The headline US Personal Consumption Expenditures (PCE) inflation has increased to 2.3%, reported the Bureau of Economic Analysis on Friday.

Moreover, the core PCE inflation in the United States has increased to 2.7% after declining for two months.

Following the release, Bitcoin (BTC) price fell slightly towards $106K support, triggering a selloff in the wider crypto community.

However, it appears that the large investors are likely to continue buying at dips after short-term holders and derivatives traders liquidate their holdings.

US PCE Inflation Comes in at 2.3%

The U.S. Bureau of Economic Analysis released the Federal Reserve’s preferred inflation gauge, US PCE data, on June 27.

On a year-over-year basis, headline PCE inflation increased to 2.3% from the revised 2.2% previous month. Similarly, core PCE inflation edged up to 2.7%, higher than the 2.6% estimate.

The US PCE inflation rises to 0.1% month-over-month, matching the gains for the previous two months.

Whereas, the core PCE index, which excludes volatile food and energy prices, increased 0.2%, higher than the 0.1% estimate.

Wall Street Expectations of US PCE Inflation

Nick Timiraos, chief economics correspondent at the Wall Street Journal, said,

“Economists who translate the CPI and PPI into the PCE expect a third consecutive cool monthly core inflation reading in May.”

Wall Street giants, including Goldman Sachs, Bank of America, Morgan Stanley, UBS, Barclays, and others, predicted a 2.3% headline US PCE inflation reading. They also estimated core PCE inflation to increase to 2.6%.

The financial services firms pointed to US tariffs as the reason behind the rise in inflation. During the congressional testimony, Fed Chair Jerome Powell also claimed that the reluctance to cut interest rates was due to US tariffs.

US Fed to Keep Interest Rate Unchanged

US Federal Reserve Chair Jerome Powell and other FOMC members warned about an uptick in inflation to 3% by the end of the year. They have cited tariffs and the recent Israel-Iran conflict as reasons for rising inflation.

However, the CME FedWatch tool showed a 71.3% probability for the Fed rate cut in September. The data suggested 75 bps in total rate cuts by the Federal Reserve this year if inflation data and uncertainty in the markets remained stable in the coming months.

Bitcoin (BTC) Price Drops Slightly

BTC value today slipped below $107K after the US PCE inflation data, with the price at $106,679 at the time of writing. The 24-hour low and high were $106,519 and $107,973, respectively.

Moreover, the trading volume has decreased by 15% in the past 24 hours, indicating interest among traders despite uncertainty.

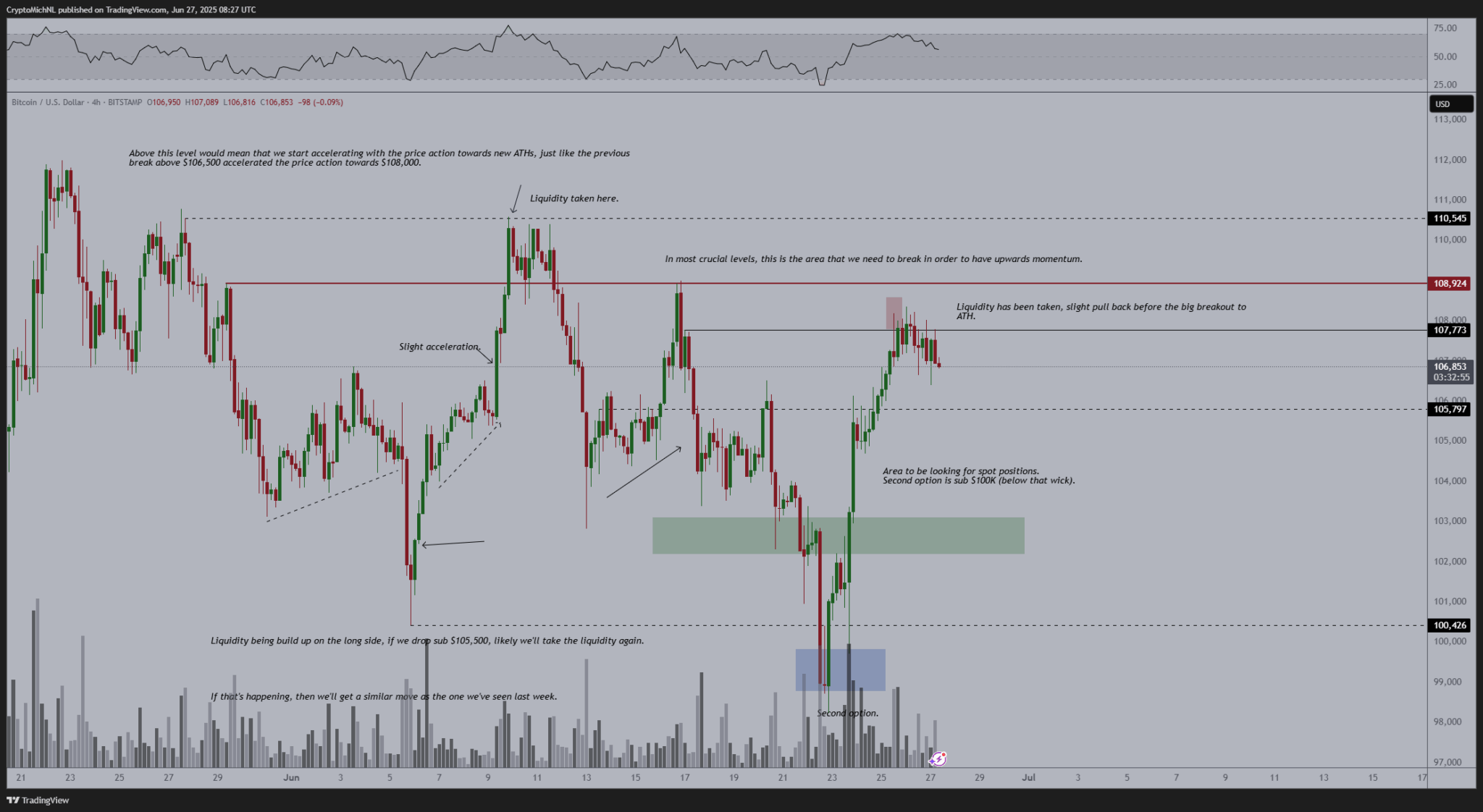

Amid this, popular analyst Michael van de Poppe pointed out that BTC price could see a slight consolidation before the next breakout.

Bitcoin (BTC) 4-Hour Chart | Source: Michael van de Poppe on X

On the other hand, analyst Daan Crypto Trades warned that there are some large liquidation clusters located around the current price. Traders need to keep an eye on these, as they could act as a short-term liquidity grab.

Read the full article here