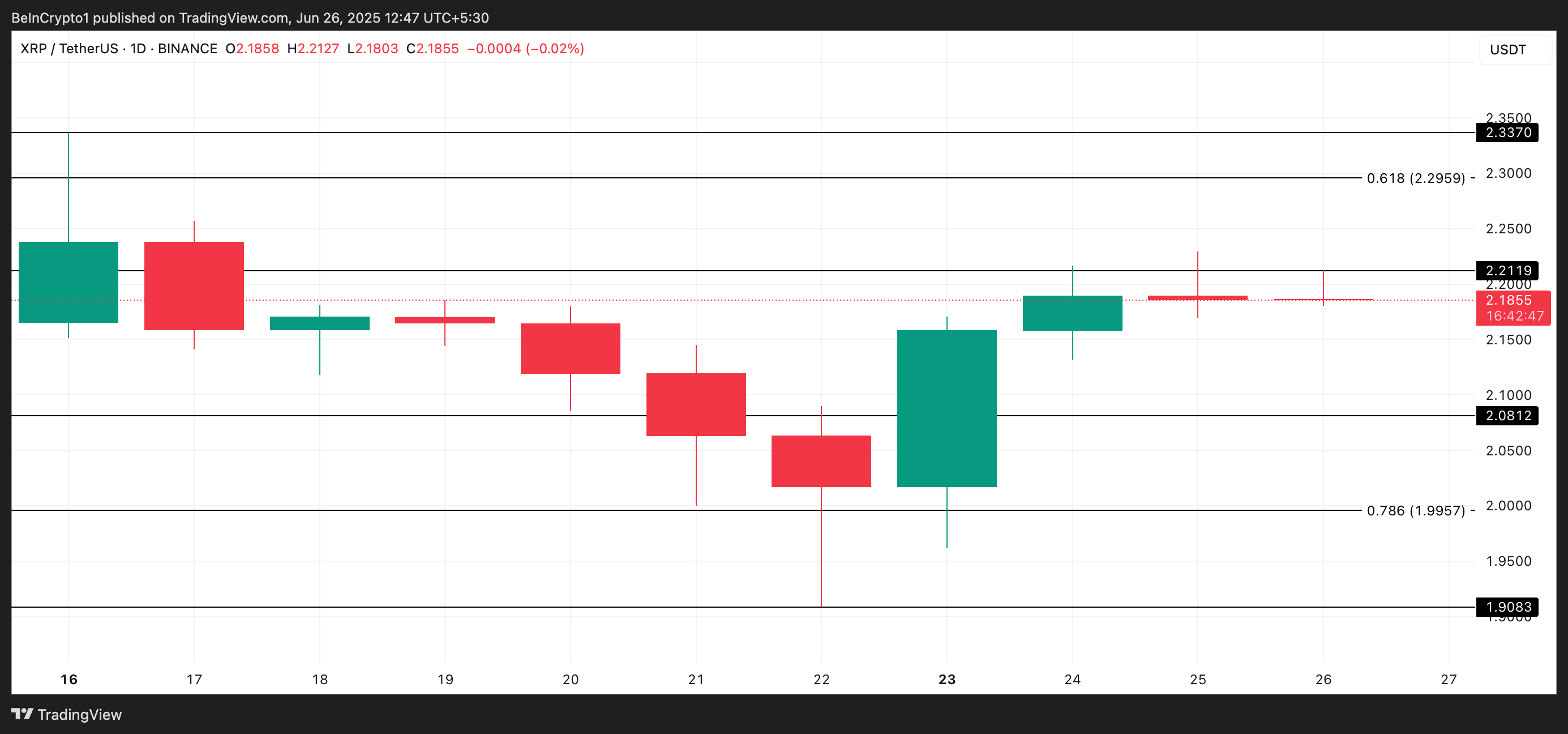

Since closing high on Monday, XRP’s price appears to have entered a range-bound phase. This sideways movement reflects a cautious market.

Interestingly, this period of consolidation has sparked interest among long-term holders (LTHs), who now see it as a strategic buying opportunity.

XRP Rally Stalls After 7% Surge

The announcement of the Israel-Iran ceasefire on Monday triggered a bullish shift in broader market sentiment, pushing XRP’s value up by 7% that day.

However, this momentum has stalled over the past two days, with the altcoin trending sideways. Neither buyers nor sellers are gaining a decisive edge in the short term.

Key technical indicators confirm this standoff. For instance, XRP’s Relative Strength Index (RSI) has flattened since Tuesday, indicating a relative balance between buying and selling pressures. At press time, the RSI stands at 49.97, hovering around the neutral 50 mark since Tuesday.

When an asset’s RSI flattens like this, it signals indecision in the market, with no clear directional bias.

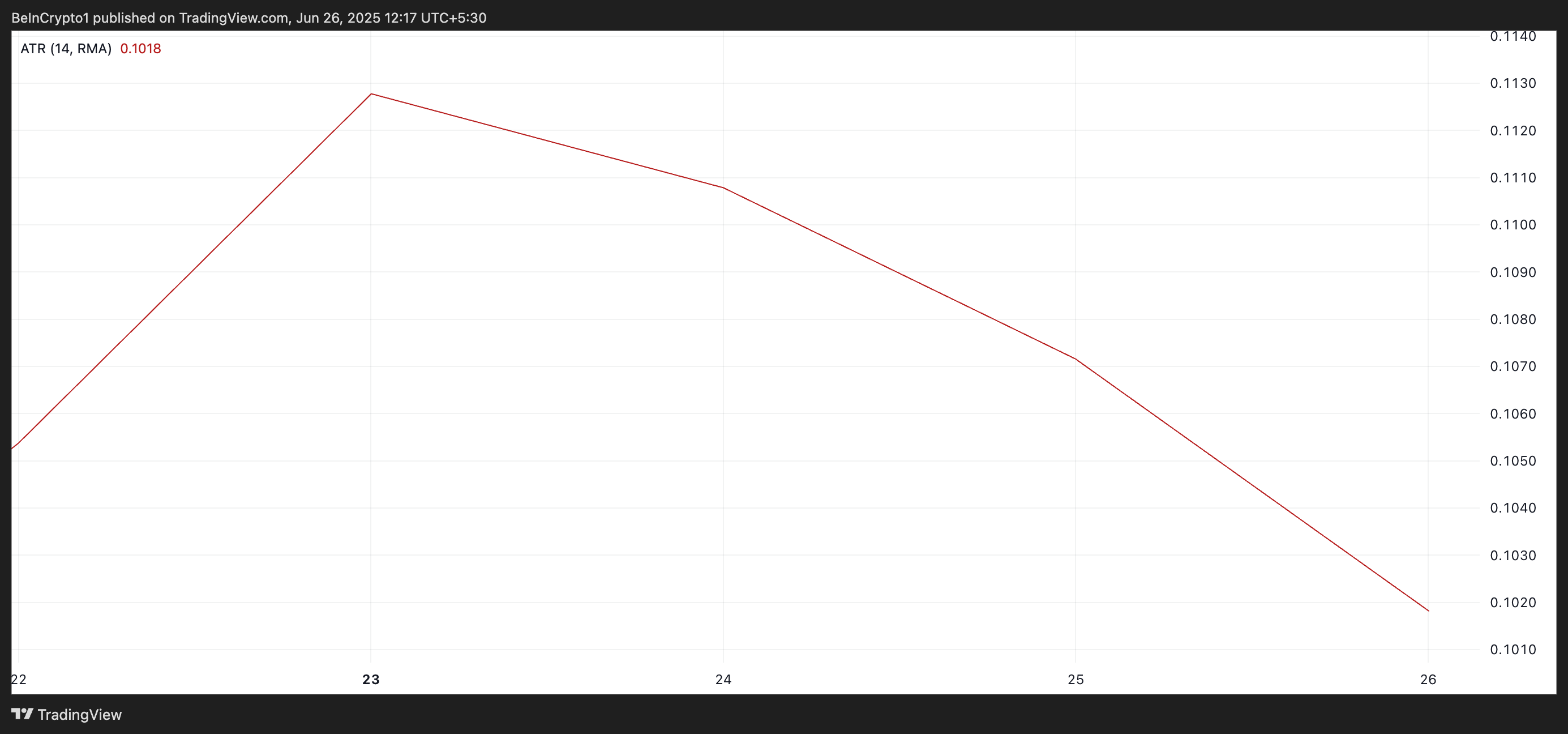

Additionally, XRP’s Average True Range (ATR) has steadily declined during the review period. At press time, it is 0.101.

The ATR measures the degree of price movement over a given period. When it trends downward like this, it typically indicates that price fluctuations are narrowing and overall momentum is weakening.

Long-Term Holders Show Resilience

Data from Glassnode shows a consistent drop in XRP’s Liveliness, even as the token continues to struggle amid the broader market’s weakness over the past few weeks.

This metric, which tracks the movement of previously dormant tokens, fell to a year-to-date low of 0.808 yesterday, indicating a notable decline in sell-offs among XRP’s LTHs.

Liveliness measures the movement of long-held tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it climbs, it suggests that more dormant tokens are being moved or sold, often signaling profit-taking by long-term holders.

Converesly, when Liveliness declines, it indicates that LTHs are moving their assets off exchanges and opting to hold.

For XRP, this suggests that despite its recent sideways action, conviction among long-term holders remains strong. If this trend continues, it could set the stage for a bullish breakout once broader market sentiment improves.

XRP Eyes Breakout as Accumulation Rises

A continued rise in LTH accumulation and a shift in broader crypto market sentiment toward risk assets could position XRP to break out of its current range and enter a sustained uptrend as Q3 commences.

An increase in demand could propel the token’s price above the resistance at $2.21 and push it toward $2.29.

However, XRP’s value could slip to $2.08 if profit-taking resumes. A failure by the bulls to defend this level may open the doors for a further decline toward $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here