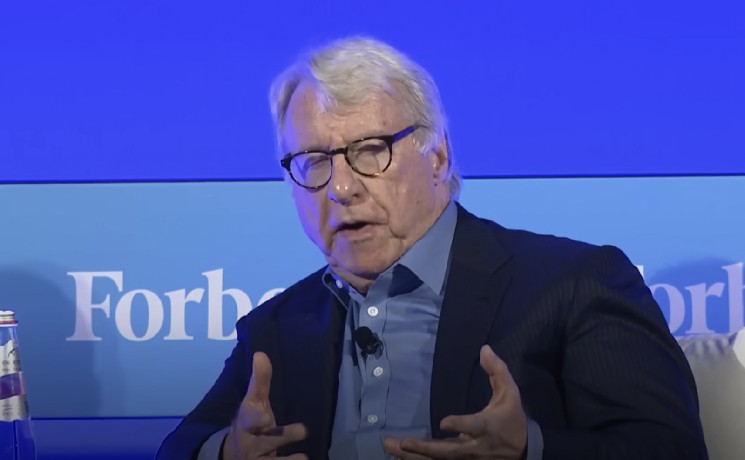

Jim Chanos, one of the most famous short sellers, recently slammed Strategy founder Michael Saylor for promoting “complete financial gibberish.”

Chanos believes that justifying valuation through NAV changes is absurd.

“This is, of course, complete financial gibberish. Mr. Saylor wants you to value his business based not only on the net value of his Bitcoin holdings (NAV) at market, but additionally with a multiple on the change in that NAV!” Chanos said in a recent social media post.

James Chanos recently came up with a provocative idea of buying Bitcoin (BTC) as a hedge while simultaneously shorting Strategy (MSTR), the largest corporate holder of the leading cryptocurrency.

During a recent appearance on Bloomberg, Saylor questioned whether Chanos actually understands what Strategy’s business model is.

He stressed that Strategy is the largest issuer of Bitcoin-backed credit instruments in the world.

Saylor has clarified that its Bitcoin purchases are being funded without issuing any common stock, pointing to the company’s trio of preferred stock offerings (“Stride,” “Strife,” and “Strike”).

“If the stock trades at a weak premium, we just gonna sell the preferreds,” Saylor said.

Saylor has warned that Chanos will end up getting liquidated if the Strategy stock ends up rallying.

Those who are attempting to value the company have to take into account its ability to generate Bitcoin yield.

Read the full article here