Despite recent volatility, prominent analysts argue XRP’s technical setup is not bearish yet. They highlight specific price levels crucial for confirming the trend.

A technical evaluation of XRP’s recent 5-day chart adds context to these analyst views.

Analysts Remain Cautiously Optimistic About XRP Price

XRP prices dipped nearly 7% over the past week amid heightened geopolitical tensions, notably driven by US airstrikes on Iranian facilities. The altcoin fell from roughly $2.20 to a low near $1.90 before stabilizing around $2.06.

Veteran trader Peter Brandt highlighted a potential Head-and-Shoulders (H&S) pattern on XRP’s chart. This is traditionally a bearish indicator that signals a reversal from bullish to bearish if key support levels break.

However, Brandt emphasizes caution against premature bearish conclusions. He explicitly notes the importance of XRP maintaining support above $1.80.

A decisive weekly close below that critical level would be needed to confirm a bearish scenario.

Meanwhile, analyst EGRAG CRYPTO provided a detailed bullish perspective using multiple technical indicators.

The Gaussian Channel is a volatility indicator used to identify trend strength and potential reversals. Closing within this channel boundary, around $1.75 currently, could signal weakening momentum and possible downward pressure.

EGRAG emphasizes the importance of XRP staying above this boundary to maintain bullish strength.

Additionally, the 21-week EMA acts as a critical moving average that traders use to identify macro trends.

A close above the EMA level of $2.33 would signify strong bullish momentum.

Moreover, breaking above the resistance at $2.65 would confirm a robust long-term bullish trend.

EGRAG also applies Elliott Wave analysis, a technical approach that identifies repeating patterns (waves) in market prices to forecast potential targets.

Using Elliott Wave ratios, the analyst projects XRP could reach between $9 and $10 if the altcoin successfully completes its anticipated fifth wave, provided current support levels hold firm.

Short-Term Technical Analysis Supports Caution

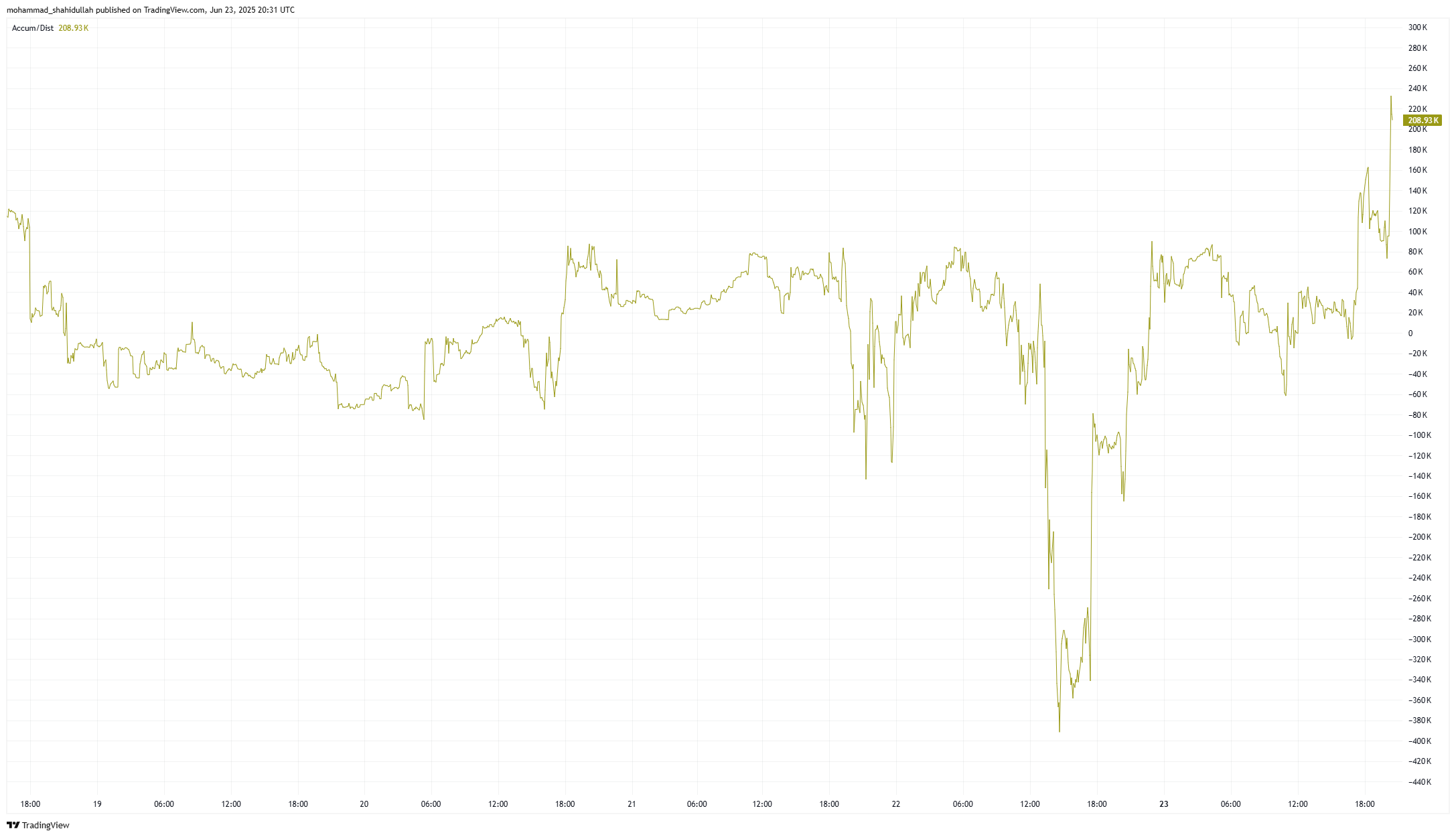

XRP faced significant selling pressure as prices declined sharply towards $1.90, confirmed by the Accumulation/Distribution (A/D) line dropping notably.

The A/D line measures cumulative buying and selling pressure, and its decline indicates higher trading volume on price decreases, reflecting strong seller activity.

As XRP price reached support near $1.90, the A/D line stabilized and began a modest climb during the rebound, indicating renewed buyer activity.

Nevertheless, the accumulation during this rebound has not yet fully neutralized the earlier distribution, suggesting caution remains warranted.

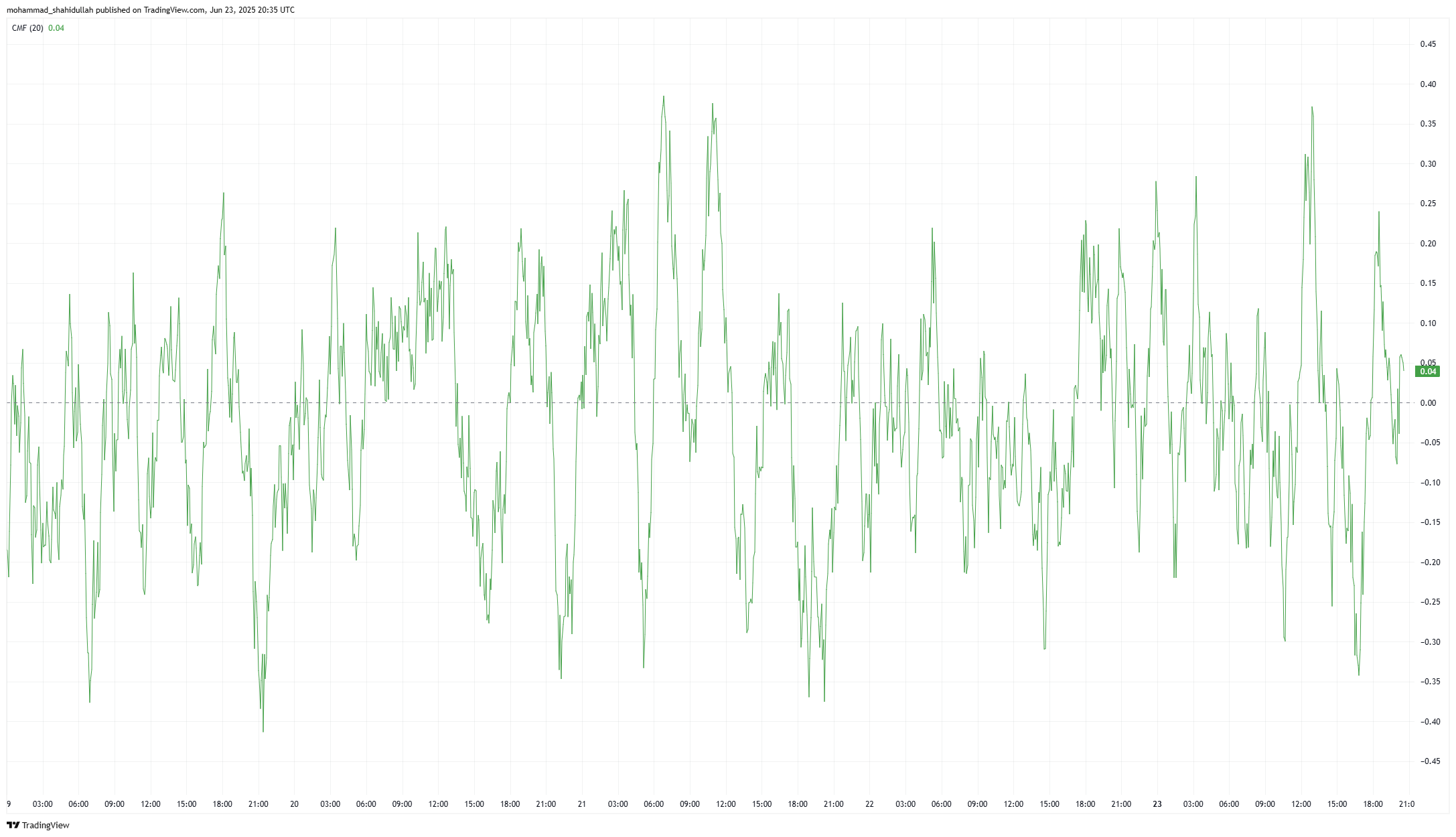

Meanwhile, the Chaikin Money Flow (CMF), an indicator showing the strength of money flowing into or out of an asset, turned negative during the sell-off, confirming strong outflows.

Although CMF improved somewhat during XRP’s rebound, it remained weak and did not enter positive territory, signaling that buyers remain tentative.

Consolidation and Critical Levels to Watch for XRP

These technical indicators suggest XRP is currently in cautious consolidation. While support near $1.90 proved strong, the limited improvement in CMF indicates ongoing market uncertainty.

Overall, this analysis aligns with analyst views that key support around $1.75 to $1.80 remains intact. Only a decisive weekly close below these supports would validate a bearish outlook.

Traders should closely monitor XRP’s interaction with critical support and resistance levels.

Specifically, a confirmed breakout above $2.33 and then $2.65 would signal bullish continuation, while a decisive breach of $1.75-$1.80 support would indicate increased bearish risk.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here